The European Union is planning to have a large share of the global semiconductor market by the end of the decade. The bloc wants to end dependence on non-European technologies by producing a fifth of the global output of cutting-edge chips.

The plan, named Digital Compass, is designed to set the 27 country bloc on the path of making its first quantum computer in five years.

COVID-19 pandemic-induced strains threw the world of technology into chip shortage, which has seen the auto, smartphone and internet-based technologies shutting down.

Europe has depended on Chinese and American companies for semiconductor supply, and in face of scarcity, the countries have been prioritizing.

“It is our proposed level of ambition that by 2030 the production of cutting-edge and sustainable semiconductors in Europe including processors is at least 20% of world production in value,” a document from the bloc seen by Reuters said.

The plan will be unveiled Tuesday by EU’s Vice President Margrethe Vestager and EU industry chief Thierry Breton.

The plan is geared toward establishing quantum technologies that will help the bloc in developing new medicines and speed up genome sequencing.

“It is our proposed level of ambition that by 2025, Europe will have the first computer with quantum acceleration paving the way for Europe to be at the cutting edge of quantum capabilities by 2030,” the document added.

The document revealed according to Reuters, that the plan is also to help Europe build 10,000 climate-neutral facilities by 2030, helping the bloc to develop cloud infrastructure and the doubling of unicorns, or companies with a $1 billion valuation, in the same period.

It will also aim to cover all European households by a Gigabit network by 2030, with all populated areas covered by 5G.

However, EU member states and the European parliament will need to approve the plan for it to be implemented.

Brussels has been tightening its grip on climate laws, limiting industrial activities. On Monday, some of Europe’s largest industry groups have asked EU lawmakers to change their position on the bloc’s planned carbon border policy, according to emails seen by Reuters.

The move came as European Parliament is set to vote on a report covering EU’s plan to impose carbon costs on imports of polluting goods. The aim is to protect European industry from competitors in countries with lax climate policies, and avoid firms leaving Europe to avoid CO2 (carbon leakage) cost.

Currently, the EU gives industry free CO2 permits to comply with the carbon market, allowing companies to emit a certain amount for free, to protect them from carbon leakage.

The move underlines the seriousness of climate laws within the bloc, emphasizing the need for climate-friendly facilities and automobiles.

But the new EU plan for semiconductors goes beyond climate concerns to economy interest for the European Union.

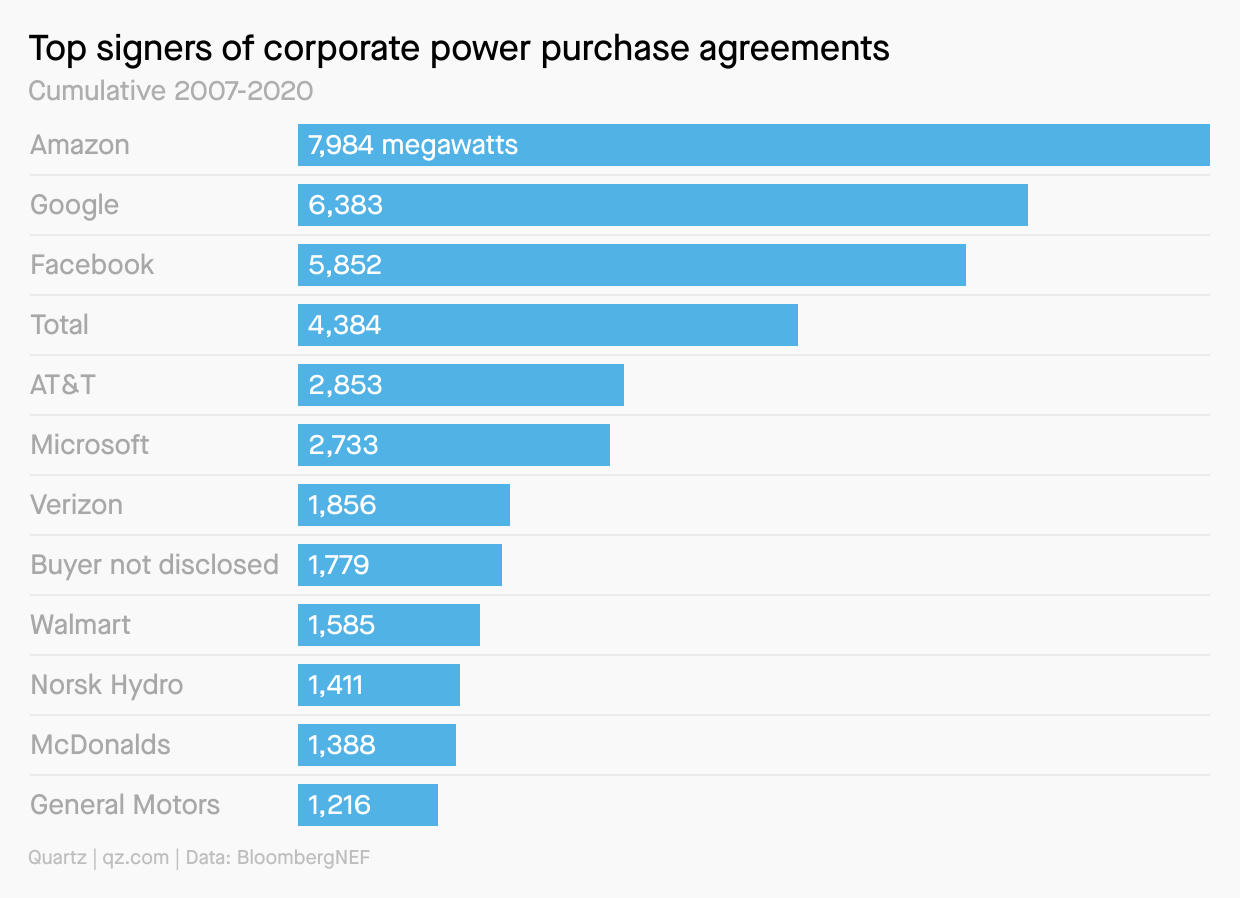

The European Semiconductor Industry Association (ESIA) announced last week that semiconductor sales reached $3.453 billion in January, an increase of 6.4% versus the same month a year ago. This represents a two percent increase compared to the December 2020 total of $3.370 billion.

But that is just a fraction of the global semiconductor market that is expected to reach $469 billion in 2021, compared to its 2020’s $439.0 billion market value.

Compared to other regions, Europe is the least market in the semiconductor industry. The United States, although it has recorded a drop to 12% since 1992, still leads the industry, followed by China who recorded over $13 billion in market value last year.

With the current drop in global semiconductor production, every region is seeing a reason to up the ante. The EU, driven mainly by climate concerns, AI and other tech developments, is pushing the Digital Compass plan to move from the spectators’ status to competitors in the semiconductor global market by the end of the decade.