I am proposing a rethink of the UN Sustainable Development Goals (or SDGs), largely from an African lens. In this article, “Making a Case for SDG 18 Eradicating Pandemics and Epidemics,” my main contention is that Africa has always been late to the party from a global community perspective.

We have witnessed the laid back attitude of many countries who are party to numerous accords and treaties include those related to climate change and the sustainable development goals. I say laid back, because the arguably “smart” members put their national/ regional interests first. Is it protect Big Tech as is the case of the US or the Common Agricultural Policy (including fisheries) in Europe (notably France)?

Why is the UN SDG skewed towards climate change and the environment and less elaborate on health concerns (Africa’s main challenge), which have now been accentuated by the coronavirus pandemic and the firefighting approach to what should have been long foreseen?

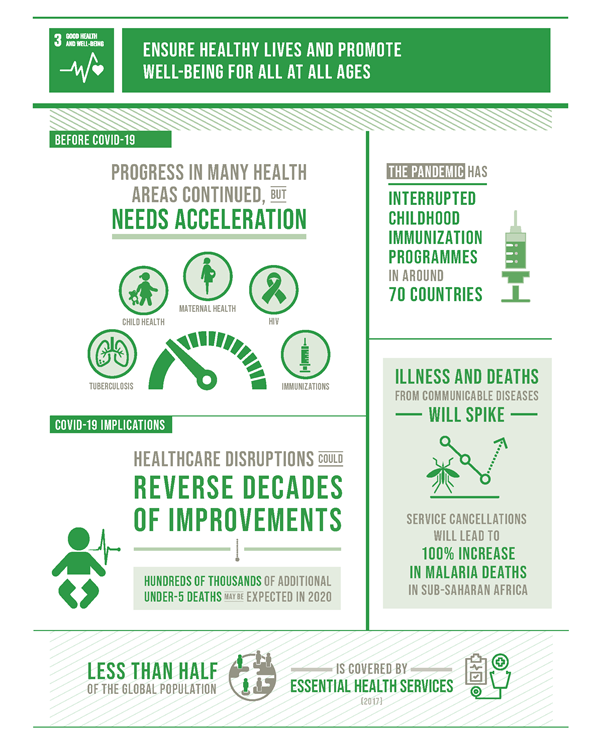

Looking at the 17 SDGs, at least seven revolving around the environment i.e., SDG 6 (Clean Water and Sanitation), SDG7 (Affordable and Clean Energy), SDG 11 Sustainable Cities and Communities, SDG 12 Responsible Consumption and Production, SDG 13 Climate Action, SDG 14 Life below Water, SDG 15 Life on Land. In all of this, only 1 is focused on health i.e., SDG 3 Good Health and Well Being. This makes me wonder how unhealthy people can take care of the environment and climate change related matters.

Malaria is still baffling Africa alongside Tuberculosis, Cholera and Ebola – all immunisable epidemics that preceded the technological advancements we enjoy today.

Believe it or not, Ebola is (not was) a pandemic only limited by its spread, and consequently relegated to the status of epidemic. However, neglecting its severity may well have made it more difficult to manage the current coronavirus pandemic. As a recent article in The Africa Report points out, African leaders are still at the preparatory phase of tackling the next pandemic.

Only recently, a report from the African Union read “Africa Mulls over Vaccine Manufacturing – African Union.” Read the excerpts of that news briefing:

African leaders and international and regional partners are holding a two-day conference to discuss manufacturing and supply of COVID-19 vaccines across the continent. President of the Democratic Republic of the Congo Felix Tshisekedi, who is the current chairman of the African Union for 2021, South African President Cyril Ramaphosa, Rwanda President Paul Kagame, and Senegal President Macky Sall are attending the two-day conference…

The list of attendees at the conference cannot get any bigger that the following four:

- Moussa Faki Mahamat: Head of the African Union Commission.

- Tedros Adhanom: Director General of the World Health Organisation.

- Akinwumi Adesina: President of the African Development Bank.

- Ngozi Okonjo-Iweala: Director General of the World Trade Organization.

In his welcome address at the virtual conference, Mahamat called for what he described as “a strategic partnership for a new health world order” in view of enabling the continent to be able to meet most of its need for pharmaceutical drugs and vaccines.

In an article I published two years ago, “Meeting the Sustainable Development Goals through Higher Education,” I raised concerns about the preparedness of Africa towards meeting SDG 4 Quality Education.

Interestingly, the 2021 session (ninth in the series of meetings) of the High-level Political Forum on Sustainable Development (HLPF) taking place from 6 July 2021 plans to interrogate the national implementation of the SDGs by tracking progress and challenges at this level.

The HLPF is the main UN platform on sustainable development. It has a central role in the follow-up and review of implementation of the 2030 Agenda for Sustainable Development and its Sustainable Development Goals (SDGs). All UN Member States as well as representatives from civil society organizations participate in the HLPF, which meets under the auspices of the UN Economic and Social Council (ECOSOC).

It also seems, from reading the agenda of the forthcoming conference, that only nine of the 17 SDGs would be on the table come July 2021.

The 2021 HLPF will also hold in-depth reviews of nine SDGs: Goal 1 (no poverty), Goal 2 (zero hunger), Goal 3 (good health and well-being), Goal 8 (decent work and economic growth), Goal 10 (reduced inequalities), Goal 12 (responsible consumption and production), Goal 13 (climate action), Goal 16 (peace, justice and strong institutions), and Goal 17 (partnership for the Goals).

In the light of the above, perhaps it may be too late or unnecessary to have another SDG, but the importance of refocusing efforts on preventing future pandemics and having an “armed response,” so to speak, strategy in place, may well move SDG 3 further up the agenda. For African Leaders, kindly make more judicious use of the resources you plan to set aside for Covid-19 vaccines by sourcing what you have limited capacity of making. Focus on sourcing and distribution for now and provide us with an update on the Ebola vaccine and other diseases that pose a clear and present danger.