Food, safety, and companionship are innate human needs that are satisfied through hedonic experience. Happiness is based on the satisfaction of needs, which is influenced by both external living conditions and inner abilities. Poor living conditions can have a negative impact on happiness, especially when demands exceed human capabilities. Societies are systems for meeting human needs, but not all of them are equally effective. Happiness can be increased by improving the fit between social institutions and human needs.

This background sheds light on the reasons governments, private businesses, and members of the civic space always strive to make the environment fit for human needs, enhancing their capacities to strive for themselves towards attaining what interests them the most.

Several experts and scholars have worked and are still working on how to make cities and towns livable for humans and non-humans. Meanwhile, this piece takes a look at the place of the Economist Intelligence Unit’s yearly ranking of cities across the world with the intention of calling the attention of political and business leaders to critical aspects that need short-, medium-, and long-term initiatives in making cities livable.

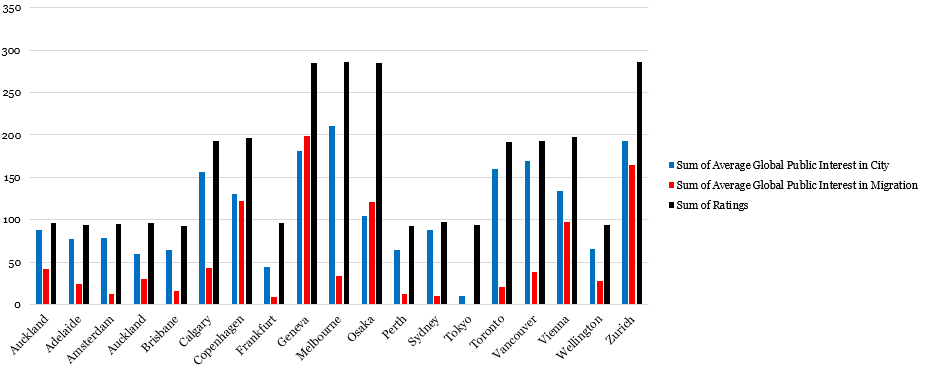

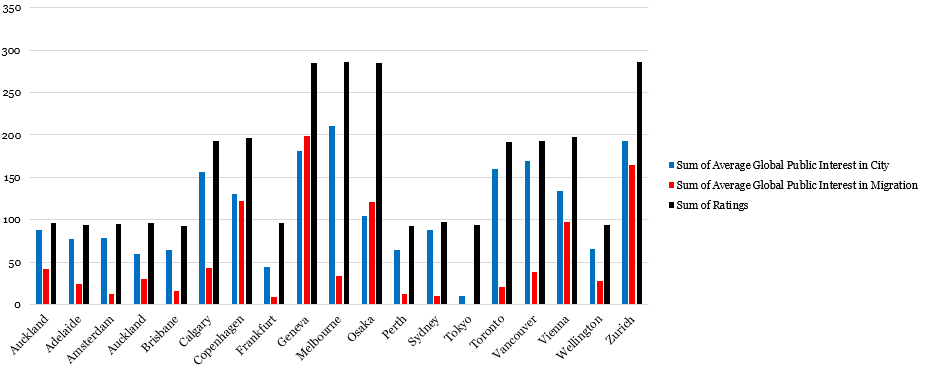

The EIU considers stability, healthcare, culture and environment, education, and infrastructure indicators for the assessment of over 100 cities. To illustrate our proposition that this organisation is making significant contributions to how stakeholders should be thinking and acting on making cities livable for everyone, we leveraged the top 10 most livable cities between 2021 and 2023. In this regard, we considered Auckland, Adelaide, Amsterdam, Auckland, Brisbane, Calgary, Copenhagen, Frankfurt, Geneva, Melbourne, Osaka, Perth, Sydney, Tokyo, Toronto, Vancouver, Vienna, Wellington, and Zurich.

These cities are mostly in the global north, while a few are in the global south. From the data, we have gleaned that some of the cities have consistently been ranked between first and third, suggesting that government at the city and national levels did well during the years. To further substantiate our proposition, we examined public interest through information seeking about the cities using the Google Search Engine. Interestingly, our analysis suggests that the higher these cities EIU ratings, the more the public develops an interest in understanding them. This is highly detected for Geneva, Zurich, and Melbourne (see Exhibit 1).

Our analyst notes that the Economist Intelligence Unit’s (EIU) yearly rating of the most livable cities has become a prominent benchmark for individuals and families seeking to relocate. It is on this basis that we provide some strategies for stakeholders, especially the governments of cities that have constantly been ranked within the least livable city paradigm.

Exhibit 1: Ratings against global public interest in select most livable cities between 2021 and 2023

Source: Economist Intelligence Unit, 2021-2023, Google Trends, 2021-2023, Infoprations Analysis, 2023

Impact of the EIU’s Ratings on Urban Migration

Reputation and Perception

Cities ranked highly by the EIU gain a reputation for offering a high quality of life, attracting migrants seeking better opportunities.

Decision-making Tool

The EIU’s rating serves as a valuable tool for individuals and businesses when considering relocation options, influencing migration patterns.

Economic Growth

Cities with high livability ratings often experience increased economic activity, as businesses and investments are drawn to the favorable conditions.

Strategies for Cities to Attract and Accommodate Newcomers

Focus on Livability Factors

Prioritize investments and policies that address the EIU’s livability factors, such as improving infrastructure, healthcare services, and education systems.

Marketing and Promotion

Leverage the EIU’s ratings in city marketing efforts to highlight the city’s strengths and attract potential migrants.

Talent Attraction

Develop initiatives to attract skilled professionals, entrepreneurs, and innovators by offering incentives, networking opportunities, and supportive business environments.

Affordable Housing

Implement strategies to address housing affordability issues, such as promoting mixed-income developments, rent control measures, or subsidized housing programs. e. Cultural Exchange Programs: Foster social integration by promoting cultural exchange, community events, and initiatives that celebrate diversity.

Sustainable Development

Emphasize environmental sustainability by implementing eco-friendly infrastructure, promoting green spaces, and adopting renewable energy solutions. g. Enhanced Public Services: Invest in public transportation, healthcare facilities, education institutions, and other vital services to meet the needs of a growing population.

Participatory Governance

Engage residents in decision-making processes through participatory urban planning, ensuring their voices are heard and their needs are addressed.

Like this:

Like Loading...