The administration of U.S. President Joe Biden has proposed an excise tax on cryptocurrency miners equal to 30 percent of the cost of the electricity they use, and plans to eliminate tax deductible losses related to wash-trading of crypto tokens, according to a U.S. Department of the Treasury’s document published Thursday. It’s “hindering the transition to a low-emission energy future,” the White House says.

The Treasury Department said any company using computing resources owned or borrowed — to mine digital assets will be subject to the 30% tax, which is expected to be introduced over three years in 10% annual stages starting from Dec. 31, 2023.

The increase in energy consumption attributable to the growth of digital asset mining has negative environmental effects and can have environmental justice implications as well as increase energy prices for those that share an electricity grid, the Treasury Department said.

According to the White House, the estimated global electricity usage for crypto assets is between 120 and 240 billion kilowatt-hours per year, a range that exceeds the annual electricity usage of Australia.

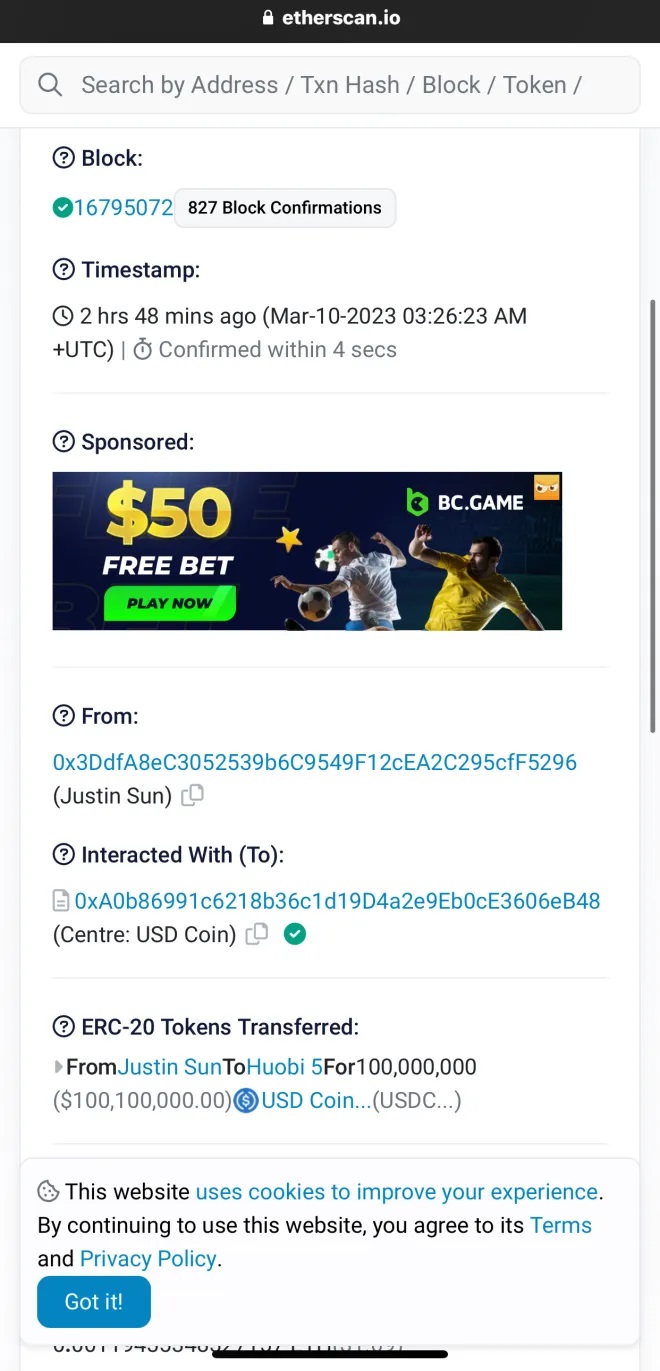

President Biden’s 2024 Fiscal Year budget also included a proposal to apply “wash sale rules” to digital assets to close tax loopholes. Wash trading for tax purposes refers to investors selling a financial instrument for a loss to claim the deductible and then immediately buying it back.

Crypto traders can claim tax-deductible losses on losses and then immediately repurchase tokens as digital assets are not classified as securities, while stocks and bond traders are prohibited from repurchasing the same securities for 30 days.

Similarly on the new tax havens, Speaker McCarthy said; President Biden just delivered his budget to Congress, and it is completely unserious. He proposes trillions in new taxes that you and your family will pay directly or through higher costs. Mr. President: Washington has a spending problem, NOT a revenue problem. However, both the House and Senate voted against Biden’s ESG rule.

The U.S. expects to apply the same restrictions on crypto from Dec. 31, 2023, where the country might raise US$24 billion from fixing the loophole, according to the White House.

Now according to the new proposed tax plan: Joe Biden Calls to double down the capital gains tax from 20% to 40%. The increase in capital tax gains means that a person has to pay more tax on his/her crypto profits this will lead to less motivation to invest further and hence will reduce volumes plus crypto prices.

Also, the new tax rule also removes the ability to tax-loss harvest. Tax-loss harvesting is a practice of selling a security that has incurred a loss to help investors reduce or offset taxes on any capital gains income subject to taxation. This practice is accomplished by harvesting the loss. The sold security can be bought back or replaced by a similar one.

More so, major price movements in the crypto markets are done by whales. Now the new tax plan also requires that the richest 0.01% of Americans pay at least a 25% tax rate “This means taxing more to the rich” Again, due to more tax the rich (whales) can lose motivation to buy & ultimately leading to low volume & low crypto prices.

Lastly, the Corporate tax rate is set to increase from 21% to 28%, which could impact the company’s bottom line. Biden also adds a new tax on small business owners. Biden also proposes a 30% tax on electricity used for Bitcoin and crypto mining.