On Thursday, Paymob, an Egyptian digital payment startup, announced it has raised a new $15 million Series A round led by Global Ventures. A15 and FMO, the Dutch entrepreneurial development bank, also participated in the investment.

This brings the total money raised by the startup to $18.5 million having secured $3.5 million that came as its first tranche in July 2020. It is the largest-ever Series A raised by a fintech in Egypt and one of the largest equity rounds in North Africa.

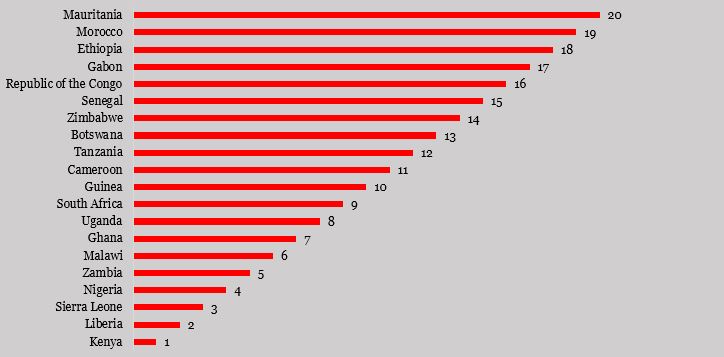

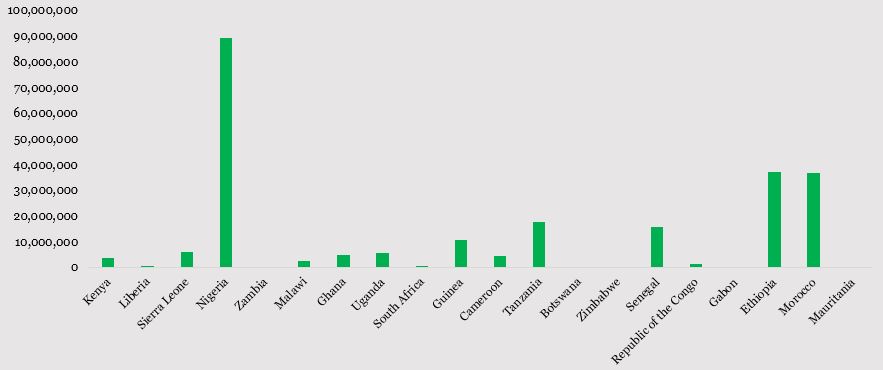

The round also points to a change in the African fintech industry, where Nigeria, Kenya and South Africa have been leading the way.

Founded in 2015 by Alain El Hajj, Islam Shawky and Mostafa El Menessy, Paymob was rated among top 10 of the 83 fintech startups in Egypt in 2020.

The startup helps online and offline merchants accept payments from their customers via several products and solutions.

With its different products and APIs, it enables online and offline businesses to accept and send payments. The merchants can easily integrate Paymob’s payments APIs in their websites or mobile apps to accept payments from their customers using different payment methods including cards, mobile wallets, and cash on delivery.

Nigerian payment startup, Flutterwave, which recently attained unicorn status, is seeking to expand its services to North Africa, where Fawry, Paymob’s country rival, reigns. The move which underscores how ripe and vast the African fintech market is, also points to the fact that Egypt’s fintech startups are yet to catch up with their sub-Saharan Africa counterparts.

Paymob said in a statement that the revenue for its payment acceptance business grew over 5x in 2020, with its technology now being used by over 35,000 local and global merchants including Swvl, LG, Samsonite, and the American University in Cairo. The startup claims to have processed payments worth over $5 billion to date.

Paymob also offers white-label mobile wallet solutions, helping businesses build a digital wallet into their apps, using its technology. The startup said that its mobile wallets infrastructure processes over 85 percent market share of transactions in the Egyptian market. The solution also serves merchants across international markets like Kenya, Pakistan, and Palestine.

With the fresh capital, the company aims to accelerate its expansion to Saudi and other regional markets this year. It will also use the funds to expand its merchant network and further enhance the suite of products.

Islam Shawky, the co-founder and CEO of Paymob, said the latest round will be used to fill abounding digital payment gaps through the acceleration of its services.

“We couldn’t be more excited for Paymob’s next phase of growth; the market opportunity in the region is unprecedented. The large digital payments gap still exists and we are delighted to be working with progressive-thinking regulators to address this,” he said.

“This latest capital raise will accelerate our progress to reducing the digital payments bottleneck. All our existing investors have increased their holdings, and we thank them both for their support and the confidence they have in our business model and track record of execution,” he added.

Aside from Egypt, Paymob is also present in Kenya, Pakistan and Palestine. Shawky said the company has plans to expand into more Sub-Saharan African countries.

Paymob has a perfect combination of high-quality technology, a product customers increasingly cannot do without, and an outstanding management team. Their market opportunity is also huge; Egypt’s transformation to a cashless society is being enabled by the unique products Paymob has built, Basil Moftah, General Partner of Global Ventures, said,

Last year, Fawry became a publicly traded unicorn for the first time, a major boost to the Egyptian fintech ecosystem and is also seen as an inspiration to other startups in Egypt and the North African region.

With investors racing to grab a cut of the African fintech boom, every startup appears to stand a chance for maximum growth. But with Egypt’s startups attracting more investors now, the market is about to get more competitive.

Like this:

Like Loading...