Pele, Edson Arantes do Nascimento, died on December 29, 2022. According to various sources, he was born on October 23, 1940 in Três Coraçes, Minas Gerais, Brazil. While battling colon cancer, he was covered by several media outlets around the world and discussed by individuals and organizations on various digital platforms and in physical settings. Using Pele as a keyword for navigational search on Google yields approximately 270 million results, with the majority of publications focusing on his life times and death period, as of the time of writing this piece.

Aside from the mainstream news media, creative industry players have also curated a number of his activities on pitches and in general administrations for public consumption. Our investigations reveal that the public has been flooded with stories about how he helped some countries during their political crises, as well as how he supported the less fortunate in his immediate communities and beyond. For example, Netflix already has a film about his football career.

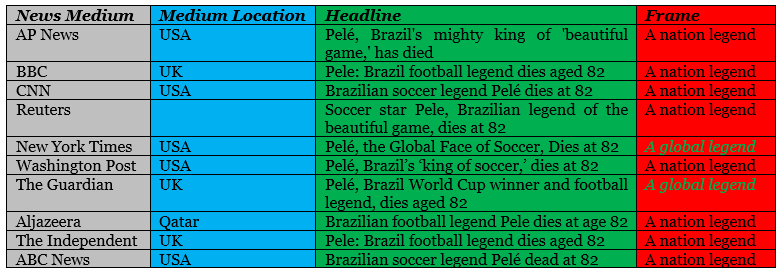

Exhibit 1: Select news media and their respective frames

Meanwhile, the purpose of this piece goes beyond explaining his life and achievements as reported in the media. The piece looks at how the “King of Soccer” was portrayed in the global media in the days leading up to his death. The selection and examination of prominent news organizations from the global north and south reveals that AP News, BBC, Reuters, Washington Post, Aljazeera, The Independent, and ABC News portrayed him as “a nation legend” rather than “a global legend” in their early reports. According to research, The New York Times and The Guardian, both based in the United States of America and the United Kingdom, regarded him as “a global legend.”

Based on the emerging insights, our analyst concludes that it is obvious that international media, such as those chosen for analysis, may create a “backward frame” when the death of an acclaimed international icon occurs in contrast to a “forward thinking frame”. When natural disasters occur, our analyst believes that “backward framing” occurs when media organizations and their employees fail to repeat previously held framing patterns of a specific person or organization. Those who used the “forward frame” by portraying him as “a global legend” solidify their previous belief that he was truly “a king of soccer.”