Trader Joe, a one-stop Decentralized Trading platform on the Avalanche network, will be deploying the highly innovative and efficient Liquidity Book AMM onto Arbitrum One, a next-generation Layer-2 network, bringing zero slippage trades and discretized liquidity provisioning to all Arbinauts.

Why Arbitrum?

Arbitrum, is the leading Ethereum Layer-2 scaling solution, developed by Offchain Labs. Since launching in August 2021, TVL has grown to hold a majority share (over 50%) in the L2 segment and the ecosystem home to more than 400 DeFi and NFT projects.

The Arbitrum ecosystem is packed with progressively innovative protocols, as well as having presence from many industry leading DeFi protocols. Deploying Liquidity Book onto Arbitrum, will be a great addition to the vibrant ecosystem.

Exporting Innovation on the Avalanche Chain is the birthplace and true home of Trader Joe and that will not change. Avalanche will remain our top priority for all growth efforts. The aim was to always innovate on the frontiers of DeFi at a global level. We have achieved our first step with the launch of our new AMM, Liquidity Book, the most efficient AMM built to date that offers an unparalleled user experience that is fully on-chain and decentralized.

Deployment to Arbitrum One is the next step in this global expansion effort and we look forward to introducing the innovative AMM built on Avalanche, and also working with new partners to benefit the collective DeFi ecosystems of Arbitrum and Avalanche — An aspect on our Mission statement we would see through its growth.

What exactly is deploying onto Arbitrum?

Liquidity Book AMM and Joe V1 will deploy on the Arbitrum One network, this move will combine a next generation AMM protocol with a next-generation Layer-2 network.

A quick recap on Liquidity Book: The Liquidity Book AMM is highly efficient, flexible and composable AMMThe key features of Liquidity Book AMM: Novel Volatility Accumulator that controls a volatility adjusted dynamic fee Discretised bin architecture enabling the concentration of liquidity Composable architecture with fungible token receipts Minimal trading fees, thanks to zero slippage swaps.

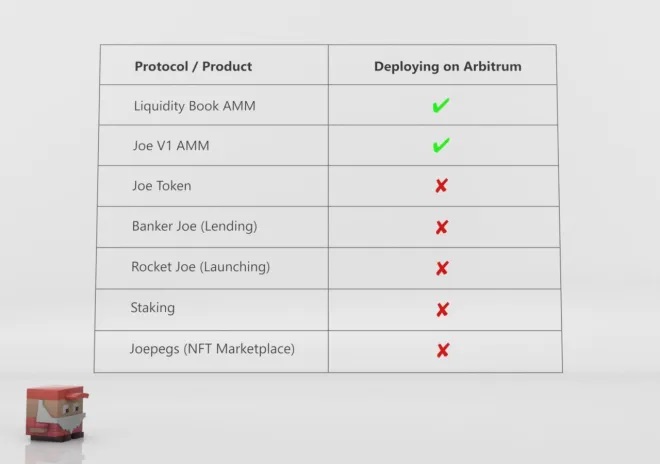

What is NOT deploying onto Arbitrum?

Trader Joe, will not be deploying the JOE Token, nor the full suite of DeFi products that has been built on Avalanche in this initial phase.

For clarity, the below graphic clearly highlights what is deploying and what is not deploying on Arbitrum One. Disclaimer: Whilst this is the primary plan, there may or may not be changes in the future.

What is the expected timeline for Deployment?

Trader Joe, is working closely with the Offchain Labs team to launch onto the Arbitrum testnet within the coming days. We expect that mainnet will be deployed onto the Arbitrum One network by early January and all communications will be prompt in the expected timeframe.