On Thursday, President Muhammadu Buhari resent the $29.96 billion external borrowing plan to the senate for approval.

The borrowing plan was previously sent to the 8th Assembly in September 2016, after being approved by the Federal Executive Council (FEC). Buhari has asked the 8th Assembly to approve the plan to enable the Federal Government to fund infrastructure from 2016 to 2018.

But the 8th Assembly, led by Bukola Saraki rejected the plan since there was no detail on how the fund will be utilized.

On resending the plan to the 9th Assembly, Buhari explained that the preceding Assembly only approved a segment of the loan plan, which resulted in infrastructural decay due to lack of funds by the Federal Government to execute projects across sectors like power, health, agriculture, water and education.

The letter, dated November 26, 2019, reads thus:

“Pursuant to Section 21 and 27 of the Debt Management Office (Establishment) Act, I hereby request for Resolution of the Senate to approve the Federal Government’s 2016 – 2018 External Borrowing Plan, as well as relevant projects under this plan.

“Specifically, the Senate is invited to note that while I had transmitted the 2016 – 2018 External Borrowing Plan to the 8th National Assembly in September 2016, this plan was not approved in its entirety by the Legislature. Only the Federal Government’s Emergency projects and one (1) China Exam Bank Assisted Railway Modernization projects for Lagos-Ibadan segment) were approved out of a total of thirty nine (39) projects.

“The outstanding projects in the plan that were not approved by the Legislature are, nevertheless, critical to the delivery of the Government’s policies and programmes relating to power, mining, roads, agriculture, health, water and educational sectors.

“These outstanding projects are well advanced in terms of their preparation, consistent with the 2016 Debt Sustainability Analysis undertaken by the Debt Management Office and were approved by the Federal Executive Council in August 2016 under the 2016 – 2018 External Borrowing Plan.

“Accordingly, I have attached, for your kind consideration, relevant information from the Honourable Minister of Finance, Budget and National Planning the specific projects under the 2016 – 2018 External Borrowing Plan for which legislative approval is currently sought.

“I have also directed the Minister to make herself available to provide any additional information or clarification which you may require to facilitate prompt projects under this plan.”

The implementation of the projects and programmes was broken into varying costs that totaled $29.960 billion. The projects and programme loan stands for $11.274 billion. Special National Infrastructure Projects is $10.686 billion, Eurobond, $4.5 billion and Federal Government Budget Support, takes $3.5 billion.

The Federal Government maintained that the loan is necessary for the implementation of needed infrastructural development nationwide. And that positive technical economic evaluation and the presumed contribution to the economic development of the country was conducted before the projects, which varies from railroad, electricity to roads etc. were selected.

President Buhari also acknowledged the receipt of the sum of $575 million from the World Bank. He said the World Bank loan is geared toward specific social programmes such as Polio Eradication Support and routine immunization project, which will take $125 million, Community and Social Development Project, which will take $75 million.

There are also the Nigerian states Health Programme Investment Project, which will take $100 million, Nigerian Youth Employment and Social Support Project, which also will take $100 million, and Fadama III project that will consume $50 million.

However, the recent move has attracted uproar and condemnation. Economic groups and concerned Nigerians say the loan attempt will further burden on the increasing external loan profile.

The BudgIT Nigeria says the FG external debt has grown from $7.34 billion in June 2015 to $22.87 billion as at June 2019, a 211% growth in four years.

Additional $29.960 billion will do more than double the figures in a short time. It’s noted that the figures in the borrowing plan is a little more than Nigeria’s entire budget, which is suggesting that Nigeria is broke and unable to fund the 2020 budget, and so resorts to borrowing.

The Lead Director, Center for Social Justice, Eze Onyekpere, said reliance on loans to fund projects is not a course of action that will sustain Nigeria’s economy.

“At the end of the day, if there is a shortfall in revenue, salaries and overheads will be drawn down, debts will be serviced whilst capitalist projects suffer.

“At 23.74 percent of overall expenditure, the debt service is high and it is higher than capital expenditure. When the sinking fund of N296 billion is added to debt service, it comes up to N2.746 trillion which 26.61 percent of the overall budget,” he said.

The Registrar Chartered Institute of Finance and Control of Nigeria, Mr. Godwin Eohoi, also warned that the Federal Government is spending about 20 percent of its budget servicing debt, any further attempt to increase the country’s debt profile might lead to debt crisis.

Many have also concluded that the latest loan plan by the FG is an evidence that the claims by various agencies of the Government, like the Nigerian Custom Service (NCS), which claims it’s generating over N5 billion daily, since the border closure, and the Federal Inland Revenue service (FIRS), which claims it generated N5.3 trillion in 2018, and thus set for itself, a target of N8 trillion in 2019, are more of propaganda.

Like this:

Like Loading...

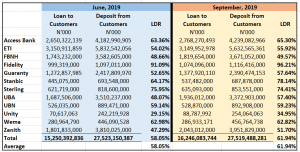

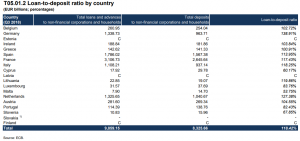

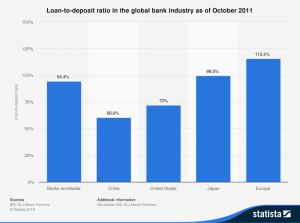

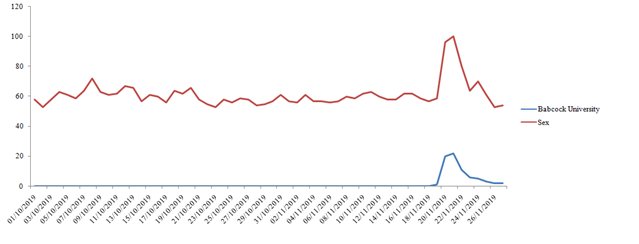

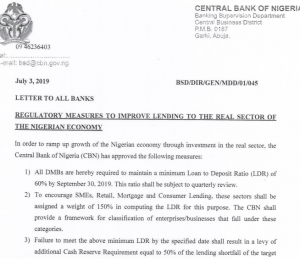

Currently, there are quite a number of CBN initiatives to increase credit to SMEs, the focus of this article is LDR. Loan-deposit ratio (LDR) is a ratio between a bank’s total loans to customers and total deposits from customers, measured in percentage terms.

Currently, there are quite a number of CBN initiatives to increase credit to SMEs, the focus of this article is LDR. Loan-deposit ratio (LDR) is a ratio between a bank’s total loans to customers and total deposits from customers, measured in percentage terms.