Lagos State Governor, Mr. Babajide Sanwo-Olu, has successfully secured a substantial partnership for infrastructure investment, amounting to $1.352 billion, in collaboration with the African Export-Import Bank and Access Bank.

The historic agreement was formalized during the second Africaribbean Trade and Investment Forum 2023 in Georgetown, Guyana.

Governor Sanwo-Olu announced this significant milestone on his verified social media handle, X (formerly Twitter), on Tuesday. He expressed his enthusiasm for the partnership, which will play a pivotal role in funding long-term infrastructure projects, demonstrating the trust and confidence of both international and local partners in the growing economy of Lagos.

“It was a significant moment in Guyana at the Africaribbean Trade and Investment Forum 2023 as we’ve secured a partnership with the African Export-Import Bank and Access Bank for a massive investment of $1.352bn in Lagos.

“This investment will power our long-term infrastructure projects, demonstrating confidence from international and local partners in our growing economy,” he said.

Sanwo-Olu highlighted that this substantial investment will support the execution of key projects, including the Fourth Mainland Bridge, the Omu Creek Project, and the second phase of the LRMT Blue Line from Mile 2 to Okokomaiko.

These projects are critical for the development and progress of Lagos State, and they are expected to have a substantial impact on the region’s infrastructure and transportation systems.

The governor emphasized the commitment to creating a brighter future for Lagos and its residents. He also noted the ongoing realization of the state’s vision, which includes the development of the Lekki-Epe International Airport and the Lagos Food Systems and Logistics Hub in Epe. These initiatives are poised to bolster the local economy and serve as a cornerstone for future generations.

The partnership with the African Export-Import Bank and Access Bank represents a significant step forward in the development and expansion of Lagos State’s infrastructure, ensuring that the region remains a beacon of economic growth and prosperity.

The 4th mainland project was conceived years ago and has been repeatedly hindered by lack of funds. On November 28, 2019, the advert for expression of interest was placed by the state government.

About the bridge

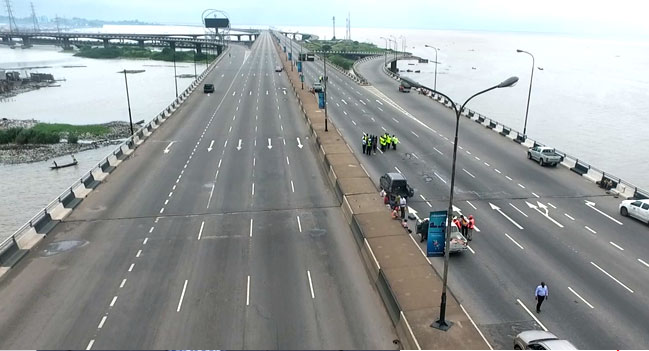

In 2008, NLE Works created the visual concept for a bridge, which was subsequently approved by the State Government. The bridge was planned to be a 38-kilometer expressway with a speed limit of 140 kilometers per hour. It featured a unique two-level design, with the upper level dedicated to vehicle traffic and the lower level reserved for pedestrian use, allowing for social and commercial activities.

The bridge’s design included eight interchanges, facilitating connectivity to various parts of Lagos. The proposed route passed through towns such as Lekki, Langbasa, and Baiyeku along the Lagos Lagoon estuaries, traversed the Igbogbo River Basin, and crossed the Lagos Lagoon estuaries to reach the Itamaga area in Ikorodu. It continued across the Itokin road and the Ikorodu-Sagamu road before connecting to Isawo and ultimately reaching the Lagos-Ibadan expressway at Ojodu Berger.

This bridge was designed to feature a four-lane dual carriageway, with each carriageway consisting of three lanes and two-meter hard shoulders on each side. With a total length of 38 kilometers, it would become the longest bridge in Africa, surpassing Egypt’s 6th October Bridge, which measures 20.5 kilometers.

In December last year, the Lagos State Government revealed the selected bidder for the 4th mainland bridge project. The announcement came three years after the expression of interest for the project was initially advertised.

The Special Adviser to the Governor on Public Private Partnerships, Mr. Ope George, disclosed that the preferred bidder for the project is the consortium known as Messrs CCECC-CRCCIG CONSORTIUM.