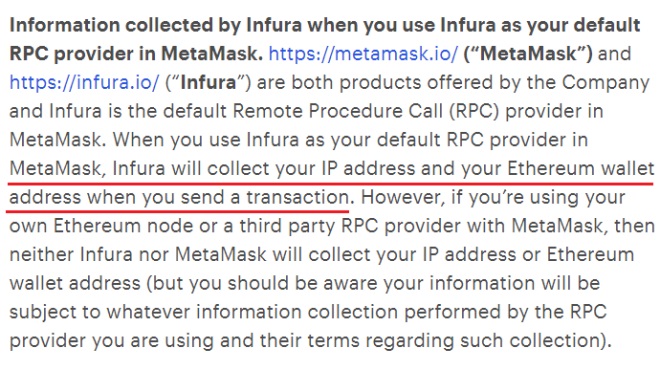

Consensys, owners of MetaMask a decentralized wallet Infrastructure use in storing and trading Digital Assets just updated its Privacy Policy, which states that they are collecting ‘Users IP ADDRESS’ when you send a transaction. The company made this release on its newly updated terms and conditions – https://consensys.net/privacy-policy/.

As long as you are using a public RPC; you’re subjected to surveillance, switching wallets and RPC only moves the surveillance to another service. If you really want to stay truly anonymous, you would have to setup your own private node.

Metamask does not collect IPs, Infura does collect them, by using their RPC your IP is then collected. The nuance is very important, because you can avoid this by using a different node. User wallets must be completely user owned, all info must be in user control, not in any company or quorum control.

Wu Blockchain said;

However, if you’re using your own Ethereum node or a third party RPC provider with MetaMask, then neither Infura nor MetaMask will collect your IP address or Ethereum wallet address.

How To Bye-pass Metamask RPC

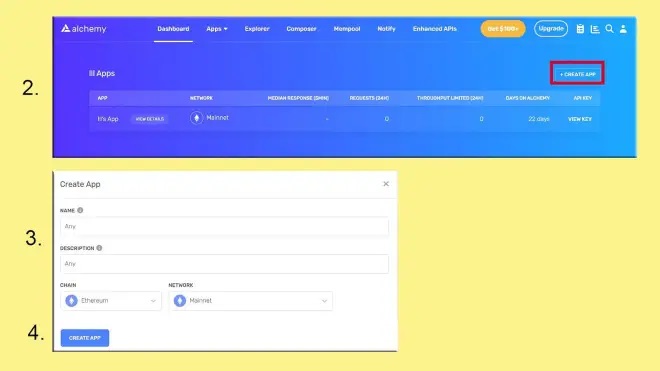

To change the Infura RPC endpoint for the Alchemy one on your Metamask; Sign up here https://www.alchemy.com/?r=250a75f9beb6ffb5:

Click on ‘Create App’.

Name: Any

Description: Any

Chain: Ethereum

Network: Mainnet

Click on ‘View Key’ then Copy the ‘HTTPS’ link. Go to metamask, click on ‘Add Network’ >> ‘Add a network manually’

Network name: Ethereum Mainnet Alchemy; RPC URL: paste the HTTP link we copied earlier: Chain id: 1; Currency: ETH; Block exp URL: https://etherscan.io Click ‘Save’.

Web3, is centered around value and not users data, thou Users’ data has been the most valuable asset on Earth for the last decade, the bigger a product gets the more anti-Crypto ethos it becomes, which only pivot it to be Web2 alike, hard to even trust them on using external RPC.

We want an ideal Web3 ecosystem, this means security and privacy are essential. But users must now, trust that any company collecting personal data is not going to misuse it, or be at risk of anyone gaining access to vital informations – for sure safe custody is the way forward.