This registration has closed. Please join the next edition here.

Invent, innovate and drive organizational transformation, performance, and growth. Capture emerging opportunities in changing markets while optimizing innovation and profitability. Digitally evolve your business or functional area, turning digital disruption into a competitive capability and advantage. Master the concepts of building category-king companies, and thrive.

Registration for 4th edition of Tekedia Mini-MBA (Feb 8 – May 3, 2021) continues. Tekedia Mini-MBA, from Tekedia Institute, is an innovation management 12-week program, optimized for business execution and growth, with digital operational overlay. It runs 100% online. The theme is Innovation, Growth & Digital Execution – Techniques for Building Category-King Companies. All contents are self-paced, recorded and archived which means participants do not have to be at any scheduled time to consume contents.

- Our dedicated learning management system, school.tekedia.com, is where you will take your classes.

- Our “Facebook for Innovators” is live hub.tekedia.com . The Android version is coming once Google approves. It will enable our members to collaborate more effectively.

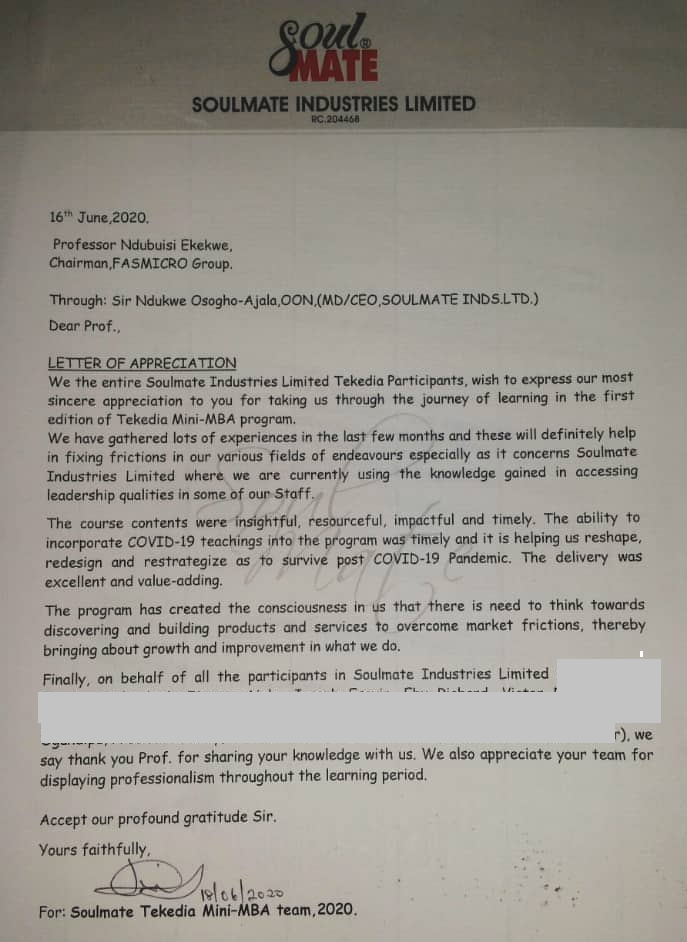

More so, it is a sector- and firm-agnostic management program comprising videos, flash cases, challenge assignments, labs, written materials, webinars, etc by a global faculty coordinated by Prof Ndubuisi Ekekwe. When we finish, we will issue a certificate from the Tekedia Institute, Boston USA.

Register and join us. You will emerge transformed with tools and capabilities that engineer confidence, performance and growth. Accelerate your leadership ascent with us and have access to speak with me on your career and professional development! Here are our programs and costs.

| Code | Program |

| MINI | Tekedia Mini-MBA costs US$140 (N50,000 naira) per person. |

| MINR | Add extra (optional) $30 or N10,000 if you want us to review and provide feedback on your labs. |

| MINF | Annual Package (includes 3 editions of MINI and optional 2 certificate courses): $280 or N100,000. |

| CERT: Add extra (optional) $60 or N20,000 for each capstone-based Certificate specialty course. You must have attended, begun, or about attending Tekedia Mini-MBA to qualify. The following Certificate tracks are available: | |

The Certificate program is completely capstone-based. Tekedia capstone is a research paper or a case study exploring a topic, market, sector or a company. Tekedia Institute supervises the work.

How To Register

Use options to pay for Tekedia and Fasmicro services.

- Bank transfer (Nigerian naira) options:

- GTBank 0114016493

- UBA 1019195493

- Name: First Atlantic Semiconductors and Microelectronics.

- Flutterwave: follow this link to use Verve, Visa, Mastercard, etc in Naira, USD, Ksh, Cedi, etc.

- PayPal: follow this link and pay in US dollars with global debit/credit cards

- Stripe: follow this link and pay in US dollars with global debit/credit cards

- Zelle (USD): use tekedia@fasmicro.com

After payment, email info@tekedia.com

After payment, email tekedia@fasmicro.com with participant’s name and code or program paid for, to complete the registration.

Registration Benefits

Tekedia CaseWorks

Tekedia has produced and still produces case studies, concept notes & investment briefs, exclusive to Tekedia Mini-MBA members. Visit Tekedia CaseWorks for some of the companies and brands.

Tekedia Mini-MBA Syllabus

Theme: Innovation, Growth & Digital Execution – Techniques for Building Category-King Companies

Introduction

Over the last few decades, digital technology has emerged as a very critical element in organizational competitiveness. It has transformed industrial sectors and anchored new business architectures, redesigning markets and facilitating efficiency in the allocation and utilization of factors of production. The impacts have been consequential: nations like Nigeria are moving towards knowledge-based economic structures and information societies, comprising networks of individuals, firms and states that are linked electronically and in interdependent relationships. In this program, we will examine this redesign within the context of fixing market frictions and deploying growth business frameworks in a world of perception demand where meeting needs and expectations of customers are not enough.

Program Time: Feb 8 – May 3, 2021

Venue & Format: Online via videos, articles, webinars, and flash cases. Program is self-paced which means you consume the materials at your own time and pace. It is completely online. You will have something to complete within 7 days. You decide when you do that within the window. Where you live or your time zone would not be an issue as program is not live-delivered.

Cost: US$140 (N50,000 naira). We have a payment plan, i.e. installment payment plan (email us for details)

Program Structure: The program structure is presented below.

Target Audience: This program is designed for professionals across functional areas like sales, marketing, technology, administration, legal, strategy, finance, etc across all business sectors and domains.

Learning Objectives: To innovate is to set a new basis of competition in an economy, business sector or market. Most times, it results to disruption. This program is designed for private (large, SMEs, startups) and public institutions. Participants will:

- Master the mechanics of growth – the reward of innovation – through frameworks, cases and evolving strategies.

- Understand how to undergo transformation journey that is fully aligned with corporate objectives through measurable and realizable benchmarks.

- Acquire business capability tools that do not just RUN their firms but can TRANSFORM them.

- Design corporate growth experiments in Lab sessions based on One Oasis Strategy, Aggregation Construct, Double Play Strategy, Accumulation of Capability Construct, and more.

- ETC

Tekedia Advanced Diploma Programs – Immediate Access Upon Payment

Each track of Tekedia Advanced Diploma programs runs for 8 weeks (2 months). A track has no Live Zoom session, and it is completely self-paced and online. Upon payment, you have immediate access to start learning. The program includes class notes, flash cases and videos, but no webinar. Each track costs $100 or N36,000 naira per participant. The tracks and curriculum are presented below.

| DLSM | Advanced Diploma in Logistics & Supply Chain Management |

| DBIS | Advanced Diploma in Business Innovation, Growth & Sustainability |

| DBPM | Advanced Diploma in Project Management |

| DIRM | Advanced Diploma in Risk Management |

| DIBA | Advanced Diploma in Business Administration |

| DIDT | Advanced Diploma in Innovation & Design Thinking |

| DIAT | Advanced Diploma in Accounting, Auditing, Forensics & Taxation |

Part A – General for All Tracks

In the first 4 weeks, all the tracks take the same courses.

| Week | Part A – Common to All Tracks |

| 1 | Innovation & Growth:

Growth and Innovation of Firms Digital Transformation, Innovation & Strategy |

| 2 | Business Systems & Processes:

Grand Playbook of Business & Entrepreneurial Pursuit Process Improvement and Operations Management |

| 3 | Business Model & Transformation:

Modern Business Models and Growth Execution Effective Organizational Change Management |

| 4 | Design and Innovation Lessons:

Innovation Lessons (5in5, Global, Africa) Product Design and Packaging |

The electives for the tracks are presented on this slider-table.

Part B.1 - Elective for Business Administration

| Week | Part B – Business Administration |

| 5 |

Quality & Project Management: Quality and Asset Management Effective Project Management |

| 6 |

Finance & Fundraising: Capital Markets, Investing and Fundraising Accounting, Building Sustainable Enterprises Financial Modelling |

| 7 |

Delivery and Execution: Marketing and Sales Management Supply Chain & Logistics Management |

| 8 |

Understanding Technologies and Sectors: Technologies: Cybersecurity, Blockchain, AI & Cloud, Data Management, 5G Sectors: Ecommerce, Fintech, EdTech, Agtech, HealthTech |

Part B.2 - Elective for Risk Management

| Week | Part B – Risk Management |

| 5 |

Risk Management: - Risk Management - Effective Security Risk Management Process - Digital Business Risk Management |

| 6 |

Law and Governance - Effective Corporate Governance - Law, Contracting & Negotiation |

| 7 |

Auditing & Accounting - Auditing, Forensics, Policies and Controls - Accounting, Building Sustainable Enterprises - Internal Auditing Strategy |

| 8 |

Sustainability · Cybersecurity - Sustainability Innovation for Business Growth |

Part B.3 - Elective for Project Management

| Week | Part B – Project Management |

| 5 |

Quality & Project Management: - Effective Project Management - Business Relationship Management & Negotiation Skills |

| 6 |

Partnership and Contracting - Global Partnership & Contracting - Law, Contracting & Negotiation |

| 7 |

Models and Planning - Planning Supply Chain - Accounting, Building Sustainable Enterprises - Financial Modeling |

| 8 |

Planning and Execution · Broadband Service Delivery – Business Case - Execution – Business Objectives and Technologies |

Part B.4 - Elective for Business Innovation, Growth & Sustainability

| Week | Part B – Business Innovation, Growth & Sustainability |

| 5 |

Growth - Managerial Accounting, Business Decision Making and Growth - Driving Profitable Growth, Marginal Cost, Scaling - Human Productivity Innovation |

| 6 |

Planning and Execution - Project Planning, Execution and Control - Execution – Business Objectives and Technologies |

| 7 |

Modelling - Accounting, Building Sustainable Enterprises - Financial modelling - Internal Auditing Strategy for SMEs |

| 8 |

Sustainability · Sustainability Strategy and Social Innovation - Sustainability Innovation for Business Growth |

Part B.5 - Elective for Logistics & Supply Chain Management

| Week | Part B – Logistics & Supply Chain Management |

| 5 |

Supply Chain - Outlook on Supply Chain Management - Supply Chain Systems & Management |

| 6 |

Partnership and Contracting - Global Partnership & Contracting - Law, Contracting & Negotiation |

| 7 |

Models and Planning - Planning Supply Chain - Accounting, Building Sustainable Enterprises - Financial Modeling |

| 8 |

Business Cases · Zido Logistics & Freight - Foodlocker (Ecommerce Logistics) |

Part B.6 - Elective for Innovation & Design Thinking

| Week | Part B – Innovation & Design Thinking |

| 5 |

Design Thinking - Introduction to Design Thinking - Digital + Design + Thinking |

| 6 |

Innovation & Design Thinking - Design Thinking Lab, Action Planning - Human Productivity Innovation |

| 7 |

Sustainability and Execution - Sustainability Strategy and Social Innovation - Execution – Business Objectives and Technologies |

| 8 |

Quality & Project Management: - Quality and Asset Management - Effective Project Management |

Part B.7 - Elective for Accounting, Auditing, Forensics & Taxation

| Week | Part B – Accounting, Auditing, Forensics & Taxation |

| 5 |

Accounting - Accounting, Building Sustainable Enterprises - Managerial Accounting, Business Decision Making and Growth |

| 6 |

Auditing - Auditing, Forensics, Policies and Controls - Internal Auditing Strategy for SMEs |

| 7 |

Taxation and Tax Law - Tax Management for SMEs - Tax Treaties and Their Benefits |

| 8 |

Digital and Case - Information Security and Digital Forensics - Case Study: Tax Law & Compliance in Lagos State, Nigeria |

Tekedia Live Sessions

We run optional three Live Zoom sessions (two weekdays and one Saturday). This provides a way for our members to ask our Faculty and experts live questions and get feedback.

Capstone-Based Certificate Program

Tekedia capstone is a research paper or a case study exploring a topic, market, sector or a company. You will pick a topic which the Institute will approve. Then you will go and execute that project. Think of this as a final year student product in a university. We expect it to last a maximum of 3 months. The member will submit a report at the end of the capstone. For someone who wants to start a business, you may choose a topic to do market study in that sector. You design a questionnaire and execute your study. Essentially, the essence of this is to apply what you have learnt in the Mini-MBA to produce a practical business document.

You must have attended, begun or about attending Tekedia Mini-MBA to qualify to register. Each certificate course costs $60 or N20,000 as noted above where the Certificate tracks were listed.

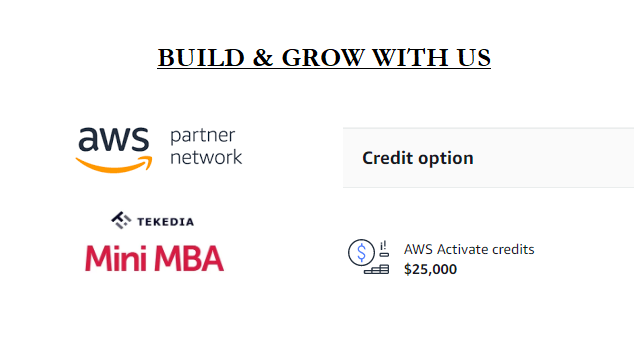

Amazon AWS Credit to Innovators

Tekedia Mini-MBA is a quasi startup accelerator, extending the school core innovate & grow mindset to support innovators. That means, innovators and companies can have access to resources which our Fund provides. If you are in our program, and need support, we will help. We have credits to support founders and companies in Tekedia Mini-MBA who are bootstrapping or have raised small money. Then, as you grow, we will offer you more credits.

Special Weeks

Tekedia runs two special annual programs – Tekedia Career Week (not designed for finding jobs but rather planning careers) and Tekedia Innovation Week for our members. Admission is that member must have attended a Tekedia Mini-MBA program in that year. The dates are announced in our program curriculum. For the last edition, click here.

Our Career Week is not designed for finding jobs. Rather, it is structured to TRANSFORM workers, founders & professionals into business leaders and champions of innovation in their companies. The sub-theme is Nurturing Innovators: Career Planning & Resilience During Disruption. It is packaged under the Tekedia Mini-MBA theme of Innovation, Execution & Growth. Our knowledge experts for the Week include human resources experts and leaders from MNCs and startups, across industries and global regions:

Other Tekedia Mini-MBA Programs

- Tekedia CollegeBoost is a version of the Advanced Diploma in Business Administration for colleges and schools.

- Tekedia Mini-MBA for Corporates is a customized version of the general Tekedia Mini-MBA for companies.

- Tekedia Mini-MBA for Governments is a customized version of the general Tekedia Mini-MBA for governments, government agencies and related public institutions.

- Tekedia Live (GMP and AMP) Training: The General Management Program (GMP) and the Advanced Management Program (AMP) are live (i.e. real time) virtual programs which are delivered by our experts.

Our Contact Email

tekedia@fasmicro.com

Lead Faculty of Tekedia Institute

Prof Ndubuisi Ekekwe is the Lead Faculty of Tekedia Institute

- PhD, Electrical & Computer Engineering, Johns Hopkins University, USA

- MBA, University of Calabar, Nigeria

- BEng Electrical & Electronics Engineering ( Federal University of Technology, Owerri, Nigeria)

Prof Ndubuisi Ekekwe invented and patented a robotic system which the United States Government acquired assignee rights. Dr Ekekwe holds two doctoral and four master’s degrees including a PhD in engineering from the Johns Hopkins University, USA. He earned undergraduate degree from FUT Owerri where he graduated as his class best student. While in Analog Devices Corp, he co-designed an accelerometer for the iPhone. A recipient of IGI Global “Book of the Year” award, a TED Fellow, IBM Global Entrepreneur and World Economic Forum Young Global Leader, Prof. Ekekwe has held professorships in Carnegie Mellon University and Babcock University, and served in the United States National Science Foundation Committee.

The South African press called him “a doctor of innovation” for helping organizations on the mechanics of business innovation, strategy, and growth. Since 2009, the Chairman of Fasmicro Group which controls many startups and entities has been writing in the Harvard Business Review. He was recognized by The Guardian as one of 60 Nigerians Making “Nigerian Live Matter” on Nigeria’s 60th Independence Day (Oct 1, 2020).

Selected Faculty & Testimonials

We have more than 85 Faculty members; see the full list here. For selected testimonials on our program, click here.

You get discount coupon to this book