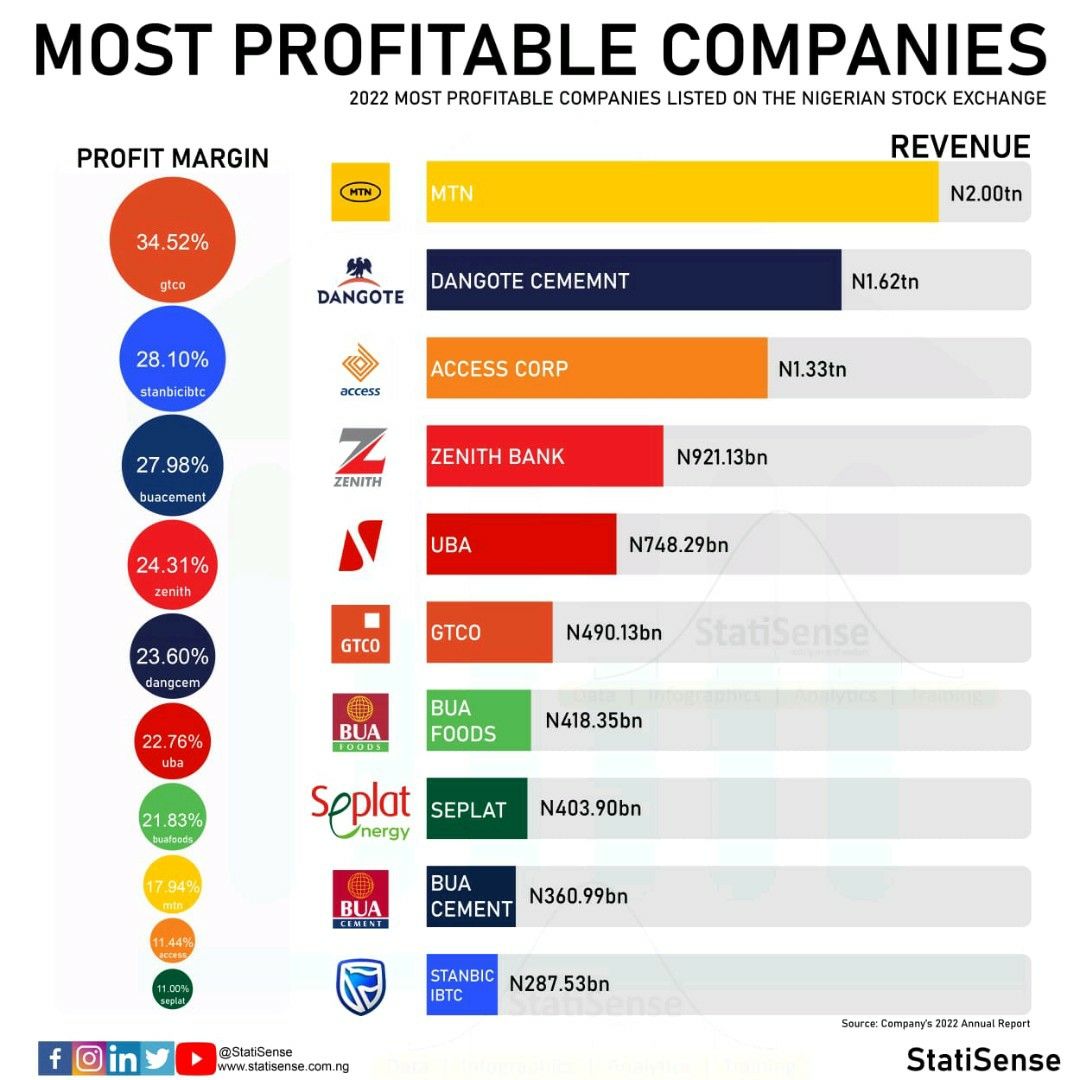

GTBank (yes, GTCO) was peerless a few years ago when it delivered an industry-leading cost-to-income ratio (CIR) of sub-35%, a critical indicator of operational excellence in banking. But recently, the CIR has dropped; from 42.3% in 2021 to 48% in 2022. Yet, it still leads the profit margin element in Nigeria’s leading companies.

From this plot, it is interesting how Dangote Cement outperformed MTN (a telecom company) on profit margin. Airtel Africa did not even make the cut, implying that it was somewhere below 11% on profit margin! Very interesting indeed!

Comment on Feed

Comment 1: Thanks for sharing Prof. I would love to understand this economics. In Market Cap, Airtel is No.1, But in Profitability, they are not even in top 10. As an investor, one is tempted to ask, “should I invest in a company with a higher Market Cap or a Company with a higher profitability”? Seems like a no-brainer right, because with more profit comes more dividend. So I am curious, what is the mathematics behind Market Cap and Profit Margins?

My Response: You have largely 3 types of public market investors – income chaser (dividend loving who want the certainty of income coming in), growth builder (they invest for shares to grow fast), and value picker (pick beaten down equities and hope they recover). Airtel has delivered great valuation growth which favours the growth builder. Dividend paying companies like Dangote Cement will appeal to the income chaser. Investment thesis is not about “profit”; Amazon was loss-making but was improving valuation over years.

That is why bankers will ask you “what do you want to accomplish in this investment?” Answering that question will help one build a portfolio. I recommend this Tekedia course -Tekedia Investment and Portfolio Management – for everyone .

Comment 2: Cement, which ordinary should be classed as ‘staple’ or essential product enjoys unregulated price regime, while telecom services have price control always looking over their shoulders. This is why both Dangote and BUA can enjoy better margins than MTN.

For the banks, their own profit margins aren’t much about hardwork or innovation, rather the system favours them so much that by doing the barest minimum, they can still turn in significant profits; we rarely have commercial banks that are not recording profits.

Our market system is broken, just like the Nigerian State, so profits and advancements aren’t necessarily tied to ingenuity and excellent execution, rather a case of aligning with the right forces, and your small hustle will balloon in profits.

The wealth without enterprise (or subpar enterprise) maxim is always in play here.

Comment 3: Everything should not be about profitability. Do a Salary survey and staff welfarism in those companies with high profitability ratio to revenue, then you will understand that this profit is to the detriment of their staff.

My Response: Actually, in the CEO Report, these companies with the highest profit margins outperform. Profitable companies have funds to pay workers. They represent the best paid sectors in the public market – banking, oil/gas, telecoms. I am not sure if you have data to show otherwise. By far, these 10 companies are the best to work for all companies traded in the public exchange in Nigeria. So, unless you show data, your comment that profit is detrimental to staff is not there