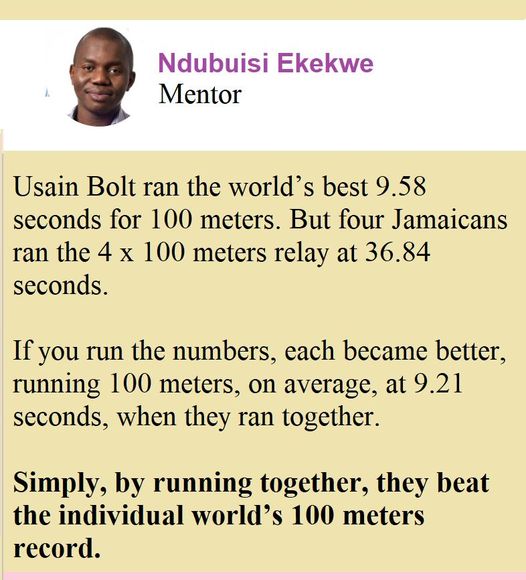

I have used this photo to teach in a military academy, a big bank and a global supply chain company, this month. At Tekedia Institute, we try to build analogies from simple things. Yes, just as the four Jamaicans beat the world’s 100 meters records when they ran together, a great team will outperform any great solo player. Collaborate, partner and work together.

Usain Bolt ran the world’s best 9.58 seconds for 100 meters. But four Jamaicans ran the 4 x 100 meters relay at 36.84 seconds. If you run the numbers, each became better, running 100 meters, on average, at 9.21 seconds, when they ran together.

Simply, by running together, they beat the individual world’s 100 meters record. Collaborate, partner and advance together.

Beat the world’s record >> work as a team.

Comment on LinkedIn Post

Here, most times, I write to read Francis Oguaju’s comment. Read this comment on the Usain Bolt post – https://lnkd.in/eXT6r7GJ) . Today, Nigeria has scored another own-goal: “Minister of Finance, Budget and National Planning, Zainab Ahmed, has said that Nigerians would get N5,000 per month as a transportation grant after the removal of fuel subsidies.” If you cannot run fuel subsidies well, do you have any chance to distribute N5,000 monthly effectively?

Minister of Finance, Budget and National Planning, Zainab Ahmed, has said that Nigerians would get N5,000 per month as a transportation grant after the removal of fuel subsidies.

According to the Minister, the Federal Government will remove fuel subsidies by 2022 and give the poorest Nigerians a transportation grant of N5,000.

Ahmed said this on Tuesday, at the launch of the World Bank Nigeria Development Update in Abuja, stating that about 30 to 40 million Nigerians, who are the poorest in the country, would have access to the grant.

She said, “The subsidies regime in the [oil] sector remains unsustainable and economically disingenuous