MTN Group exited by selling all its stocks in Jumia: “The MTN Group has now fully exited its 18.9 percent investment in Jumia Technologies AG (Jumia), realizing a total consideration of approximately R2.3 billion (US$138 million). Yes, it sold the remaining 18.9% investment for $138 million.

According to Bloomberg, MTN Group invested $243 million in Jumia: “MTN Group Ltd. is planning to sell part or all of its $243 million interest in Jumia Technologies AG as Africa’s biggest wireless carrier looks to pay down debt and enter new markets, according to people familiar with the matter”.

More so, according to GSMA, an industry organization, “in December 2013, MTN, together with Millicom and Rocket Internet, became a 33.3% stakeholder in Africa’s e-commerce and digital services company Jumia Group (formerly Africa Internet Group (AIG). MTN has since invested an additional $143 million in Jumia Group, increasing its stake to 41.4 percent.”

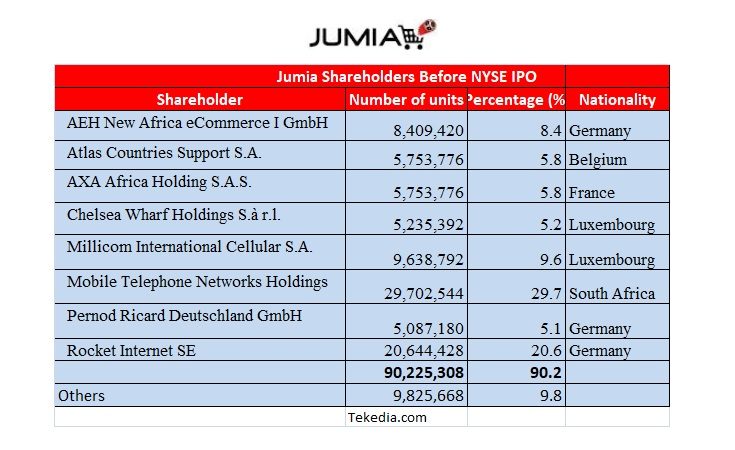

By the time Jumia went public, MTN held 29.7% of the company. The implication is this: MTN sold 11.7% during the IPO process. Jumia began trading at $14.50.

Now, the interesting part: the recently sold 18.9% brought in $138 million. This implies that MTN sold the latest batch when Jumia cap was around $695 million. Running the numbers, it came down to $7 per share. Let us approximate that it was sold at half the IPO value. Also, the other part of the 29.7% (as at IPO date) was sold when Jumia has been falling. Because of the lockout period, MTN would not have sold when the stock was high. Possibly, it sold around the $7 window.

Here are the three sales buckets:

- 18.9% for $138 million at about $7 per unit

- 10.8% at about $7, which gives about $80 million

- 11.7% during the IPO process at $14.50; that comes around $180 million

So, the total realized sales for MTN Group would be in the neighborhood of $400 million. MTN had invested $243 million. So, the company realized before tax and fees around $160 million.

*I have relied on public documents for this analysis; do not send me confidential financial statements as I do not use non-public documents in my articles. I am not a journalist that breaks news – I focus on the analysis of broken news! A good academic exercise! Tax people, do not rely on this to summon MTN.