The White House has officially confirmed that U.S. President Donald Trump will hold a bilateral meeting with Chinese President Xi Jinping on October 30, 2025—next Thursday—in Busan, South Korea.

This marks their first in-person encounter since Trump’s return to office earlier this year. The meeting is scheduled on the sidelines of the Asia-Pacific Economic Cooperation (APEC) Summit, which runs from October 31 to November 1 in Gyeongju, South Korea.

Trump is embarking on a multi-country Asia tour starting October 24, including stops in Malaysia and Japan, before arriving in South Korea for the summit.

While Trump had teased the possibility of a Xi meeting multiple times in recent weeks, the White House press secretary Karoline Leavitt provided the exact details during a briefing on October 23. The leaders have spoken by phone at least three times in 2025, most recently in September, discussing issues like TikTok’s U.S. operations.

This summit comes amid a fragile U.S.-China trade truce established in May 2025, which averted triple-digit tariffs. However, tensions have escalated recently: China expanded export controls on rare earth minerals and related technologies in early October, critical for electronics and defense.

In response, Trump threatened an additional 100% tariff on Chinese imports on top of the existing 30%, potentially effective as early as November 1. Trump has highlighted fentanyl trafficking as a top priority, stating he plans to press Xi on it directly, alongside demands for China to curb oil purchases from Russia.

The last in-person Trump-Xi meeting was in 2019 at the G20 Summit in Osaka, Japan. Based on public statements and recent developments, the agenda is likely to focus on: Trade and Tariffs: Resolving the standoff over rare earths, soybeans, and broader agricultural purchases to prevent a full trade war escalation.

Fentanyl and Drugs: Trump has repeatedly called this a “big penalty” issue, linking it to existing tariffs. Potential discussions on Taiwan, North Korea’s missile activities, Russia’s war in Ukraine Trump claims Xi wants it ended, and U.S. export curbs on software to China.

Trump has expressed optimism about a “fantastic deal,” emphasizing direct talks as the best path forward. Outlets like Reuters and CNBC describe the meeting as a critical opportunity to “dial down tensions” in the world’s top two economies, but note the elusive nature of a comprehensive trade deal.

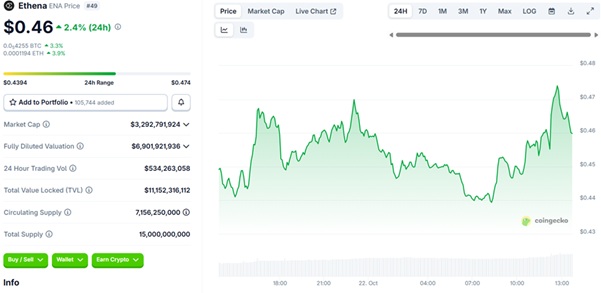

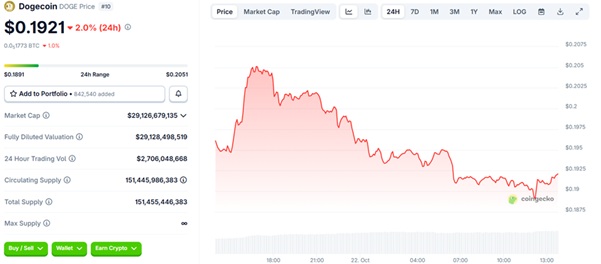

Discussions are buzzing with a mix of optimism and caution on X. Users highlight the meeting’s overlap with a busy earnings week (e.g., Meta, Amazon, Microsoft) and the Fed’s rate decision, calling it a “trading marathon.” Some speculate on outcomes like tariff pauses, while others worry about volatility if talks falter.

A positive outcome could stabilize global markets; failure might trigger immediate tariff hikes, impacting U.S. consumers who bear much of the cost via higher prices and sectors like tech and autos.

Overview of Rare Earth Tensions

Rare earth elements (REEs)—a group of 17 metals essential for technologies like electric vehicles (EVs), semiconductors, wind turbines, defense systems, and consumer electronics—have become a flashpoint in U.S.-China trade relations.

China dominates the global supply chain, mining about 70% of REEs and processing over 90%. In early October 2025, Beijing escalated controls on REE exports, prompting swift U.S. retaliation and global market jitters.

These moves threaten to unravel a fragile May 2025 trade truce that had paused triple-digit tariffs. The tensions are set against the backdrop of an upcoming Trump-Xi meeting on October 30 in Busan, South Korea, where de-escalation could be on the table.

Beijing restricts exports of seven REEs samarium, gadolinium, terbium, dysprosium, lutetium, scandium, yttrium and related magnets in response to U.S. tariffs of 34% on Chinese goods. U.S. auto firms like Ford halt production due to shortages.

U.S. President Donald Trump announces 100% additional tariffs on all Chinese imports on top of existing 30%, effective November 1, unless controls are rolled back. Questions Trump-Xi summit viability.

Ministry of Commerce calls U.S. tariffs “hypocritical” and controls “legitimate” for national security; no immediate counter-levies, signaling openness to talks. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer label controls a “global power grab” and threat to supply chains. Bessent floats extending tariff pause if China delays REE rules. China accuses U.S. of “stoking panic.”

U.S. announces REE strategic reserve and billions in investments with Australia. EU plans Brussels talks with China; French President Macron pushes for EU “Anti-Coercion Instrument” against Beijing. X discussions highlight risks to AI/tech sectors.

Exporters need MOFCOM approval; foreign firms using Chinese REEs/tech must apply for licenses to ship products globally, even if manufactured abroad. Ties to foreign militaries (e.g., U.S. defense) trigger automatic denial.

From December 1, 2025, applies to “internationally made” goods, mimicking U.S. Foreign Direct Product Rule but without national security carve-outs. Fines or imprisonment under Chinese law; non-compliance risks cutoff from Chinese suppliers.

Beijing cites “national security” and preventing “misuse” in military/AI sectors, but analysts see it as leverage against U.S. chip export bans. These controls extend to lithium-ion batteries effective November 8 and could veto global manufacturing of REE-embedded products like EV motors and fighter-jet sensors.U.S.

Trump’s 100% tariff threat could add $500B+ in annual costs to U.S. importers, hitting consumers via higher prices for electronics and autos. U.S. also eyes new software export curbs. DOD’s July 2025 deal with MP Materials for U.S. mine-to-magnet chain 1,000 tons NdFeB magnets by end-2025, <1% of China’s output.

S&P 500 dropped 2%+ on October 10; Big Tech (NVIDIA, AMD) vulnerable to AI chip disruptions. U.S. imported $22.8M in Chinese REEs in 2023; shortages could curb EV/defense production. EU mulls DUV lithography bans on China; Japan/South Korea stockpiling. IMF upgraded global growth forecast pre-escalation but warns of risks.

Analysts like those at CSIS and Eurasia Group call this “economic coercion” mirroring U.S. tactics, but China’s processing monopoly gives it an edge—experts doubt full reversal post-Trump-Xi talks. A “one-shot bazooka” strategy may spur permanent diversification, per Resources for the Future.

This standoff underscores supply chain vulnerabilities; long-term, expect accelerated “friend-shoring” to allies like Australia and Canada. Updates from Busan could pivot the trajectory. This meeting could set the tone for U.S.-China relations through 2026, especially with Trump eyeing an early 2026 visit to China.