You have these elements when it comes to business playbooks:

- Nature to consumers (N2C): Nature provides them to consumers and the products are not available under normal circumstances to be monetized. Examples are air and village clean water from the stream.

- Government to consumers (G2C): If the Nigerian government goes ahead with its e-naira digital currency, moving deposits from commercial banks to the central banks, that would be a great example. Companies can still monetize on it but lower in the food chain.

- Business to Consumers (B2C): an example is Tekedia Mini-MBA where companies serve consumers, fixing their frictions.

- Business to business(B2B) like Fidelity Bank Plc buying cars from Innoson Motors.

- Consumer to consumer(C2C ): this is peer-to-peer where people attain equilibrium and execute business transactions. That is happening in Nigeria with the cryptocurrency ban.

- Others: B2B2C, etc

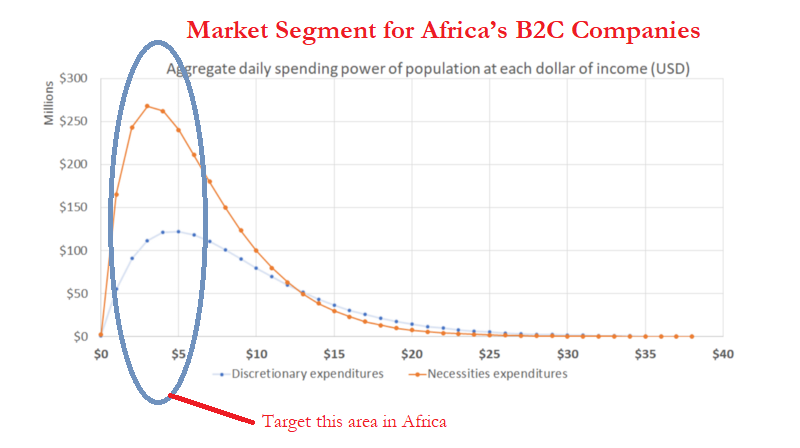

As a founder, picking the space to play in these options and how you serve the clients is the most critical decision you would make. Largely, where you commit will determine your business model. In Tekedia Capital, I will not fund a B2C company in Rwanda because it does not have the numbers. But I am open to B2C in Nigeria. Rwanda can only be attractive for B2B provided I can get early commitments for the product. So, geography shapes your playbook.

Once that is determined, the next question is this: how do I monetize now that I have known how to hit the market? For that one, you look at different indicators. One is how much can people afford to pay? Recently, breaking the pricing into “sachets” helps. That ensures people can buy what they can afford.

Flour Mills Nigeria Plc has improved its pricing and the market rewarded it. Nestle is now the queen of sachetization and it is doing amazingly fine. Cadbury is struggling because its products are not that well optimized on pricing. Unilever is also under siege but it has to clean its books first. In these entities, having well priced products, in segments that customers can afford, at their levels, is very important.

[…]

This is the age of sachetization in Nigeria irrespective of whatever you are selling. We are doing it in Tekedia Mini-MBA with bands for core courses, review of labs, projects supervision, etc. Having broken all into “sachets”, our members have the freedom to pick as they need. If we had lumped all together, resistance to conversion would mount. Pay attention to your pricing playbook – it is a key factor now to success in Nigeria.

To a large extent, Africa’s largest consumer base for B2C is at $3 daily spending bucket. So, if you want the highest possible capture of the population, that product must be priced around that point. There are many ways to do that including packaging in sachets and doing Buy Now Pay Over Time.

This is it: to win in Africa, you must understand your pricing playbook and the broad mechanics of product pricing. The market is super sensitive to prices.