Poor Shoprite – its voyage to Nigeria has not been without drama. The latest is that after the asset changed hands in Nigeria, workers want to be paid terminal benefits before the new owners take charge, and possibly re-hire them: “What you see happening here today is just a picketing type of strike, that is what the workers came here to do. Just to picket the entrance of Shoprite. Apparently, in a bid to stop them from trading until our pending proposals and demands are met by the management.” A Union member noted that “workers are supposed to be paid off and not transferred to the new owners without their consent” as Premium Times summarized.

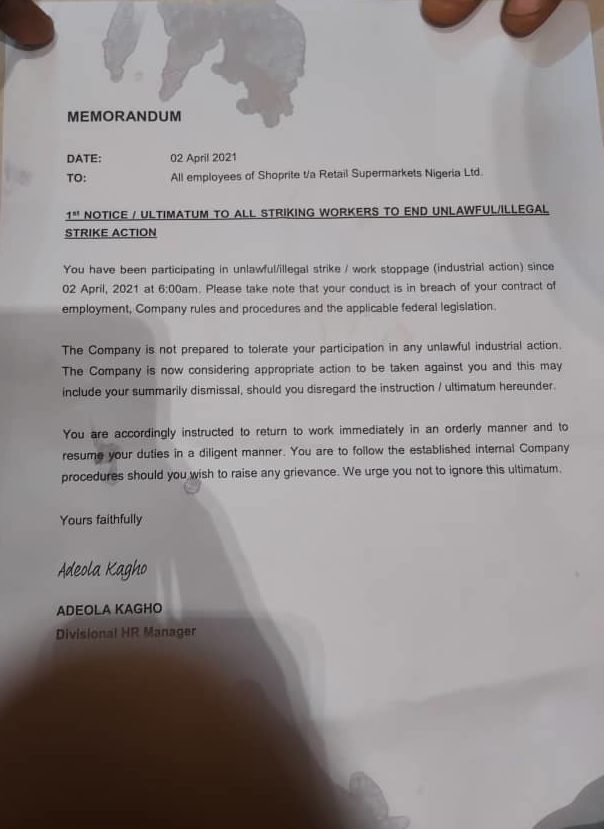

The company has a note that it would fire workers who fail to return to work (see below): “Please note that your conduct is in breach of your contract of employment, company rules and procedures and the applicable federal legislation. …“You are accordingly instructed to return to work immediately in an orderly and diligent manner”.

But the workers are saying that “People can’t come to our country, invest, and we give you all you need and then you have Nigerian staff that are not treated very well, that’s bad.”

I am hoping they find a common ground – and get back to work. But if there is a double trigger acceleration clause, these workers may be out of luck legally; the clause requires two events to trigger acceleration, usually a company sale and involuntary termination of workers. When that happens, current workers are not guaranteed new jobs in the new company.

So, the new owners can decide to pay terminal benefits and refuse to rehire! The Union must check the deal agreement.

Yet, it is always fair to share the goodies with your staff. But here, no one considers this as an exit, from any point of strength. In other words, Shoprite Nigeria’s original investors are not necessarily popping champagne because of this sale. Most of them are bloodied after this voyage and it would be good for the workers to have that in consideration as they negotiate. A labourer is worthy of his/her wage; the management and the workers must find a mechanism to avoid further harm to the company.

Double-trigger acceleration, as the name implies, requires two events to trigger acceleration – most typically the sale of the company and the involuntary termination of the employee, usually within 9-18 months after closing, and in some cases including a short pre-closing window (3 months or shorter) to counter any preemptive termination by the company to avoid a payout. Typically, the qualifying termination means termination of employment by the company without “cause,” but can also include resignation by the employee for “good reason” (e.g. a cut in pay, mandated relocation or significant downgrade of duties).

Double-trigger acceleration has become very popular with early stage companies and aims to align the interests of the employees, the investors and potential acquirers by (i) providing a safety net for key employees, some of whom may be removed in the consolidation during post-closing integration – CFOs and GCs are particularly susceptible, (ii) reducing dilution from automatic acceleration, and (iii) easing the qualms of the acquirer by preserving the requirement of ongoing service to the company in order to vest.