People who are close to Prof Wole Soyinka should tell him to ignore faceless Twitter netizens. Africa cannot afford him going to this level. That he has to put a press statement to defend himself over ‘accusation” of his degree diminishes Nigeria. Men like Soyinka are legends, and even though we’re in the season of verifying certificates in Nigeria, Prof should focus on more important things.

I was never a Literature in English student (substituted it for Further Mathematics), but as a teenagor, I did everything offered in school;I ignored the WAEC prescription. In the Literature class, I was always invited to pick up roles as I could memorize plays. One of those was acting like Lakunle in The Lion and the Jewel, and I muttered these words to Sidi in the Soyinka’s play: “a savage custom, barbaric, outdated, rejected, denounced, accursed, excommunicated, archaic, degrading, humiliating, unspeakable, redundant, retrogressive, remarkable, unpalatable.”

Nigeria has become a very challenging country, and no matter what you have achieved, nobody cares. Prof should ignore these young people and focus on more important things.

The custom which Prof explained in that play seems to be the national culture of Nigeria. But Prof does not need to get into these fights.

According to Nairametrics:

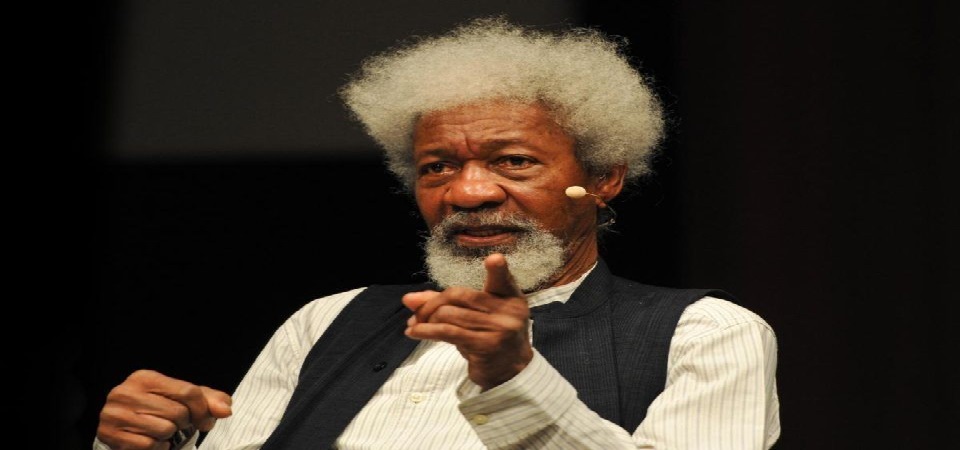

Nobel laureate Prof. Wole Soyinka has issued a 30-day challenge to those questioning his academic credentials, urging them to provide evidence to the nation’s investigative authorities.

Professor Soyinka released a statement yesterday addressing the allegations made by one Prof. James Gibbs in an online publication. Gibbs had questioned Soyinka’s First Class degree in Literature from Leeds University, UK.

- “A document of unmatchable scurrility, last encountered during General Sani Abacha’s global campaign of calumny against opponents of his despotic, infernally venal and homicidal reign, is back in circulation. Duly modified to suit a debased internet culture, it is making its grimy rounds ironically under the auspices of a democratic political party, supposedly dedicated to an ethos of freedom of opinion and expression. The contents of that script are attributed, as before, to the scholastic industry of a Bristol school teacher.

- “While awaiting a decision from my lawyers whether or not to dignify the current sponsors of this mouldy tract with legal action, I wish to state in advance that I voluntarily waive all protection under the statute of limitations and insist that the laws that govern fraudulent academic claims be invoked and applied to these allegations to the uttermost limit. I also declare, in advance, that, if found culpable, I shall strip myself of any titles and honours I may have garnered in my entire career, from the most obscure to the most coveted.

- “In return, I expect the purveyors of this sordid material to submit all evidence, however minuscule, to the nation’s investigative agencies – Directorates of Prosecutions, EFCC, ICPC, plus affected institutions and others – within the next 30 days.

- “Failing this elementary service in public interest within the stated time, and/or if such allegations are yet again proven baseless, thus indicating that their sponsors can boast of neither honours to their careers nor honour to their births and origins, then, as a token of moral recompense, they should undertake to jump off the bridge of the symbolic River Niger, provided with life jackets to ensure a life of remorse after this ritual purgation, but chained to one another in a commendable unity of purpose.

- “This is being copied to the Academic Staff Union of Nigeria, Pan-African Writers Association, Accra, Nigerian Association of Authors, the Nobel Foundation, Stockholm, the University of Leeds, the alleged Bristol Primary Source and his school, and the infested media.”