In any country, creating new products and services, as well as ensuring the sustainability of existing ones by restoring their prior level of functionality when issues have prevented them from delivering the expected value, is crucial for economic growth. This is also expected to lead to direct or indirect personal growth for individuals, regardless of their socioeconomic status or political class. At the heart of initiating and executing plans for developing and revamping existing offerings—products and services—lies innovation, a concept that has been theorized and researched worldwide over the years. From political leaders to captains of industries and professionals who execute various ideas into the commercialization stage, innovation serves as the bedrock for ensuring the hyper-commercialization of ideas, benefiting everyone and the country at large.

This has been one of the reasons for measuring the innovation ecosystem by different organizations and individuals at global, regional, national, and local levels. Nigeria is not an exception in this regard. The country has been among those studied by various organizations and researched by academics with the intention of understanding what works and what doesn’t work in its innovation ecosystem over the years. Leveraging the research conducted by the World Intellectual Property Organization and others that have studied the country’s innovation ecosystem, the outcomes have consistently been mixed, with a significant focus on the poor status of institutions – including political, regulatory, and business environments – in ensuring good innovation ecosystem performance.

Primarily, World Intellectual Property Organisation and others assess various factors, including institutions, human capital and research, infrastructure, market sophistication, and business sophistication. These factors serve as inputs for gauging the knowledge, technology, and creative outputs in any given country. The “institution” pillar encompasses political, economic, and business environments. Sub-indicators for the “human capital and research” pillar include the presence of high schools and higher education institutions teaching innovation, as well as active engagement in research and development. Under the “infrastructure” pillar, WIPO and others evaluate the strength of information and communication facilities, general infrastructure quality, and ecological sustainability in countries. The “market sophistication” pillar considers financial support, diversification, and the ability to scale products and services in markets as relevant sub-indicators.

Similarly, “business sophistication” aims to gauge the ability of workers to absorb innovation knowledge and skills. However, this alone is insufficient. They must also possess the capability to connect various innovations to develop sustained innovation outputs. In this regard, they should be able to create and disseminate impactful knowledge without neglecting the capacity to generate intangible assets, creative products, and services, whether online or in physical stores.

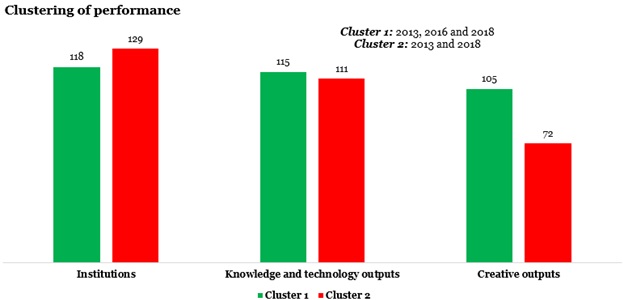

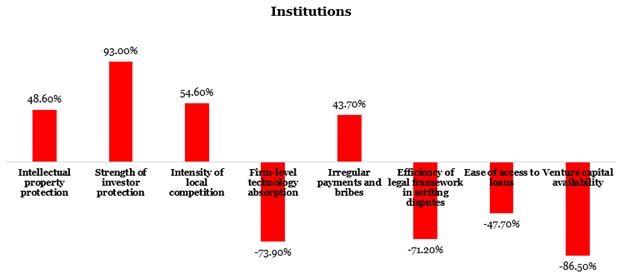

Unfortunately, considering these pillars, Nigeria did not perform well within the institution pillar between 2013 and 2022. The average ranking during this period was 120, while innovation stood at 117, reflecting suboptimal results over the course of a decade. An analysis during this timeframe reveals that the strength of institutions contributed only 11.2% towards creating a more favourable innovation ecosystem. However, when examining the impact on specific aspects, institutions had a significant influence on knowledge and technology outputs, accounting for 42.8%, and also affected creative outputs by 23.4%. These findings suggest that institutions showed relatively good performance, helping the country achieve nearly half of the expected 100% outcome of institutions in fostering a better innovation ecosystem. This also indicates that businesses, non-profit organizations, and individuals were able to overcome some obstacles related to the political, regulatory, and business environment while pursuing creativity and disseminating impactful knowledge across various sectors and industries.

When we break down the years, it becomes apparent that institutions performed better in 2018 compared to other years between 2013 and 2022, particularly in contrast to 2013 and 2014. Although 2013 wasn’t a favourable year for the country in terms of institutional ranking, it was relatively successful in terms of innovation outputs, especially in the realm of creativity. On the other hand, 2014 exhibited slight improvements, particularly in knowledge and technology output.

What the future holds if the status remains?

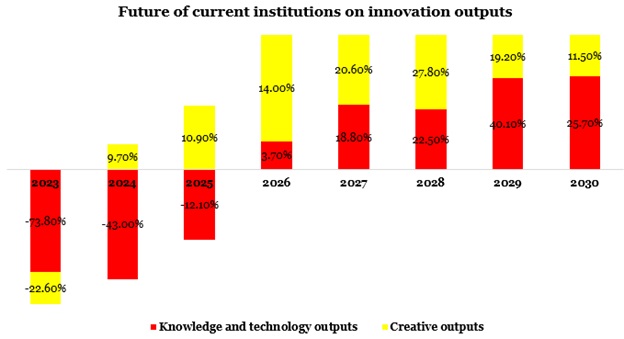

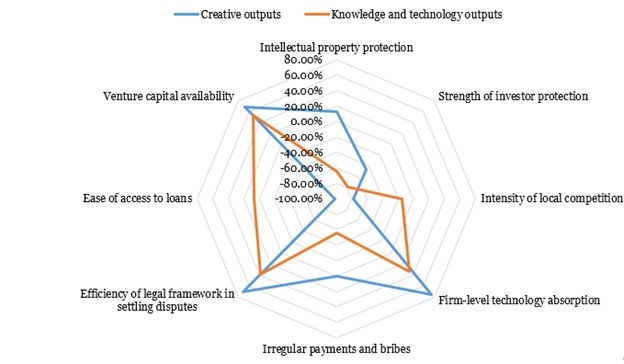

In the future, the current status of institutions will be bleak on attaining innovation outputs, at least between 2023 and 2025. During this period, Nigeria is expected to feel the significant effects of political, regulatory, and business environments on knowledge, technology, and creative outputs. However, there is optimism for more positive outcomes from 2026 to 2030. To mitigate the adverse effects of these institutions on innovation outputs and to enhance future results from 2026 to 2030, political and business leaders must address inherent challenges within the political, regulatory, and business environments. Political leaders at all levels, from federal to state and local, should create a conducive environment that facilitates the effectiveness of legal frameworks aimed at resolving various disputes related to intellectual property.

Moreover, access to loans that do not hinder innovation should be made available by avoiding stringent requirements that might deter innovators from exploring the potential of launching new products and services. Venture capitalists should recognize the importance of innovation financing as a key driver of the country’s economy and should actively support innovators. Additionally, businesses and their employees should strive to adopt existing innovative products or services more effectively, thus enhancing efficiency and productivity.

Source: Global Innovation Index, 2013-2022; World Economic Forum, 2013-2022

In order to hone the different institutional framework for rejuvenating the ecosystem, steps must be taken to improve the health of the political, regulatory and business environment. Based on the data, we suggest the following remedies.

Improved policy implementation and environment

From observations, it was noticed that the innovation and digital ecosystem in Nigeria started receiving serious governmental attention perhaps from 2015 or thereabout when the ministry of communication was reconfigured to also include digital economy. From then till the new administration of President Ahmed Bola Tinubu came on board, there was a flurry of policies upon policies probably to give shape to enhanced prosperity through the digital economy. There is a need to accelerate the provisions of the policies and find a place of convergence and divergence between them. It is then new policies could be put in place if there is a need for such. In driving a mechanism for accelerated growth in the innovation ecosystem, it is important to avoid policy glut and improve the policy environment.

Activate the National Startup Act

In order to address the issue of funding inadequacy for innovation ecosystem, the National Startup Act has extensively addressed access to funding by the ecosystem players. The Act has provisions that cater to the financial needs of startups in Nigeria through the Startup Investment Seed Fund. It is our advice to the Minister of Communication and Digital Economy to fast track the establishment of the National Council for Digital Innovation and Entrepreneurship for the current administration. We also advise a strong coordination with the state governments through the Nigeria Governors Forum (NGF). Efforts such as these would assist the drive for the growth of innovation and entrepreneurship in the country.

Increased and Enhanced Public-Private Partnership

To grow the digital and innovation ecosystem in the country, it is critical to increase and enhance public-private partnership. This is to address the issue of sustainability of programmes put in place by government. From observation, governments at state levels are also seriously considering growing innovation and digital prosperity in their various states. However, the capacity of the state civil service bureaucracy to successfully run some of the needed programmes to bring this to a reality is in doubt. This is where the need for private operators in the ecosystem comes in. With their established processes, programmes and experience, the private sector working hand in hand with public institutions would bring far reaching impact to the drive for innovation and digital economy. A good example of this is what Opolo is doing across higher institutions where it has presence. We help in talent management of the ecosystem through offering programmes that plug the gaps in curriculum especially in entrepreneurship and and student work experience programmes. In Osun State University, Opolo partnered the Faculty of Engineering to provide facilitation in Data Science for 200 Level Engineering students in the university. In the same vein, the hub at the Rivers State University of Science and Technology had an engagement with the startup ecosystem on campus addressing issues such as ideation, incubation, acceleration and funding for their ideas. Improved and enhanced partnership would go a long way to accelerate innovation in the country.

Time for Innovation to Flourish but more needs to be done

It is a good time for digital economy to boom in Nigeria. This is not farfetched from the fact that the personality and professionalism of the new driver of the national vehicle of digital economy has been a strong and established player in the terrain before his appointment. Still, there is a need to pay attention to factors that could make the job well-coordinated, easier and more impactful. Addressing improved policy implementation and environment, fostering partnership with established private players and putting up a structure to implement the provision of the National Startup Act would show the needed result.