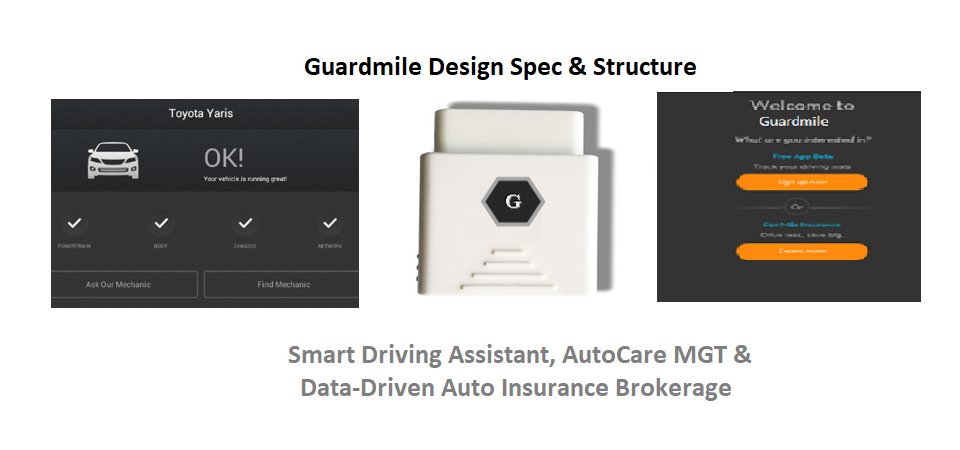

Last week, I noted that Fasmicro did works on smart driving assistance, autocare management & on-demand auto insurance brokerage but decided to focus on something else. If Jonathan was re-elected Nigerian president, we would have continued with this project. But when General Buhari was elected president, we pivoted to agriculture after reading his inaugural speech. […]

Winning Ecommerce Strategy for Africa

I invite you to read the one oasis strategy in Tekedia store [PDF]. In that piece, I used Amazon as a case study. Reading from that piece, you will get a good idea on how to run an ecommerce company especially in Africa to make a profit. Sure, I have noted some challenges with this sector in an article in the Harvard Business Review. But that does not mean one cannot built a thriving business therein.

The One Oasis Strategy is the proposition that if the best product drives key investments in a firm, it has the capacity to help other products in the business. Other products would feed from the best product, and on overall, the company would flourish. By removing the inherent risk of external markets, the best product becomes the first and the most important customer for that new investment and in the process eliminates investment risks. It makes firms move very fast because you do not have to even consider external customer opinion since the products are not made for them. Indeed, the time wasted on surveys, focus groups and market research works are eliminated because there is a customer right inside the firm.

Once done, I invite you to read this extract from Fortune newsletter.

It’s a well-known fact that restaurants make their money on marked-up cocktails and other libations, not the food they serve, no matter how tasty. It’s a similar story for auto dealers, whose margins are slim on hunks of steel even as their vigs are fat on warranties, financing fees, and car mats. (I fell for that one in 1997, and I’m still annoyed.)

Now we see Amazon has pulled off a similar feat. Its barely-break-even retail business was all it had for years, and for eons Amazon didn’t make money. Just wait, the company’s fans would say. Eventually Amazon’s hugeness will pay dividends.

And it has, but not because the business of traditional retailing suddenly got better. Amazon, instead, is now oozing profits because of the services it has built on top of its something-for-everyone merchandising. It takes a cut from other merchants who sell on its platform. It charges brands and others to advertise on its sites. And its best services business of all is AWS, the online business that rents computing power and software programs to the commercial masses. Fortune Newsletter

As Fortune notes, Amazon does not have to make profit in the best product. It simply needs the best product to ensure it can make the supporting ones work out. The oasis, the ecommerce business, drives payment, advertising, etc. And on those ones, Amazon is finding profitability. This is the winning strategy for ecommerce even in places like Africa.

Facebook’s Unbreakable Gene

In April 2018, I wrote that no person or government can effectively break Facebook. In my opinion, breaking a platform-business within the same mindset of the industrial age companies is waste of time: one part of that company will grow and dominate just as the previously broken one.

If you decide to break Facebook apart, one part will grow and dominate others. This is possible because of the positive continuum of network effect where the biggest keeps getting bigger and also better. I explained that in a recent piece in the Harvard Business Review. You can regulate Facebook but another company will come to take over its position because in this sector, it is winner-takes-all. Yes, the best wins. Why? The scalable advantage improves with lower marginal cost.

In a piece in Bloomberg, the Editorial Board made the same point:

Market forces would also likely impede such an effort. The main way Facebook and its fellow tech behemoths have grown so powerful is through network effects: The more people who join Facebook, the more useful it becomes; the more useful, the easier to attract more users. Breaking it up wouldn’t reverse this dynamic. One of the new MiniBooks would in all likelihood emerge as better than the rest — bringing in disproportionate users, data, and advertising dollars, and thus achieving dominance just as Facebook has.

Simply, only markets can put these companies in order – not dead regulations. And markets are working: Facebook lost $119 billion yesterday over its problems.

Facebook lost about $119 billion of its market cap today. Technically, it made history: it recorded the largest loss in a single day in stock market history. But Facebook is lucky: it did not lose because of competition; it lost because of correcting its past. Yes, User Privacy won even as Facebook temporarily lost.

Governments need to focus on policy and standards, and allow these companies to compete. Provided they do no harm, consumers will be fine. We are already used to the best search, best social media, best micro-messaging, etc and even if governments engineer many versions at the end, only one or two would survive. Simply, the best will win because of the positive continuum which drives these businesses. As the Bloomberg editorial noted, governments need to be on alert to check abuses from platform companies.

Regulators must keep a close eye on this sort of thing, and shouldn’t hesitate to intervene when it’s being abused. The Federal Trade Commission should ensure that Facebook isn’t collecting such data under false pretenses — Onavo, audaciously, markets itself as tool to “keep you and your data safe” — and any new Facebook acquisitions should be greeted with due skepticism by antitrust officials.

The Brilliance of Google Nigeria, Twilight for Nigerian Telcos

Google unveiled a new vision for Nigerian tech sector yesterday with the launch of Google Station. In my practice, we now think that our 2022 target year of immersive connectivity may even come earlier. Many things are connected to this BOLD initiative by Google.

This is a catalytic industry-defining project in Nigeria: our web sector is ON. If Google follows through [there is no reason why it should not, it has the cash], Nigeria will have free high speed Wi-FI in 200 locations. This would affect 10 million people – think of a nation in a country.

Google Station will be rolling out in 200 locations in five cities across Nigeria by the end of 2019, bringing Wi-Fi to millions of people. Sites will include markets, transport hubs, shopping malls, universities and more. Nigeria is the fifth country in which we’re launching Google Station, after India, Indonesia, Thailand and Mexico. (Source: Google newsletter)

Nigerian Telcos

It is looking increasingly challenging for telecom operators in Africa. I can predict that African telcos have past their best moments. Yes, MTN, Glo, Airtel Nigeria and 9Mobile will struggle as Nigerians are provided with these new options to connect to the web. It is not just Google; SpaceX is coming along with amalgam of satellite players. Add the pains from OTT solutions like WhatsApp, you would understand why the telcos will have sleepless nights.

Simply, the future will look increasingly challenging for terrestrial operators. Because from internet balloons to satellites, telcos will be under-serve competition and many of them will die. By 2025, I do expect the top four telcos in Nigeria to merge to become two. The four telcos are now more than necessary with all the evolving options. If they do not merge, they will lose value and that will hurt investors. The world is changing rapidly and the competition will be extremely ferocious that telcos as we have them will continue to see massive loss in ARPU. These GSM players disrupted CDMA players. Now, they need to find ways to survive.

All Together

The web sector in Nigeria is here. This is a new era. Do not wait any longer. The time has come because internet connectivity is going to become ubiquitous, unlocking new business models. Nigeria needs to get in touch with Amazon to help with logistics. I do not care who does it; we need to have these infrastructures. I am very confident Amazon can help.

As we explore support from ICT utilities like Facebook and Google, I do think we need to find ways to get Bezos to show interest. He is among the few that can invest in hard infrastructure to unlock more values in the continent. Think of establishing a solid logistical system that will help in the economic integration of Africa. He has done it before and he can do it here. African Union should explore that opportunity with him.

Meanwhile, well done Google – this is brilliance at best. But it would be painful season for Nigerian telcos because if 10 million people connect to free Google internet, I do not know who the profitable customers would be. Call it a double whammy: OTT like WhatsApp on one side depressing revenue, Google Loon, etc on the other side pivoting new paths. Simply, for most telcos, the best days are past. I am not sure how they could get over this, unless they decide to become Google, SpaceX, etc vendors.

Amazon Advertising’s One Oasis Strategy

I noted weeks ago that Amazon has built a solid advertising business and could challenge Google in the merchant ad spending. Yes, just like that Amazon has built another solid unit in the empire.

Amazon now runs a serious advertising business. And there are many companies putting money in that ecosystem. If companies think that advertising on Amazon is a better deal than promoting their websites on Google, it simply means that Google has a major problem in its hands.

This may explain why Google is not showing friendly handshake to Amazon these days. Amazon is not just attacking Google, it is going to the heart of its business which is advertisement.

Now, the numbers have started coming. In its latest quarter, this week, the e-commerce giant recorded $52.9 billion in revenue, a 39% year-on-year increase. Profits hit a new record, reaching $2.5 billion for the first time, while Amazon Web Services posted a 49% jump in sales to $6.1 billion.

“A big contributor to the quarter and the last few quarters obviously has been strong growth in our highest profitability businesses and also advertising,” Brian Olsavsky, Amazon’s chief financial officer, said on a call with media. “We’ve seen a greater-than-expected efficiency in a lot of our spend in things like warehouses, data centers, marketing.”

[…]

The company is working to automate tasks for advertisers and to help media buyers measure the results, Olsavsky said.

Key to its allure has been that advertisers’ placements result directly in sales, reaching customers on Amazon with an intent to shop. That contrasts with ads reaching users who are on industry leaders Facebook and Alphabet Inc’s (GOOGL.O) Google for a range of purposes.

Simply, Amazon advertising delivers better results than Google’s. If Amazon begins to automate that process, it could pose a huge challenge to Google. When you search on Amazon.com, you are actually in the process of spending money. Google delivers traffics to websites of merchants; Amazon is delivering revenue in dollars to them. That is why this is exciting for this company, and investors like the Amazon Advertising vision.

The One Oasis Strategy

Ecommerce remains the best product for Amazon. It is the oasis in the one oasis strategy. The advertising, just as the cloud business is helping the oasis, the ecommerce.

Every product is like the animal that returns to the oasis for water. Every product is like the humans that depend on the oasis for habitat. Provided that the oasis is there, and doing well, their survivals are guaranteed. Yet, as those new products do well, they could find new customers, beyond the first customer (that best product). That means, you can introduce them to the markets for other customers to buy, even when they are supporting the best product, which is the most important reason the original investments were made.

[…]

Amazon: Amazon is an ecommerce company with massive user base. It supports billions of transactions in a year and needs computing resources to keep its portal functioning well. Amazon could have called IBM to rent a cloud infrastructure for its ecommerce. Rather, Amazon decided to build one in-house knowing that the future of its ecommerce will be driven by the capacity to offer great experiences to clients. The cloud infrastructure investment is necessary as growth in the ecommerce keeps going up. It does not make sense to be sending that money away. So, Amazon went and invested in cloud. The ecommerce is the oasis and the cloud is like the animal that finds habitation from the oasis. Provided the ecommerce is doing well, the investment in cloud has minimal risk. The first customer to the cloud business was ecommerce and that means Amazon does not have to worry if there is any external customer for the cloud services. Amazon does not need to check market dynamics to invest in cloud provided its ecommerce business is doing well.

All Together

Amazon is building a solid business using the one oasis strategy. The advertisement, just as the cloud business, is now heavily making the ecommerce unit better. The Amazon search was initially engineered to make the ecommerce better. Now, it is earning revenue because it has become an advertising business.