Like other previous decisions, the introduction of a mobile app to fix identified frictions in the building maintenance and other facilities across Nigeria by Alpha Mead Facilities, a strategic business unit of Alpha Mead Group, has shown that the company is actually ready to boost the growth of Facilities Management industry and inspire small businesses in Africa.

Bringing the product to the market is not surprising because a report has indicated that FM industry needs to be disrupted with the innovative products and solutions. According to the report, “the industry growth depends on how the players and professionals collectively resolve issues within the processes, solutions, technology and people components of the industry.” The company has equally demonstrated that it could capitalise on its capabilities and competences towards the growth of other players, especially sub-contractors in the industry.

Call2Fix: What is in it?

Now, the question among the potential users and service providers is what is in the app? The Chief Executive Officer, Alpha Mead Group, Engineer Femi Akintunde briefly answered this question. “It is for the benefit of retail customers and SME companies who are unable to afford the FM contracts offered for their required FM services.” With this answer, it appears that the company is intensifying efforts on making people and small businesses understand the need for good facility management culture.

As an on-demand and round-the-clock digital application, users have the opportunity of calling building maintenance artisans with the capabilities and experience of handling their maintenance or repair services in homes or offices. Already, the company has trained 1,000 artisans and ready to leverage their many years of industry experience, size, technical, operational and financial capacity and the wide network of their operation across Nigeria and other African countries.

“With Call2Fix, customers will be able to rate performance of the artisans assigned to them. This rating system is not just a function of remuneration for the artisan, it also determines how frequently work will be assigned to the artisans by the application. Meaning that the better rating an artisan gets, the more opportunity he has to be assigned a job by the app.”

Call2Fix and Sustainable FM Industry

As the company begins assigning artisans to the users within the initial coverage areas in Lagos, Engineer Akintunde believes that the app is a game changer in the industry because it brings more power, joy and peace of mind to numerous customers. “It is about comfort, security and efficiency of service.”

Is Call2Fix really a disruptive innovation as stressed by the CEO of Alpha Mead? The answer to this is best gleaned from the number of services expected to be sought by the users. From soft to the hard services, the app will definitely disrupt the Facilities Management industry in Nigeria and African countries, where it has presences.

In Nigeria, the emergence of the app has demonstrated that companies within the passive category, offering services such as electrical and electronic, civil works, plumbing, HVAC, cleaning, domestic helps, carpentry, home appliances, fire systems, gardening, waste management, swimming pool, relocation services, office equipment and scaffolding need to tweak their people and solution innovation processes towards sustainable value capturing from the app. There is no doubt; active participants (players offering integrated facilities management solutions) have been pushed to the wall. The expectation among the industry experts is the emergence of another app that will fix other frictions in the industry.

Long Road Ahead

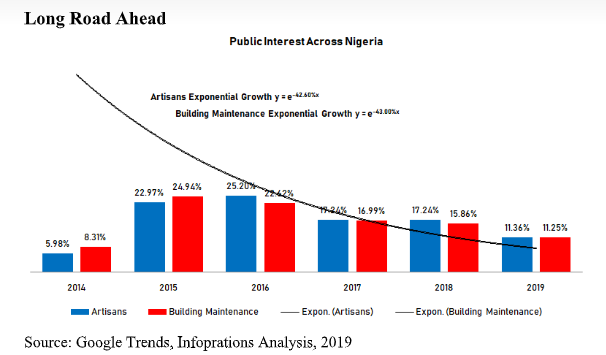

Meanwhile, despite the initial research about the target market by the company, analysis indicates that exponential growth of public interest in artisans and building maintenance in the last 5 years (September 1, 2014 to September 17, 2019) in Nigeria has been on the decaying threshold. The exponential growth rate of public interest in artisans is -42.60%, while building maintenance is -43%. A significant interest occurred between 2015 and 2016, analysis reveals. However, the choice of Lagos as the starting coverage area aligns with the growth of public interest in select services.

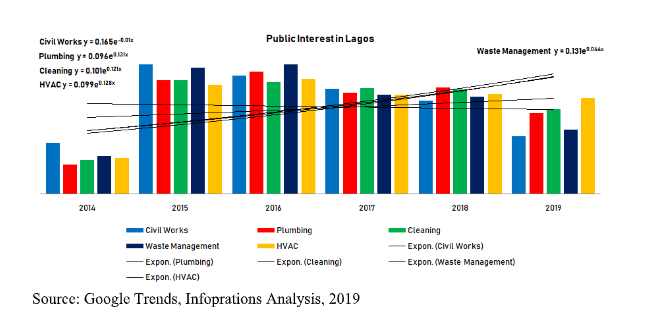

Analysis shows that interest in doing plumbing, HVAC, cleaning and waste management has been growing at 13.10%, 12.80%, 12.10% and 4.4% respectively. These results imply that the company needs to do more on marketing and communication of the inherent values of the app, most importantly through digital platforms. This is imperative because of the need to target a great number of internet users and app enabled-mobile phone customers.