Notes: Tekedia is offering a 50% discount to current co-learners for Edition 4 (you pay N25k or $70) or 2021 annual package (N50k or $140). Register here. For members asking for project experiences, Tekedia capstones which award a different certificate, separate from Tekedia Mini-MBA, is available. We have 10 tracks therein. Learn more here. As […]

Week 11 Session

Notes: We have scheduled Zoom reviews for members who returned their Labs for review. If for any reason you paid and have not been scheduled, contact Admin (email below) For members asking for project experiences, Tekedia capstones which award a different certificate, separate from Tekedia Mini-MBA, is available. We have 10 tracks therein. Learn more […]

Week 8 Session

Notes: Tekedia Career Week is Nov 2-7, 2020. Click and learn more here. All programs have resumed after the pause, arising due to the protests in Nigeria. Tekedia Live Wed | 11am – 12noon | Paystack $1,300 Revenue and YC; General – Ndubuisi Ekekwe | Zoom link Fri | 7pm-8pm | Global Contracting – Adebayo Adeleke, […]

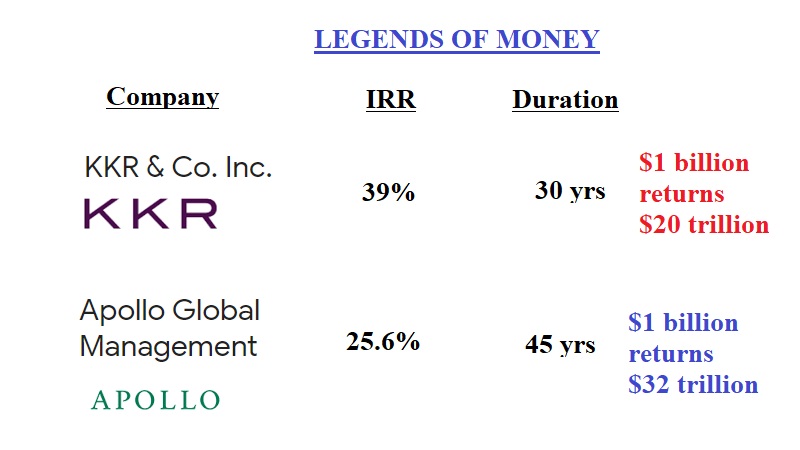

The Legends of Money

Now you understand why KKR and Apollo are peerless in the world of private equity business. They shared data with the SEC and the world got a window into the the most exclusive club in this world. A $1 billion investment in Apollo, on formation, would be worth $32 Trillion (with T) today. Source.

The SEC was shown a version of Apollo’s annual report which said it had generated an annual IRR of 39.0% over the past 30 years. At that rate, a $1 billion investment would be worth $20 TRILLION over 30 years or roughly the GDP of the US.

The SEC was also shown a of KKR’s annual report, which said it had generated an annual IRR of 25.6% over the past 45 years. At that rate, a $1 billion investment would be worth $32 TRILLION over 45 years or almost half of the GDP of planet earth.

Update: apologies that I did not give the meaning of IRR. IRR means an internal rate of returns. Think of it as an annual rate of growth and investment generated.

It Is Good Morning In Jumia – Stock Surges

In July 2020, I became a fan of Jumia when I wrote, “I have written so much about Jumia when it was a pure ecommerce company. I never liked the business model then. But when Jumia changed and added payment, I became a fan. My change of heart was supported by data: the world has not seen any successful ecommerce company without double play.” Jumia has multiple plays now via payment and gaming.

Jumia rose more than 17% on Friday. People, it is good morning in Jumia as the company has crossed its IPO value. The man who called it a fraud now believes in Jumia.

Jumia Technologies JMIA 17.98% is an e-commerce company in Africa with operations in 11 countries in the continent. The company operates its Jumia Logistics and Jumia Pay businesses and also recently launched gaming division.

Jumia had 6.8 million consumers in the second quarter, year-over-year growth of 40%. The company also saw an all-time high for its Jumia Pay gross volume and saw 2.4 million transactions in the second quarter.

Andrew Left Bullish: Activist investor Andrew Left of Citron Research has changed his tune and is now going long shares of Jumia.

In May 2019, Left called out fraud at the company and said shares were worthless. This came shortly after the company went public in April at $14.50 a share.

Jumia Games will live inside the JumiaPay App. Yes, that is it: if you do not have money to buy things, you can play games by spending small money. Jumia just wants you to stay on the platform. This makes sense because winning the control of demand is important in the digital economy domain. Possibly, those games would result to buying or owning virtual Aso Rock palace, Second Nigeria Bridge toll gate, Ikoyi mansions, Banana Island biggies, etc. Investors like those, as by doing them, Jumia is expanding its demand-control and how it could monetize in the ecosystem. Why not? Gaming could deliver better value than ecommerce in the near future even as the ecommerce platform is what is attracting them to Jumia to begin with.

People, update your playbook because the world is changing. Yes, you must meet or stimulate a new dimension of customers needs to thrive. As Jumia unlocks this massive value, Konga which has since gone hybrid commerce has reported that it would make money soon. These two companies have evolved and the markets have rewarded them. Your business model must evolve as markets change.