Gain Financial Independence with BEASTS Coin

Have you ever wondered how to earn passive income with Crypto? Look no further! BEASTS Coin (BEASTS) presents a groundbreaking opportunity that can potentially lead you to financial independence. Imagine a world where you can earn substantial profits while having fun and being part of a thriving community.

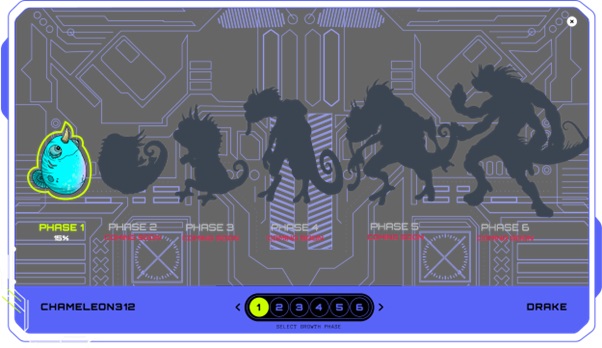

BEASTS Coin is not just your average cryptocurrency. It operates as a unique crypto token, combining the excitement of a meme coin with the potential for significant financial gains. Instead of traditional investment tracking methods, this new meme coin introduces an innovative concept—mascots that represent your investments. These amazing creatures, such as Blue Rage, Whiplash, and Blaze, evolve as your investments grow, adding a fun and engaging element to your financial journey.

One of the standout features of BEASTS Coin is its highly popular referral system. Upon joining the platform, you receive a unique shareable code that opens the doors to passive income. When someone signs up using your referral code, you earn a remarkable 20% of their purchase value in either USDT, ETH, or BNB. But it doesn’t end there! The person you referred also receives an extra 20% of BEASTS Coin, creating a mutually beneficial arrangement. The possibilities are limitless as you can share your referral code with as many individuals as you desire, maximizing your earning potential.

Is Beasts Coin For You?

BEASTS Coin appeals to many crypto investors, particularly those who have an interest in meme coins and passive income. Furthermore, its user-centric approach and commitment to decentralization attract investors who value transparency and community-driven initiatives. By participating in the referral scheme, users not only enjoy the financial benefits but also become part of a thriving and supportive community. The opportunity to earn over $1000 a day by spreading your unique referral code is a game-changer for anyone seeking financial independence.

In a crowded crypto market, BEASTS Coin stands out through its transparent policies. The project follows an open liquidity policy, allocating 75% of its tokens for the presale phase while dedicating the remaining portion to marketing efforts. This commitment to transparency not only ensures the credibility of the project within the meme coin niche but also provides investors with confidence and a clear understanding of the project’s mission.

If you are interested in making millions with the meme coin sphere’s latest rising star, you can buy BEASTS Coin tokens on well-established crypto exchanges such as Binance and Coinbase.

In conclusion, BEASTS Coin offers a unique and rewarding opportunity for crypto investors to earn passive income online. With its innovative approach to investment tracking and powerful referral system, this new meme coin sets itself apart from other projects in the market. By joining the BEASTS community, you not only have the chance to become financially independent but also get to be part of a supportive and active network!

Follow the Links For More Information on BEASTS Coin!

Website: https://cagedbeasts.com

Twitter: https://twitter.com/CAGED_BEASTS

Telegram: https://t.me/CAGEDBEASTS