In 2003, the administration of former President Olusegun Obasanjo established the Economic and Financial Crimes Commission with the sole responsibility of getting rid of economic and financial crimes in the country. From the leadership era of Mallam Nuhu Ribadu to the current chairman, Abdulrasheed Bawa, the Commission has carried out a number of arrests and successfully executed persons found guilty of various crimes.

In spite of the Commission’s activities, social commentators, political leaders and public affairs, locally and internationally, have always perceived the Commission has been selective in arresting and prosecuting some politically and economically exposed citizens across the country.

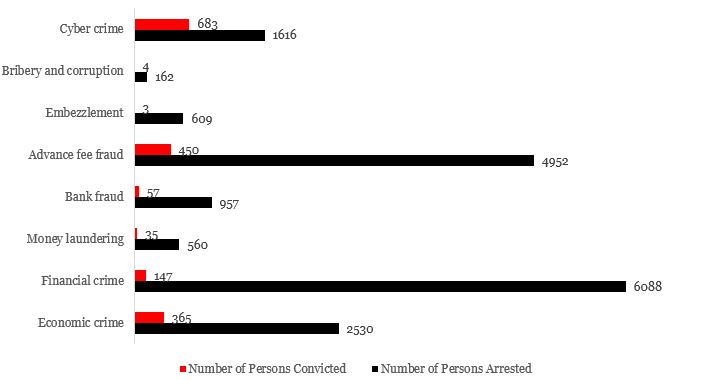

Beyond the public perception and representation of the Commission’s activities in digital and physical spaces, this piece interrogates the recent statistics jointly released in a statistical report of women and men, which establishes the Commission’s performance in terms of number of persons arrested and prosecuted between 2017 and 2019 for economic crime, financial crime, bribery and corruption, cyber crime, embezzlement, advance fee fraud, bank fraud and money laundering.

For these crimes, the Commission was able to arrest 17, 474 persons and prosecuted 1,744 persons during the three-year period [see Exhibit 1]. Looking at the number of persons convicted against those arrested, analysis indicates 9.98% conviction success rate. Our analysis further suggests that the Commission appeared to deploy its resources towards ending crimes that are being committed by Nigerians with low socioeconomic and political status.

For instance, the Commission’s data reveal an exponential increase in both arrest and conviction of offenders of cybercrime. “In 2017, 2018 and 2019 the number of males arrested for cybercrime were 277; 319 and 878 as against 21; 48 and 73 females respectively. Out of these, 134, 151 and 390 males were convicted in 2017, 2018 and 2019 respectively, while only 8 females were convicted in 2019,” the Statistical Report says.

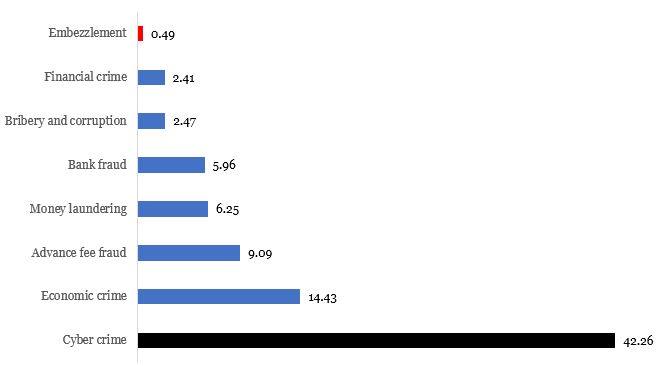

Exhibit 1: Performance across crimes categories

Crime by crime conviction success rate analysis reveals that offenders of economic crime, advance fee fraud, money laundering and bank fraud were more convicted than those who committed bribery and corruption, financial crime and embezzlement crimes during the period. Our analyst notes that the disparity in arrests and convictions could be linked with a number of factors. The poor criminal justice system remains key obstacle to more convictions. Concerned stakeholders are expected to work out more strategies and right political will for the arrest and prosecution of offenders.

Exhibit 2: Commission’s Conviction Success Rate based on Number of Arrested and Convicted Persons [in %]