Many months ago, I wrote that Tecno, an African leading phone company, should invest on iROKOtv, the pioneer streaming video company, in order to have a platform since platforms have become very strategic in the consumer technology business.

iROKTOtv products are very popular in most markets Tecno operates. So this provides a natural ecosystem to help it drive further growth and lock customers in the video ecosystem.

We propose for Tecno to buy iROKOtv and use the product to deepen its capabilities in Africa and beyond. Our core idea is that Tecno needs to open a unit to be dubbed Tecno TV. It will be one place for anyone in Africa to access television, delivering unified TV experience. This ecosystem will meet the needs for TV shows, movies and broadcasting contents, across the continent. It will be TV and movie content-ready. Through the iROKOtv brand, it will close partnerships with leading local content providers.

[…]

Tecno will face real competitive challenges in coming years in Africa. Finding how to lock its present believers in a platform will be strategic. It has to do that as quickly as possible. iROTOtv provides a golden opportunity to make such “locks” happen. Tecno Mobile should buy iROKOtv and rebrand it Tecno TV, and rule the mobile device market in Africa, through service.

Tecno has been rumored to be building Tecno TV (they might have launched it; I am yet to use it). Interestingly, the opportunity may not be just for Tecno. If the Konga can build a royalty program on strong membership club [think of Amazon Prime] through clusters of its physical locations tied to its digital platform, we could see Konga well positioned in the market for multi-level partnerships.

Should that happen, Konga could also help iROKOtv, GoTv and DStv distribute their video contents by making subscriptions to those videos additional options on top of the regular club membership of Konga.

Sure – the major challenge remains the cost of bandwidth but there is nothing that stops someone bundling from an ecommerce platform to enjoy videos via kiosks which iROKOtv had created.

The Amazon Strategy

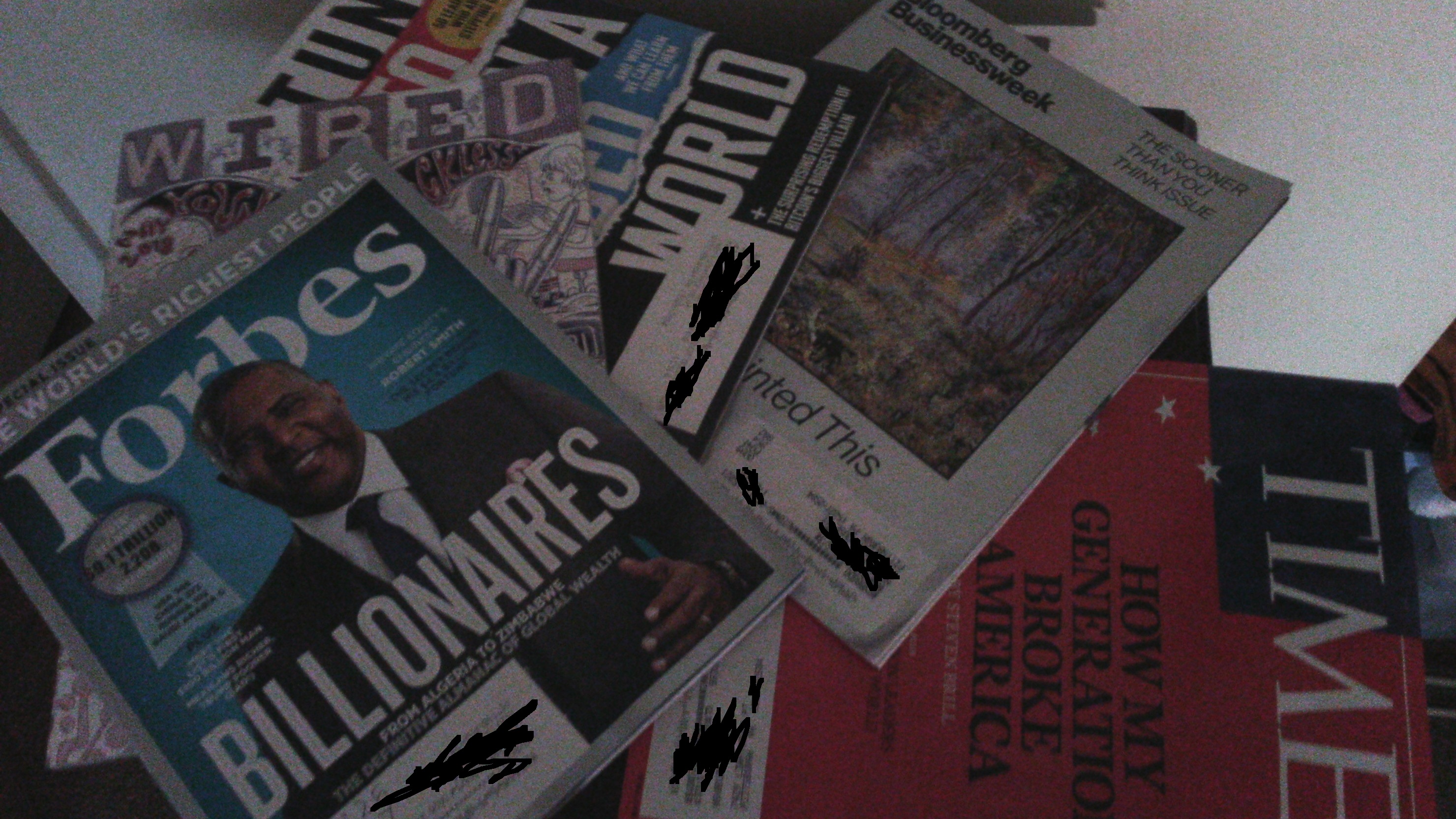

In U.S., premium cable channels like HBO and Showtime are garnering significant sales via Amazon, which sells the programming as additional options in its Prime video service. Over half of HBO subscriptions sold without a traditional cable systems and 72% of such Showtime subscriptions came from Amazon, Variety reports. Simply, Amazon has demonstrated that an ecommerce company can become an ecosystem for many other different types of businesses, charging “taxes” along the line.

Amazon has quietly become a major player in the subscription video sales business: Amazon Channels, the company’s platform for reselling subscription services like HBO and Showtime, now accounts for 55 percent of all a la carte direct-to-consumer video subscriptions, according to new data from The Diffusion Group (TDG).

53 percent of all consumers who don’t get HBO through their pay TV provider are purchasing it via Amazon channels, TDG estimated in a new report titled The Future of Direct-to-Consumer Video Services. Those numbers are apparently even higher for some of the other TV networks: 72 percent of Showtime subscribers get the network’s direct-to-consumer offering via Amazon Channels, and 70 percent of Starz a la carte subscribers receive it from Amazon.

The new Konga

If you look at the new Mission statement of Konga – “To create a trusted and vibrant retail ecosystem that facilitates trade across Africa” – you would not see any online or electronic thing in it. Simply, Konga wants to be an ecosystem for retail in Africa. And that retail does not mean only trousers, shoes and watches. It includes digital contents like books, videos and more. With Konga, iROKOtv will not need kiosks because Konga outlets could serve as service outlets. That is exactly the broad Vision of the new Konga which emphasized connectivity, growth and commerce, with no mention of “online” or “electronic”.

-

To be a powerful force for the Economic Growth of Africa

-

To connect Africans with each other and the rest of the world through Technology & Commerce

-

To be a company that employees, customers & society are proud of and depend on

All Together

Nigeria needs to invent multi- and cluster-subscription service where people can get more value for signing up for many things together. The benefit is typically lower fee per service when services are bundled. Konga with its hybrid business model is possibly going to unify ecosystems, bringing digital and physical companies under one mammoth network, thereby helping customers to discover more value. This is why I am very bullish on the promise of the new Konga.