It was a moment of fortuitous erudition and joyous felicitation at the recent launching of the book; ‘’Handbook of Public Relations Case studies’’ authored by Rasheed Adebiyi , Kamoru Salaudeen and Mutiu Lasisi Iyanda all of whom have been described by their friends, mentors and benefactors as refined minds of significant influence in the communication industry.

The book launch which held on Saturday, January 21, 2023 via zoom was attended by scholars and practitioners alike who commended the authors for their collective efforts towards adding to knowledge and raising the bar of public relations practices in Nigeria, in Africa and in the global south at large.

In attendance were Dr. Emannuel Mogaji, Senior Lecturer of Marketing and Advertising Communications, Greenwich University, London; Dr. Bisi Olawuyi, Lecturer at the department of communication and Language Art, University of Ibadan; Dr. Adewale Adeniyi, Vice President, Nigerian Institute of Public Relations; Professor Ayo Ojebode of Applied Communication, Department of communication and Language Art, University of Ibadan; and Mr Rasheed Bolarinwa, Head of Corporate Communications, Polaris Bank among others.

In his opening remarks, Mr Adewale Adeniyi commented on the timely value of the new book considering the increasing demand for data-driven perspectives in the PR profession. He congratulated the authors for adding their perspectives to the study of public relations and hoped that students and scholars will find the book very resourceful and rewarding.

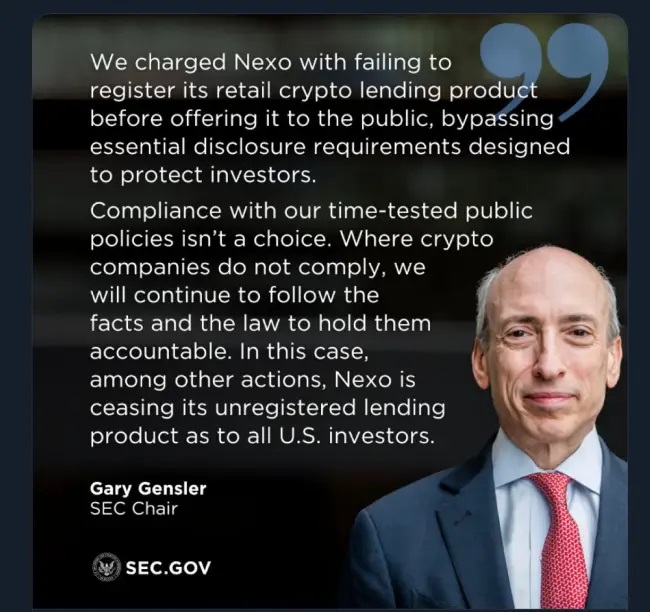

Giving the launching lecture entitled, ‘’The Strategic Place of Digital Platforms and Data in Reinventing PR Practice in Uncertian Times’’ Mr Rasheed Bolarinwa stressed on how the social media has become an integral part of modern PR practices and why mastery of the social media space and the necessary tools to navigate it is the fulcrum of digital PR.

Mr Bolarinwa also made the case for digital PR referencing how the social media has increasingly been used by corporate organisations to break limits in different areas of their enterprises including marketing, brand visibility, communication and promotion, customer relations and community service and community growth.

Digital PR has wide possibilities across its value chains. However, relevant stakeholders need to put up strong collaborative efforts to deal with the existing “dearth of quality contents and content curators” in the social media space moving forward, Mr Bolarinwa noted. He proposed that students of communication have to be given the needed internships to build the required capacity for the next generation PR practices.

The hand book of PR case studies is an intervention to decolonize African literature and contextualize emerging theories and perspectives in PR practices, Dr. Rasheed Adebiyi, one of the authors of the book who is also a communication lecturer at Fountain University, Oshogbo, has said. According to DR Adebiyi, the book is targeted towards achieving some specific objectives which include the following:

- To encourage the use case studies method for teaching in the classrooms

- To bridge the gap between the industry and the classroom

- To provide practical guide and real-life cases to students and practitioners in the industry

- To promote data-driven digital public relations

Finally, Dr. Rasheed Adebiyi noted that effort is ongoing to extend hands of fellowship to institutions where Public Relation is taught across the country to further the conversation around digital PR practices.

Data is the oil of Digital Public Relations – An Interview with Dr Adebiyi, University Don