Dogecoin’s rollercoaster history is entwined with Elon Musk, whose influence has helped drive its narrative for years. Now, the question many ask is, does Musk still own Dogecoin? As DOGE faces fresh changes in sentiment and technical setups, Remittix (RTX) enters the frame as a fundamentally grounded altcoin that could outperform meme volatility.

While DOGE leans on its meme legacy and Musk’s shadow, Remittix is building real rails and traction that may deliver stronger returns in Q4.

Elon Musk’s Current Stance On DOGE

Elon Musk has publicly disclosed holding Bitcoin, Ethereum, and Dogecoin, and has been vocal in his support for DOGE over time. However, Musk has also clarified limits. He stated, “That’s it” when listing his crypto holdings, implying no stake in other meme tokens like Shiba Inu.

Rumours that Elon Musk is the secret DOGE whale holding 28% of the supply, roughly 36 billion DOGE, have circulated for years, though no credible evidence supports the claim.

In recent months, Musk’s engagement with the project has tapered off, and he has clarified that the federal government has no plans to adopt Dogecoin. This pullback is worth monitoring closely for its potential ripple effects on DOGE’s market sentiment.

Remittix’s Edge Against DOGE’s Narrative In Q4

While DOGE depends heavily on narrative, community, and Musk’s presence, Remittix is building structural momentum that could make Q4 its breakout period.

Compared to DOGE’s speculative swings, Remittix seeks to capture the same capital flows with utility that resonates in financial use. Where DOGE’s upside is tied to meme cycles and momentum, Remittix’s value hinges on infrastructure and adoption, giving it a potentially steadier runway.

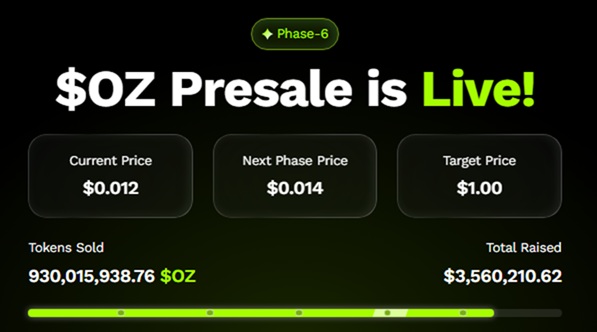

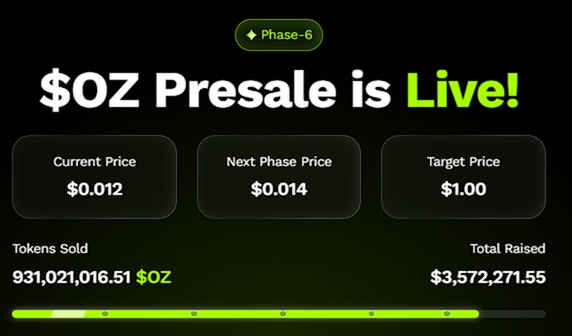

Remittix’s fundamentals are already strong. The project has raised over $27 million, sold over 675 million tokens, and currently trades at $0.113. The project has secured listings on BitMart and LBank after surpassing $20 million and $22 million, and a third listing is in view.

The Remittix team is verified by CertiK, and Remittix holds the #1 rank among prelaunch tokens. Its wallet is live in beta, tested by community users. The platform features a 15% USDT referral reward, claimable every 24 hours and also has a running $250,000 giveaway.

Key Highlights of Remittix:

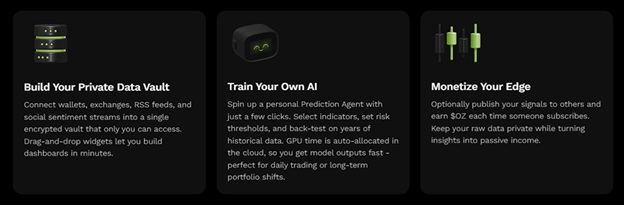

- Solving a real-world $19 trillion payments problem

- Direct crypto to bank transfers in 30+ countries

- Audited by CertiK, built with trust and transparency

- One of the few projects with product progress before TGE

- Mass market appeal beyond just the crypto crowd

What Q4 May Hold For DOGE And Remittix

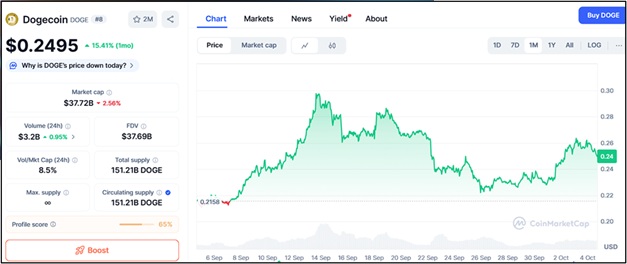

Analysts expect DOGE to push resistance zones around $0.29 to $0.31, with bullish targets up to $0.65 if momentum sustains. Some models forecast up to a 730% surge over time. But dependence on narrative and external sentiment leaves DOGE vulnerable to abrupt reversals.

Meanwhile, Remittix’s backing by real utility and exchange moves gives it a shot to outperform in Q4, especially if DOGE’s reliance on Musk becomes a limiting factor.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway