You can read the text here from page 11.

Zenvus, our agtech product, will be on exhibitions in three countries – Senegal, South Africa and Germany. The exhibitions are managed by ZKM I Karlsruhe, Germany to chronicle some of the most fascinating digital ideas out of modern Africa. For date and time, visit ZKM. When you walk into the locations – Afropixel Festival in Dakar, Wits Art Museum and Fak’ugesi Festival of African Digital Innovation in Johannesburg and center for Art and Media Karlsruhe in Germany – check for Digital Imaginaries – Africas in Production.

ZKM I Karlsruhe will hold the research and exhibition project Digital Imaginaries – Africas in Production from November 17, 2018 until March 31, 2019. The project explores how digital practices and imaginaries shift what Africa is and can be. Digital Imaginaries brings together artist, social scientist and digital makers to trace, disturb and redirect the flux between digital practices and imaginaries. Digital Imaginaries is a joined project of Kër Thiossane, the independent center for digital art, and the Afropixel Festival in Dakar, the Wits Art Museum and Fak’ugesi Festival of African Digital Innovation in Johannesburg and the ZKM | Center for Art and Media Karlsruhe.

The ZKM I Center for Art and Media Karlsruhe (Germany) will is a unique cultural institution worldwide. Established in 1989 as a foundation under public law, the ZKM is a house of all media and genres, a house of both spatial arts such as painting, photography and sculpture and time-based arts such as film, video, media art, music, dance, theater and performance. Numerous temporary exhibitions and thematic events are to be found alongside research and production in the field of new media, fundamental research and a comprehensive concept of education.

I wrote a piece on Paul Graham’s bold prediction on the Nigerian startup scene. Many responded on LinkedIn and noted largely that Nigeria must have electricity, great schools, etc before we could witness what Mr. Graham was predicting. I am not saying that we do not need those enabling environments. Yet, if you check human history, great private companies have typically preceded the strengthening of public institutions. Why? Governments use the taxes and fees on companies to build public institutions! In other words, you cannot expect good roads, great schools, etc if there are no companies with capacities to pay taxes to make such possible. The thinking that one has to wait, for everything to be perfect, before investing or building in Nigeria, is decoupled from how nations have developed.

While I believe in the potentials of Africa, especially Nigeria, I would caution against the celebration of hype as reality and hope as achievement. Especially when all the factors that perpetuated the creation, scale and success of Airbnb are absent in Nigeria. In four years, the only new $millionaires will be from Africa’s political class, unless some serious institutions for delivering good governance, politics, free market economy and civil interactions magically appear and become effectively implemented before 2022. Since there are no indications of such positive change happening overnight in Africa and or Nigeria, given that such processes take decades, I simply wouldn’t be banking on such $millionaire party. That’s not how Rome was built.

It’s all about a media hype, the reality on ground is that Africa still lies in the dark and Nigeria especially is backward in terms of ordinary electricity that is the source of innovation

So, if you expect Nigeria to be perfect with good infrastructure, top-grade schools, etc before you can invest or do anything in Nigeria, you would be out of luck. Vodafone had the same mindset when Nigeria wanted it desperately for mobile telephony. We continue to appreciate MTN for believing in Nigeria.

Across human histories, from UK to America, companies rise before nations can build strong institutions. In other words, if you expect Nigeria to have the best public institutions before great companies, you would keep waiting. Typically, what happens is that nations have great companies, and then use the taxes paid by those companies to build better public institutions.

My thesis is that Nigeria cannot have solid public institutions, from great schools to good public institutions, until Nigeria has created category-leading private companies that would provide resources to build those institutions. This was well discussed in one of my books which received IGI Global Book of the Year award.

Yet, the private companies need good public institutions to thrive. But there is no record that that public institutions must exist first. America was partially built on the wealth created by Rockefeller, Carnegie, Mellon, etc who generated enormous wealth for the commonwealth, and using the money the American government set up institutions. Yes, the tax from Standard Oil was used to build institutions to regulate the oil industry. Without the money from Standard Oil, government would not have the resourceful to do the needful in bringing competition in the American energy sector, by breaking the firm into pieces with incarnations of Exxon, Chevron, etc.

Standard Oil Co. Inc. was an American oil producing, transporting, refining, and marketing company. Established in 1870 by John D. Rockefeller and Henry Flagler as a corporation in Ohio, it was the largest oil refinery in the world of its time.

[…]

In 1911 The original Standard Oil Company corporate entity continues in existence and was the operating entity for Sohio; the Standard Oil Company was transformed into entities such as ESSO (phonetic spelling of SO), now Exxon; and SOcal, now Chevron

That is what will happen – we cannot expect a poor public sector to do magic. It is only when the private sector has generated enormous wealth would we see governments begin to evolve in ways we want them. Interestingly, the private sector cannot exclusively wait for those public institutions to be in existence before they can move to fix the market frictions.

I hope things improve from the public sector. Yes, I do wish we can move faster in many things. But I am not the type that believes that things can only happen after government has fixed many things. Government needs money to do those things and having great companies can make them happen.

The structures of many government institutions are designed in ways that unless the private sector does well, the government institutions will not do well. From National Information Technology Development Agency (NITDA) to Industrial Training Fund (ITF), government has structured everything that unless the private sector does well, these institutions would not have resources to thrive.

That is what is happening across all government agencies and institutions – they are largely waiting for resources from the private sector to build them. The oil revenue is asymmetric, largely uncorrelated to the growth of the local economic organically, and offers nothing sustainable. You take the oil money to Umuahia, Sokoto, Osogbo etc and once it is finished, nothing happens. But if you have companies in those cities that could bring a quarter of the allocations coming from oil money via taxes, the local economies will be better over long-term.

In summary, if you just wait for Nigeria to be perfect before investing or starting a business, you would run out of time. Nigeria is really waiting for the private sector to fund whatever it wants in Nigerian public institutions. That has been the ways the world has developed – public institutions are funded by private companies. Most private companies would be pioneers in some categories and sectors. Before them, government had nothing to regulate those areas. But as they begin to operate, they would provide funding which government would then use to regulate, develop and improve them.

Practically, we have no aerospace tourism sector in Nigeria. But if we have 5 private companies in that sector, in weeks, government will establish an agency to support it. Interestingly, as those companies expand, they would fund the institution needed to keep them going by providing better standards and regulations to ensure they are nurtured. But where you want that aerospace tourism agency to emerge before the private sector, you may keep waiting for decades.

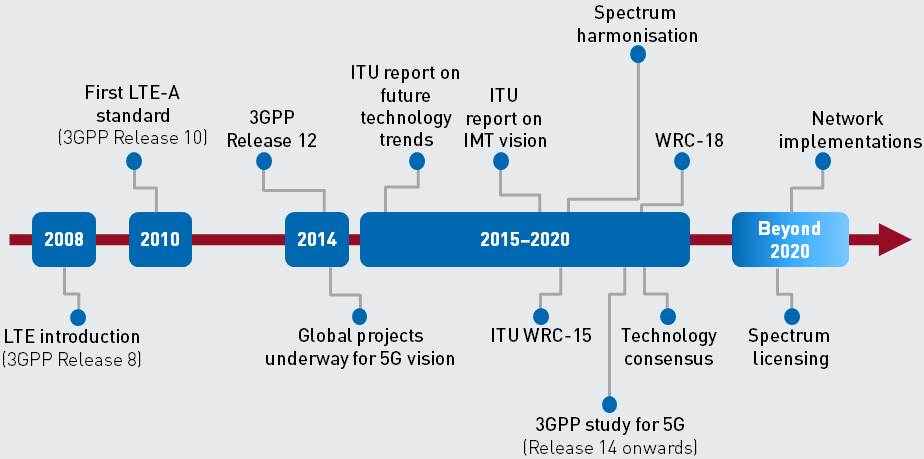

5G has often been pitched as a race among countries to attain technological superiority and global dominance. Even though, this view may not necessarily be true, indications point to a competitive atmosphere across the globe, in the deployment of 5G technology, which arguably show that some sort of race is definitely on. As we approach 2019, we should begin to witness several launches, releases, validation and tests and anticipate spectrum debates leading up to World Radio Congress (WRC) 2019. In different parts of the world, operators are starting to launch 5G with specific use cases relevant to their domestic market. In this piece, I summarize the early attractive use cases for 5G within different parts of the world and conclude with some recommendations for the continent of Africa.

In the US, it is anticipated that 5G will be used to deliver Gigabits of data throughput and serve as a last mile technology for fixed broadband connectivity. 5G based fixed wireless would therefore serve as an alternative to fixed broadband connectivity due to its advantages such as lower cost and higher speed. Verizon plans to launch its 5G Home Service in four cities within the US on the 1st October 2018. As part of offers to attract consumers, Verizon has also stated that its 5G Home subscribers will be able to purchase 5G mobile devices as soon as they become available.

The US has the highest number of tech-savvy mobile consumers and would therefore see an early adoption of 5G in consumer applications like immersive television, AR/VR devices for gaming, entertainment services with advanced video capabilities, sports coverage broadcasting offering 360-degree view etc. This shows that the US Market is definitely going hard for the consumers. As the markets mature and cross industry alliances are formed, we should see 5G being used in the US for enterprise applications like connected cars, smart cities etc.

China, unlike the US, seems much focused on the enterprise market for 5G, from the start. China is home to some of the largest car manufacturers in the world and is therefore taking a leading role in converging the automotive sector with the ICT industry with diverse applications in connected cars, autonomous vehicles etc. This has also been supported by the policies of the Chinese Government, with its ‘Made in China 2025’ ambitious plan to make China a leader within this space. China, also boasts as home to some of the world’s biggest factories and is looking to deploy 5G in smart manufacturing applications for the realization of Industry 4.0 as well as provide an increased connectivity for UAVs etc.

In comparison with the US and China, Europe definitely seems to be lagging behind in terms of adoption and deployment. Focus on 4G, market fragmentation, business models for 5G, lack of commitment, complicated regulation etc. among the 28 countries are some of the factors hindering the adoption of 5G in Europe. One good thing here is that Europe can learn from the mistakes of the other countries leading the 5G race.

Surprisingly, it has also been reported that the Middle East and North Africa (MENA) region will be an early adopter of 5G due to the growing demand for broadband, rising subscriber usage and smartphone usage, Government support etc. In fact, Etisalat has indicated that it will launch a 5G network in the UAE in 2020. Anticipated use cases for 5G include AR/VR services, immersive television, remote monitoring of oil wells, smart agriculture initiatives etc.

Africa is definitely watching the 5G race cautiously as most operators are currently deploying their 4G networks. Subscribers still rely on the 2G network, hence it seems out of place to mention 5G in Africa. Smart phone adoption within the continent is around 35% and affordability seems one of the biggest barriers hindering the adoption of 3G and 4G. The widespread adoption of smart phones like Tecno within the continent is already helping to reduce some of these barriers. However, these barriers can further be lowered by increasing the manufacturing of smart phones locally and accelerating the release of new spectrum. The current rise of Mobile Virtual Network Operators (MVNO) within the continent should also trigger a reduction in telecom services. As reported this week, South African banks are now becoming MVNOs, in their own right. This would no doubt act as a game changer for the continent, especially regarding the deployment and investment for 5G.

One thing that is common here – Countries that have been favored as early adopters all seem to enjoy support from their Government, even though 5G seems to be disrupting the telecom industry. The favorable policies no doubt translate into an enabling environment for operators and investors looking to deploy 5G.

Furthermore, this piece shows that early 5G use cases vary across the different regions of the globe from fixed wireless in the US, enterprise applications in China to remote monitoring of oil wells in MENA. For those within developing countries who question whether 5G would be of any use, I think the key lies in finding local applications within the verticals which present the greatest market opportunities in Africa. For instance, infrastructural deficit may hinder the deployment of 5G for smart cities application but there is a growing market for 5G in smart agriculture, health care initiatives, fintech etc. in Africa.

Besides, it’s anticipated that 4G would most likely act as a pillar for 5G. And 4G and 5G networks will likely co-exist before a transition to standalone 5G network occurs. Hence, it is crucial that telcos continue to invest in both fibre infrastructure and their 4G networks for a successful 5G deployment. This shows that telcos who are currently deploying and enhancing their 4G network in Africa are definitely on the right path.

It is the most fascinating company in Nigeria today. Paul Graham put out this tweet on the day something BIG happened. When I met the company founders, my response was “People, this is magical”. Let me say it, by 2022, Nigeria will not be the same. A unicorn will be a small thing because this company will generate at least a billion dollars in revenue. There is nothing in our nation, to my knowledge, that comes close to this startup [I track startups in Nigeria very well]. It is the finest startup in our nation and the numbers it is turning out are unprecedented.

Paul Graham is an English born computer scientist, entrepreneur, venture capitalist, author, and essayist. He is best known for his work on Lisp, his former startup Viaweb, co-founding the influential startup accelerator and seed capital firm Y Combinator, his blog, and Hacker News.

Fellow citizens, mark this day: by 2022, there would be a big party in the Nigerian startup world. Something huge is happening in Nigeria. I had predicted that 2022, but what would happen may be beyond anything I had imagined.

Airbnb, an accommodation marketplace pioneer, is a deca-corn with at least $38 billion in valuation.