The cryptocurrency market has witnessed impressive growth and innovation in recent years, with numerous tokens capturing the attention of investors.

Keep reading as we explore the potential of three tokens: Caged Beasts, VeChain, and Tradecurve. These tokens have shown significant upward momentum and have the potential to reach $1 by the end of 2023.

Summary

- Caged Beasts brings good passive income possibilities

- VeChain reveals new mobile wallet UI

- Tradecurve could hit $1 soon due to its low market cap

>>BUY TCRV TOKENS NOW<<

Caged Beasts (BEASTS): An emerging presale sensation

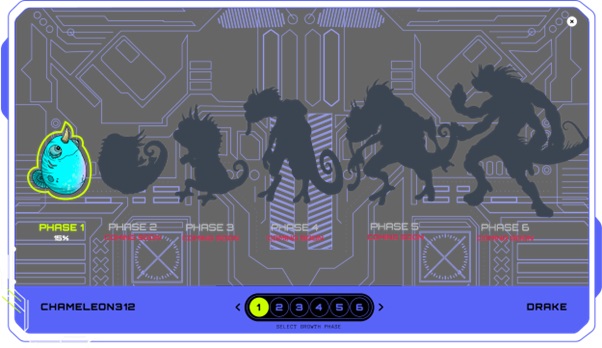

Caged Beasts are currently in Stage 1 of its presale and has managed to cause quite a bit of a name for itself.

A new caged beast is born at each presale stage, promoting excitement and interaction among the Caged Beasts community. The interaction doesn’t stop there; Caged Beasts allows users to generate passive income by referring their friends to the project – generating 20% of the deposit amount in USDT.

At the moment, $1 will bring you 179,111 Caged Beasts tokens. According to experts, Caged Beasts has a promising future.

VeChain (VET): Powering supply chain management

VeChain is a blockchain platform that enhances supply chain management and ensures product authenticity. With its focus on traceability and transparency, VeChain has gained recognition from prominent enterprises globally.

In a recent Web3 Sustainability Masterclass, Vineet Singh, the company’s product manager, gave the audience a weekend preview of VeChain’s newest mobile wallet user interface. After this reveal, the VeChain value soared and trades hands at $0.02046 with a market cap of $1.4B, a rise of 0.57% overnight.

VeChain’s new upgrades and proven track record make it a strong contender for reaching $1 by the end of 2023.

Looking for a sign to invest in #Tradecurve? ?

Well, here it is! ?

Be one of the first to enter the exciting world of #Tradecurve and unlock the potential for financial growth. Don't miss out! ?

Website: https://t.co/uXZ4W6GEHc#TCRV #InvestNow #FinancialGrowth #GetOnBoard pic.twitter.com/1EohGtJG7f

— Tradecurve (@Tradecurveapp) June 29, 2023

Tradecurve (TCRV): Set to surge by 50x

Tradecurve, currently in its presale phase, has raised $2.8M so far, and its native token, TCRV, has already soared by 80% from its starting price. This level of interest is rarely seen in the cryptocurrency market and can be attributed to Tradecurve’s hybrid infrastructure model, which has caused over 12,500 users to register.

Tradecurve combines the most notable features of DEX and CEX on a single platform. Moreover, the Tradecurve team has announced they will implement their own Proof of Reserves (PoR), demonstrating that they possess the assets they claim to hold on behalf of their users. The significant difference between Tradecurve and its competitors is that it removes the intrusive sign-up KYC checks and allows all derivatives to be traded from a single account.

Currently, TCRV is in Stage 4 of its presale with a value of $0.018. Experts have pointed out that TCRV currently has a low market cap of $32M with a 1.8B token supply as they forecast it to reach $1 way before any of the tokens mentioned above.

With plans of raising $20M by the presale’s end, Tradecurve could become a top 3 global exchange as it outshines platforms like Gemini. With an increase to $0.025 when Stage 5 begins next week and experts predicting a 50x growth by the time its presale finishes, purchase TCRV now before its value skyrockets.

For more information about the Tradecurve presale:

Click Here For Website

Click Here To Buy TCRV Presale Tokens

Follow Us Twitter