In an era of globalization, the concept of trust plays a pivotal role in shaping our decisions and actions. It is especially critical when Nigerians in the diaspora seek to invest in their homeland. Establishing trust is often a significant challenge, given the geographical and cultural distances that separate them from Nigeria. However, data from a recent global survey conducted by the World Values Survey between 2017 and 2022 provides valuable insights that can help Nigerian diaspora investors build a personal trust value system. In this article, we explore how Excel, a powerful tool, can be employed to harness this data and lay the foundation for informed investment decisions.

Understanding the Data: A Closer Look

The survey findings paint a nuanced picture of Nigerians’ affinity and trust patterns. Let’s break down the key insights:

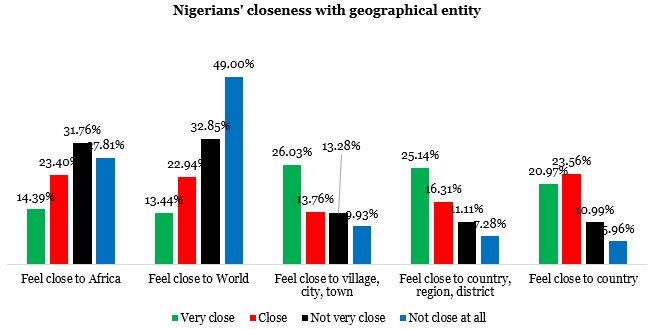

1. Affinity with Place:

- Over 26% of surveyed Nigerians feel very close to their village, city, and town.

- Approximately 25.14% and 20.97% reported strong closeness to their country, their respective region and district, and the country as a whole.

- Interestingly, nearly half (49%) of those who claimed to have no close affinity with any entity indicated a lack of connection with the world as a whole.

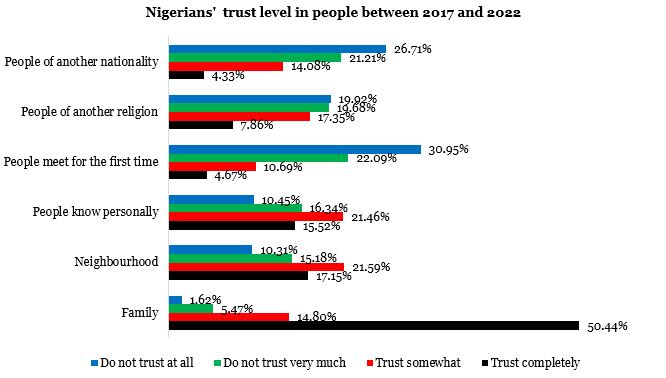

2. Trust Dynamics:

- More than half (50.44%) trust their family members more than anyone else.

- Roughly 21.59% trust people in their neighbourhood somewhat.

- An almost identical percentage (21.46%) trusts individuals they know personally somewhat.

- Notably, 22.09% do not trust people they meet for the first time.

- Over 21% expressed a lack of trust in individuals of another nationality.

Building Your Personal Trust Value System Using Excel:

Now, the question is how diaspora investors can use these insights to construct a personal trust value system. The answer lies in leveraging data analysis, and Excel is an excellent tool for the job.

1. Data Visualization:

- Excel’s data visualization tools can help you create charts and graphs to better understand the data. Visual representations make it easier to spot trends and patterns, such as the relationship between affinity and trust levels.

2. Affinity Mapping:

- Use Excel to categorize and quantify your own affinity with different aspects of Nigeria. Compare these with the survey data to see how closely your feelings align with those of the surveyed population.

3. Trust Assessment:

- Excel can help you assess your trust levels. Create a trust matrix where you score different categories of individuals based on your own trust. Compare this with the survey data to identify any gaps or discrepancies.

4. Risk Mitigation:

- Excel’s calculation features can assist you in quantifying risks associated with your investments. Consider factors such as trust levels, geographical proximity, and cultural familiarity to assess the potential risks.

5. Informed Decision-Making:

- Excel can be used to create decision matrices that weigh the pros and cons of various investment options. By incorporating your trust and affinity data, you can make well-informed decisions that align with your personal values.

6. Building Local Relationships:

- Excel can serve as your organizational tool to keep track of your interactions with local contacts. It can help you identify key stakeholders and nurture relationships that are essential for building trust in the local business environment.

7. Continuous Monitoring:

- Use Excel to set up a monitoring system to track changes in trust dynamics and affinity over time. This will enable you to adapt your investment strategies as circumstances evolve.

In today’s interconnected world, trust is a currency that transcends borders. For Nigerian diaspora investors, the path to building a personal trust value system begins with understanding the data, as revealed in the World Values Survey. Excel is a versatile tool that can help you analyze, visualize, and leverage this data to make informed investment decisions that align with your personal values and aspirations. Trust is the cornerstone of successful investments, and with the right data-driven approach, you can unlock the potential of investing in Nigeria with confidence.