Notes: Tekedia Career Week is Nov 2-7, 2020. Click and learn more here. Tekedia Live Wed | 7pm-8pm | Quibi, iROKO & TikTok Business Models, General – Ndubuisi Ekekwe | Zoom link Fri | 7pm-8pm | Disruptive Sustainability Innovation – Eustace Onuegbu – President, incsr | Zoom Link Saturday | 11am – 12noon | Accounting – Ndubuisi Umunna | Zoom […]

Week 17 Session

Notes: Tekedia Career Week is Nov 2-7, 2020. Click and learn more here. Tekedia LIVE Tuesday| 11am – 12 noon | Auditing & Controls – Yusuf O. Sanni, BUA Cement Plc | Zoom link Thursday | 7pm – 8pm | Lafiya TeleHealth – Enoh John | Zoom Link Saturday | 7pm-8pm | New IBM Playbook […]

Tekedia Mini-MBA Social Portal Is About Ready

Very excited here; our Facebook-like learning ecosystem is ready. Our goal is to remove more frictions in the relationships between our faculty and our members. It looks amazing. Our next edition would be great. Register for Tekedia Mini-MBA with a dedicated learning platform and a social community engineered for learning. BEGIN https://www.tekedia.com/programs

Tekedia offers an innovation management 12-week program, optimized for business execution and growth, with digital operational overlay. It runs 100% online. The theme is Innovation, Growth & Digital Execution – Techniques for Building Category-King Companies. All contents are self-paced, recorded and archived which means participants do not have to be at any scheduled time to consume contents.

It is a sector- and firm-agnostic management program comprising videos, flash cases, challenge assignments, labs, written materials, webinars, etc by a global faculty coordinated by Prof Ndubuisi Ekekwe.

IBM Goes HP, Spinning Off the Infrastructure Business

Hardware is no more fashionable in the world of technology. It is slow growth and there is no leverageable marginal cost improvement with scale, unlike software which gives a positive continuum near-zero marginal cost efficiency. The implication is huge: Wall Street does not like purveyors of hardware and broad infrastructure that much. And companies have the memos: spin hardware off and focus on where the alpha is. That alpha lives in software and technology services.

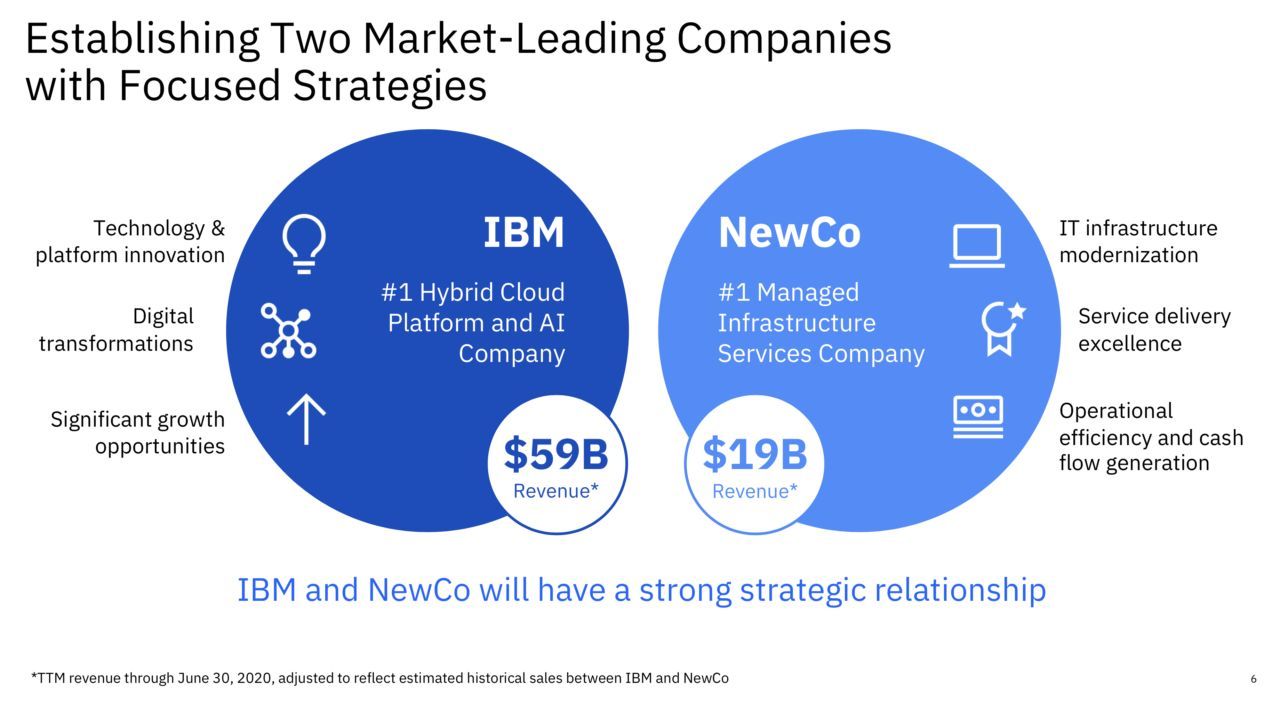

HP did it many years ago, spinning off its printing and broad hardware business to focus on the soft things of technology – consulting, services, and more. IBM is running that playbook as it breaks into two publicly traded companies. It is what it is – IBM does not want to be left behind.

In an unprecedented decision, International Business Machines (IBM) is splitting itself into two public companies. The computing company announced on Thursday it’s spinning off some of its low-margin lines of business into a new company which will be named later. The move is part of its attempt to focus on the more lucrative cloud computing.

“We divested networking back in the ‘90s, we divested PCs back in the 2000s, we divested semiconductors about five years ago because all of them didn’t necessarily play into the integrated value proposition,” IBM’s CEO Arvind Krishna said during an investor call.

IBM hopes to become a leader in hybrid-cloud software and services that allow clients to store data. That looks promising in this age of digital evolution of markets and industrial sectors. It is what it is – invent, adapt or perish.

But do not be confused, IBM would not have followed this path if the stock is doing well. Over the last few years, IBM has returned the worst results in big tech despite top-grade assets under its control. IBM is worth about $113 billion while Facebook is valued at $753 billion. For years, IBM has used many tricks to boost its market cap but nothing has worked.

This one is expected to boost shareholder value. Yes, you can unlock more multiples in the AI & cloud business than a company with the hardware business. Magically, the two parts will become better than a standalone IBM. More than 90% of the time, it works. For IBM shareholders, this is the right call as investors will stop considering the “machine” in IBM (International Business Machine) name and see the firm as a leverageable growth tech firm with nothing holding it.

LinkedIn Comment on Feed

They’ve tried but its time to retire. In less than 10 years TCS has pushed them from 1st to 3rd place. This indicates that the consumer no longer sees them as being progressive innovators

My Response: It remains an enterprise company. But IBM has many legacy systems. A great company. But that does not mean it is a good place to invest money. Like BBNaija, we are in the age of fashionista. If you list BBNaija in the Nigeria Stock Exchange, you may be surprised its market cap will topple our best banks! Why? Young people will invest in it. It is what it is.

The 2021 Nigeria Budget Proposal Contravenes The Fiscal Responsibility Act – Atiku Abubakar

Looking at the 2021 Budget Proposal placed before the National Assembly by President Muhammadu Buhari on Thursday, October 8, 2020, a number of issues, very grave and perhaps disturbing issues arise.

I could bring up several of them, but for the sake of its direness and consequence to our economy, permit me to address one very important issue.

The budget deficit in the proposal is 5.21 trillion. This amount is just over 3.5% of Nigeria’s 2019 GDP. This is contrary to the Fiscal Responsibility Act of 2007, which provides in Part II, Section 12, subsection 1 that: “Aggregate Expenditure and the Aggregate amount appropriated by the National Assembly for each financial year shall not be more than the estimated aggregate revenue plus a deficit, not exceeding three per cent of the estimated Gross Domestic Product or any sustainable percentage as may be determined by the national Assembly for each financial year.”

Nigeria had a GDP of approximately $447 billion in 2019. Three percent (3%) of this amount is $13. 3 billion, which at the current official exchange rate of 379 to $1, gives you a figure of 5.07 trillion.

So clearly, the budget deficit of 5.21 trillion, as announced by President Muhammadu, is above 3% of our GDP and is therefore in contravention of the Fiscal Responsibility Act of 2007.

Even more disturbing is the fact that our GDP has fallen sharply from its 2019 figures, and has been projected by the World Bank and other multilateral institutions at somewhere between $400 billion and $350 billion. Meaning that in actual sense, the 5.21 trillion budget deficit is actually far above the 3% threshold stipulated by the FRA.

That this escaped the notice of the Buhari administration shows a glaring lack of rigour in the formulation of the Budget. A very disturbing development.

Furthermore, this deficit shows the precarious state of our national finances, which have since been overburdened by excessive borrowing on the part of the Buhari administration.

It has not escaped my attention that the Fiscal Responsibility Act of 2007 makes provision for the National Assembly to raise the threshold of the budget deficit from 3% to a higher figure. However, if this is done, they will be serving this administration’s interests, not Nigeria’s, because the Act says that such a threshold must be sustainable. Is it sustainable when our budget makes almost as much provision for debt servicing, as it does for capital expenditure?

As such, I call on the President, to recall this budget, and recalibrate it to reflect the provisions of the Fiscal Responsibility Act of 2007, and the current economic realities of the nation. To do otherwise will not only be unpatriotic, it will also be catastrophic for our nation’s economy.