The Nigeria Labour Congress (NLC) has announced a two-day nationwide warning strike, starting on Tuesday, September 5, 2023. This move is in response to the growing economic challenges in the country, exacerbated by the government’s decision to remove the petrol subsidy.

The union made this declaration on Friday, with the primary objective of demanding an immediate adjustment of economic policies that would improve the quality of life for the general population.

This action follows a previous nationwide strike called by organized labor in June, which was prompted by fuel shortages across the country after President Bola Tinubu’s inaugural speech, in which he announced the removal of the “fuel subsidy.”

That has been followed by a series of nationwide strike threats by organized labor, which it has only carried out once early last month. The strike, which lasted only for a day, was called off following meetings between the labor leaders and the federal government.

Since then, the organized labor made up of the Trade Union Congress (TUC) and the NLC has been on standby to embark on strike. The union said that the federal government has failed to fulfill its part of their deal, which involves providing adequate palliatives for Nigerians, to help them cope with the soaring cost of living spurred by the subsidy removal and other “anti-poor policies” enacted by the government.

In mid-August, the NLC vowed to embark on another strike if the cost of petrol rises to N720 per liter as projected by marketers.

“Let me say this, Nigerian workers will not give any notice if we wake up from our sleep to hear that they have tempered with prices of petroleum products.

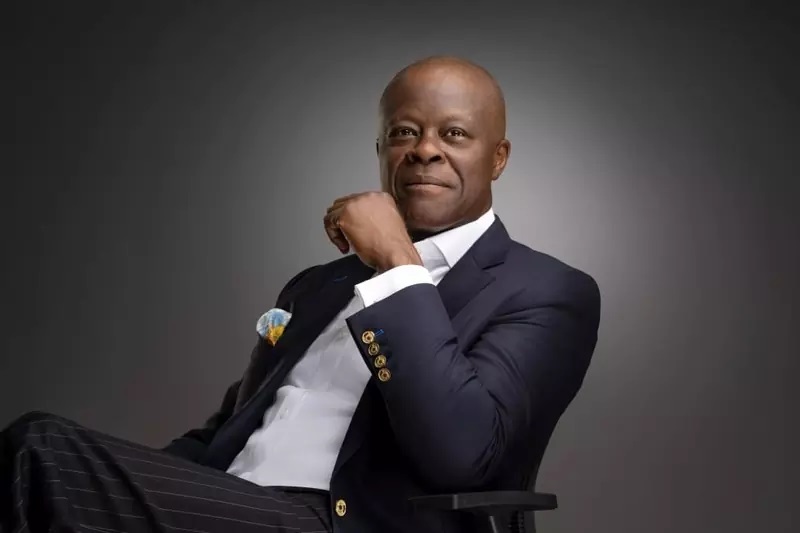

“They have started floating ideas of a likely increase in the pump price of petroleum products,” the NLC president, Joe Ajaero, said then.

Another spike in the cost of fuel is expected soon following the rise in international oil prices. Crude oil price rose to $88 this week, its highest since November 2022.

Analysts project that, with the spot rate of N930 and the N775/$1 exchange rate in the Investor & Exporter window, the next stock of petrol landing if the Central Bank Of Nigeria (CBN) is unable to provide marketers with dollar liquidity that will keep the FX rate stable – will cost N674 per liter in Lagos and around N712 in other parts of the country.

Following the removal of fuel subsidy, the Nigerian government has been trapped between the devil and the deep blue sea, making the threats of strikes from organized labor constant. The union is asking, among other things, for an upward review of the minimum wage (from N30,000 to N200,000) to help Nigerians cope with the resulting high cost of living.

With its near-bankruptcy state, the federal government is finding it hard to meet the union’s demands.

The federal government began to disburse N5 billion worth of food to the states last month. But the distribution of food palliatives to Nigeria’s 36 states has fallen short of what is needed.

“If you share that N5bn or even the five trucks of rice or grain, many people may not get one or half cup of rice,” Ajaero said on Channels Television’s Politics Today on Friday.

“If you share the N5bn, many people, probably within the working class or the poor of the poor, may not get N1,500. Now, is that the palliative?”

Many are calling on the government to implement temporary subsidy payments that will see Nigerians purchase petrol at a lower cost – reducing the high cost of living its removal has caused.