In the midst of the fear and uncertainty, each day seems to bring news that’s worse than the day before. Yesterday, the number of deaths recorded in the U.S grew by 23% to 3,073, it has now moved again by 27% to 3,909.

The good news is that most people with COVID-19 recover. “Estimates now suggest that 99% of people infected with the virus that causes COVID-19 will recover. Some people have no symptoms at all. Children seem to be infected less often and have milder disease” Harvard Health please read more…

However, based on estimates and record of infections, this pandemic is still going to rage on for some time, don’t lose your guard, hold your investments in ‘near cash’. At this crucial, unpredictable and unprecedented times, cash is king. Don’t invest in risky assets, if you must, make sure it’s calculated else hold your investments in ‘near cash’ assets.

In the midst of the uncertainty, we launched a money market fund to help you grow your cash, the fund was successful and approved by regulators. Our first valuation is out and the yield is awesome, over 11.50%, it’s one of the best in the industry if not the best at the moment. Our fund was built during this pandemic, modelled around a product that will remain good even as the pandemic wears on.

As you are aware, we are a digital bank and working from home has worked best for us. Our customer care team are online, active and friendly, you can subscribe and make redemptions from your fund within 24 hours.

Same operation model applies across all our subsidiaries and products, feel free to reach out anytime, we are here.

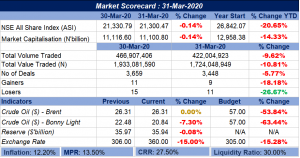

In Nigeria, the pump price of petrol has gone down again, now N123.5. A mix of good and bad news.

Today, 1st of April is significant for oil prices from the supply cut angle, not that a reduction in supply will stop the current trend of daily decline in price but if an agreement is reached to sustain the current quota or cut it further, it may reduce the degree of fall in prices.

As of now, Traders are scrambling to offload their stock of crude at heavily unprecedented discounted prices. We are in a glut and it’s growing daily, if an agreement isn’t reached between OPEC members, Saudi and Russia, prices will continue to Tank.

Locally, the pump price of oil will also reduce so also will reserves. Devaluation again?

|

Headlines:

Lagos, Ogun, FCT may lose N1.6tn to lockdown – Investigation

FG reduces petrol price to N123.5 per litre

The Federal Government on Tuesday night reduced the price of petrol from N125/litre to N123.5/litre. Current petrol price indicates a reduction of N1.5 on every litre of petrol purchased nationwide. It announced the reduction through the Petroleum Products Pricing Regulatory Agency, after a whole day meeting with stakeholders in the oil and gas sector in Abuja. Read more

Internet traffic surges as lockdown begins in Lagos

The Chief Executive Officer, Internet Exchange Point of Nigeria, Muhammed Rudman, said a surge in Internet traffic was noticed on Tuesday when the lockdown took effect in selected states, especially in Lagos. According to him, Internet traffic has increased by 10 per cent in the past one week as many companies had introduced work-from-home policy a week before the government-imposed lockdown. Read more

DPR enforces petrol sale at filling stations

In a related development, the DPR on Tuesday began the enforcement of sales and distribution of petroleum products at filling stations, particularly in states where the Federal Government declared a two-week lockdown. It was gathered that the oil sector regulator dispatched more enforcement teams to filling stations in Abuja, Lagos and Ogun states and the teams would enforce compliance during the two-week period. Read more

NERC suspends electricity tariff increase

The Nigerian Electricity Regulatory Commission has suspended the proposed increase in electricity tariffs initially slated for Wednesday (today). The regulator said on Tuesday that public hearings were held at different locations within the franchise areas of the Discos from February 25 and March 9 to consider the applications. It said the wide metering gap in the Nigerian electricity supply industry, currently at about 60 per cent, “is a major impediment to both an immediate tariff review and revenue protection for Discos.” Read more

Fed Govt distributes preventive items

The Federal Ministry of Humanitarian Affairs, Disaster Management, and Social Development has donated preventive items to the People Living with Disabilities (PLWDs), at the Karmajiji disabled community in Abuja. The ministry explained that the donation is in line with the efforts of President Muhammadu Buhari’s administration towards the prevention and further spread of COVID 19 in the country. Items donated include hand sanitizers, face masks, soaps, bleach and plastic buckets. Read more Nigeria’s COVID-19 cases rise to 139

Asian shares hold on to gains but virus keeps markets on edge

Asian stocks clung to gains on Wednesday, helped by a bounce in Australian shares, but risks for equities remain large as the coronavirus pandemic rattles the underpinnings of the global economy. E-Mini futures for the S&P 500 traded 1.39% lower in Asian trade, highlighting the cautious mood. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.23%. Australian shares jumped by 2.87%, reversing a 2% decline on Tuesday, as a slowdown in new coronavirus cases and rising iron ore prices lifted the market. Read more

European stock index futures slide as coronavirus damage grows

European stock index futures fell more than 3% on Wednesday as dismal economic data from Asia underlined the damage to the economy from the coronavirus pandemic and fanned fears of a deep global recession. Read more

Oil prices fall as U.S. inventory build-up heightens oversupply concerns

Global crude oil prices slid further on Wednesday, following their biggest-ever quarterly and monthly losses, as a bigger-than-expected rise in U.S. inventories and a widening rift within OPEC heightened oversupply fears. As of 0345 GMT, Brent crude was down by 47 cents, or 1.8%, at $25.88 a barrel. U.S. West Texas Intermediate crude was up 12 cents, or 0.6%, at $20.6 a barrel, an uptick analyst said was driven by position building at the start of a the new quarter. Read more

Dollar firms as investors brace for global downturn

The dollar was a touch firmer on Wednesday, buoyed by its safe-haven status with the world staring at what is likely to be one of the worst economic contractions for decades as it locks down to fight the coronavirus pandemic. It advanced against the Australian and New Zealand dollars, the euro, yen, Swiss franc and pound in Asian trade – but not much – as appetite for the safety of cash dollars was offset by aggressive liquidity measures from the U.S. Federal Reserve. Read more Gold Prices Down as Russia Halts Bullion Purchases Gold prices were down in Asia on Wednesday morning, extending yesterday’s losses amid speculations that Russia might move from big buyer to possible seller of bullion. Gold futures were down 0.13% to $1,594.45 by 09:40 PM ET (2:40 AM GMT), but the losses were limited as investors remained cautious amid turbulent economic times. Read more

China reports 36 new coronavirus cases

China reported on Wednesday a fall in new confirmed coronavirus cases, with almost all cases imported from overseas. China had 36 new cases on Tuesday, the National Health Commission said on Wednesday, down from 48 a day earlier. Read more Devaluation and your wealth Continue reading …

|