As China-America trade battle rages, we will see new moves like a chess game. The U.S. has largely cut-out Huawei from the supplies of critical components. China will surely respond. I expect Apple to be the main target if that Huawei ban is not reversed or softened: “But China does have a game move available: if you restrict it from component supplies because of the “entity list”, companies like Apple, maker of iPhone, may pay the penalties”. Fortune Newsletter chronicles the possible scenarios through which China can harm Apple as follows:

- And yet this month’s sharp deterioration in US-China trade relations should give pause to even the most die-hard Apple bulls. Analysts are waking up to the fact that Apple can’t escape consequences of the next round of US tariffs. Morgan Stanley estimates those duties will increase the cost of an iPhone by $160.

- The Huawei ban takes trade hostilities to def-con 4; Fareed Zakaria calls it China’s Sputnik Moment. If fully implemented, the ban would cripple China’s leading tech manufacturer. Chinese officials have decried the measure as a “cynical” act of “bullyism,” and charged Trump with mobilizing the full force of the state to crush a Chinese firm. If Beijing sticks with its current policy of “tit-for-tat” retaliation, Apple would seem an obvious target for reprisal

- On Wednesday, analysts at Goldman Sachs, while stressing that “we are not assuming restrictions on iPhone production in mainland China at this point,” nevertheless estimated such a ban or “some other restriction on Apple products” could drag Apple’s earnings down 29%.

- Even if Beijing doesn’t go after Apple directly, it can inflict pain in other ways. The Street.com suggests a Chinese ban on rare earths would be a huge headache for Apple.

- Beijing could also encourage a nationalist backlash against Apple products among Chinese consumers; there’s some evidence that’s already happening.

As I have said, this is not an asymmetric warfare – yes, both China and America are largely evenly matched even though U.S. has a light upper hand, in this trade war. You may win but you might have been better off not fighting!

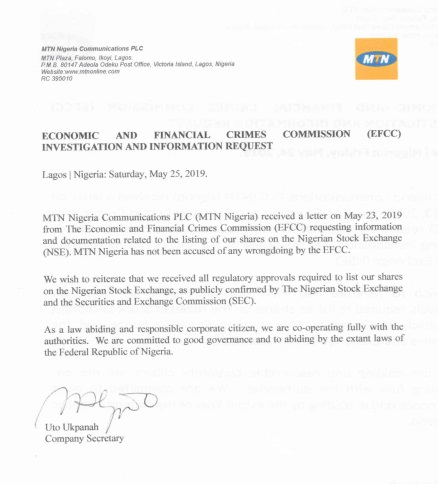

Yes, do not count out the possibilities that some Chinese firms which are traded in the New York Stock Exchange will start delisting, joining the nation’s leading chip maker.

China’s biggest maker of semiconductors is to withdraw from the New York Stock Exchange, citing low trading volumes and burdensome costs – a move that ends its 15-year US listing as the trade war with the US spills over into the technology sector.

Semiconductor Manufacturing International Corp (SMIC) said on Friday evening that it had notified the NYSE of its intention to apply on June 3 to delist its American depositary receipts (ADRs) from the bourse.