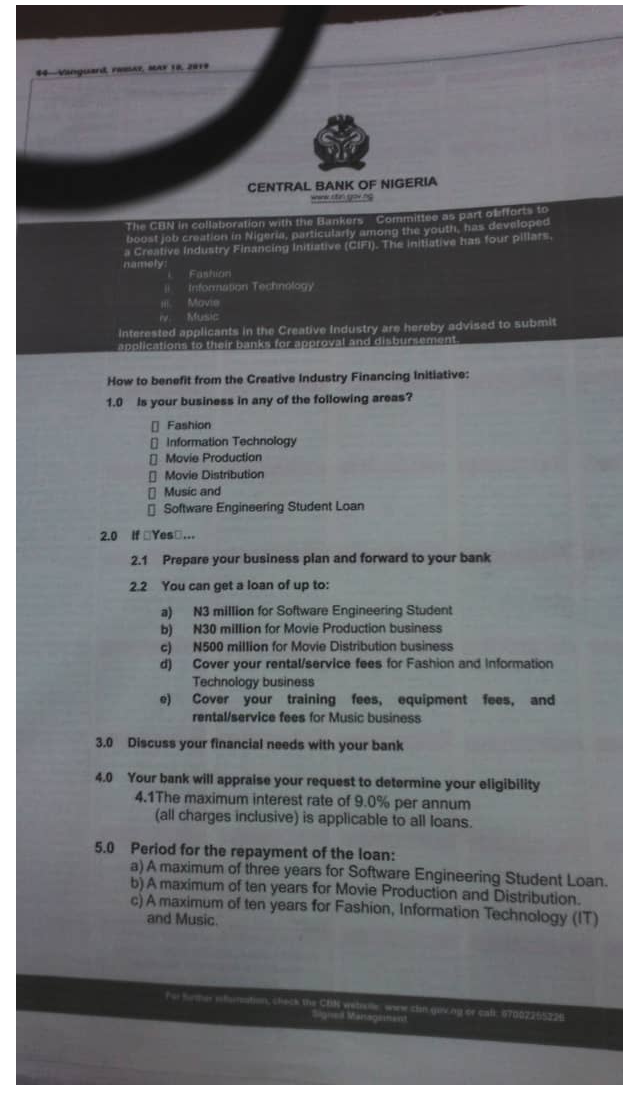

The Central Bank of Nigeria has adverts in some national newspapers on the Creative Industry Financing Initiative. They have movie production, movie production, software, etc sectors for different financing packages for young people. You can get a loan of up to N500 million at 9% annual interest rate (all charges inclusive). It may be something some here may explore. It looks great if the banks will not ask for your grandfather’s chieftaincy cap or grandmother’s ceremonial beads. The adverts below…

- a) N3 million for Software Engineering Student

- b) N30 million for Movie Production business

- c) N500 million for Movie Distribution business

- d) Cover your rental/service fees for Fashion and Information Technology business

- e) Cover your training fees, equipment fees, and rental/service fees for Music business

The Advert below.

The CBN in collaboration with the Bankers’ Committee as part of efforts to boost job creation in Nigeria, particularly among the youth, has developed a Creative Industry Financing Initiative (CIFI). The initiative has four pillars, namely:

- Fashion

- Information Technology

iii. Movie

- Music

Interested applicants in the Creative Industry are hereby advised to submit applications to their banks for approval and disbursement.

How to benefit from the Creative Industry Financing Initiative:

1.0 Is your business in any of the following areas?

- Fashion

- Information Technology

- Movie Production

- Movie Distribution

- Music and

- Software Engineering Student Loan

2.0 If “Yes”…

2.1 Prepare your business plan or statement on how much you want for your business.

2.2 You can get a loan of up to:

- a) N3 million for Software Engineering Student

- b) N30 million for Movie Production business

- c) N500 million for Movie Distribution business

- d) Cover your rental/service fees for Fashion and Information Technology business

- e) Cover your training fees, equipment fees, and rental/service fees for Music business

2.3 Go to any bank of your choice to access the fund.

3.0 Tell your bank how much you need.

4.0 Your bank will discuss your request and provide you the money

4.1 The maximum interest rate of 9.0% per annum (all charges inclusive) is applicable to all loans.

5.0 Period for the repayment of the loan:

- a) For Software Engineering Student Loan, it is a maximum of three years

- b) For Movie Production and Distribution, it is a maximum of ten years

- c) For Fashion, Information Technology (IT) and Music, it is a maximum of ten years