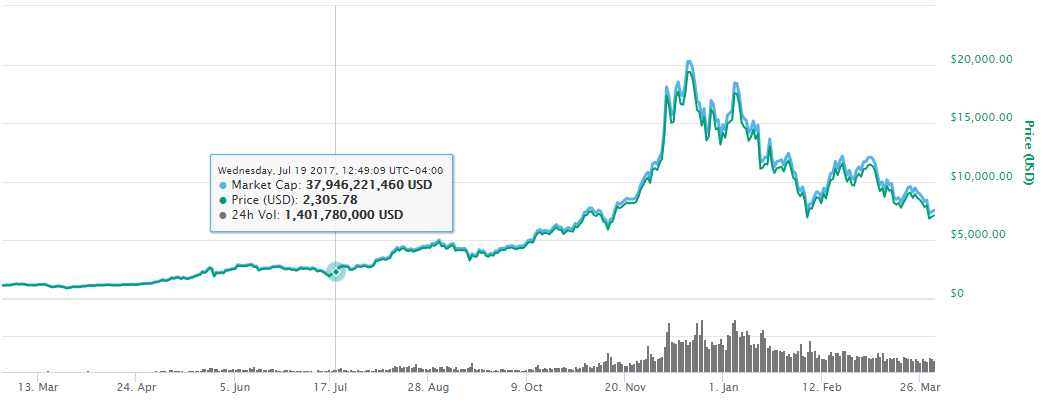

Across global markets, information and communication technology (ICT) is facilitating the process of socio-economic developments of nations. ICT has offered new ways of exchanging information, and transacting businesses, efficiently and cheaply. It has also changed the dynamic architectures of financial, entertainment and communication industries and provided better means of using the human and institutional capabilities of countries in both the public and private sectors.

The impact has been consequential: ICT is rapidly moving nations like Nigeria towards knowledge-based economic structures and information societies, comprising networks of individuals, firms and states that are linked electronically and in interdependent relationships. From Lagos to Abuja, Kano to Owerri, and indeed across the nation, ICT has provided enormous productivity gains, anchoring efficiency in production and business processes. Indeed, the penetration of ICT has driven efficient allocation of the factors of production, powering and enabling new industrial systems.

One major change is the capacity to enumerate and validate the identity of citizens through the highly successful Bank Verification Number. Every Nigerian citizen that wants to operate a bank account is required to obtain this number which involves capturing biometrics data along with other personal data. This number is evolving a new credit system which would support the growth of asset financing through verifiable sources of income for both public and private sector customers.

Our data shows that asset and equipment financing sector (without SME funding) will hit N2.2 trillion by 2020 in Nigeria.

As Africa’s largest economy and the most populous with GDP of $510 billion and excess of 180 million people, Nigeria is poised for growth in finance, energy, telecommunications, entertainment and indeed all key sectors of modern commerce and industry. It has fully recovered from recession, and as the global crude oil price accelerates, government spending would improve. The consumer confidence is already high and the sentiment generally from IMF to World Bank is that Nigeria is poised for long-term growth.

One sector would follow this trajectory: asset financing sector as Nigeria redesigns towards a credit-based economy. One of our clients, Amaecom, is a national leader in this space. You can manage your cashflow better by giving it a call. It does the following:

- Provision of mechanism to enable workers acquire equipment even as they pay with interests over time.

- Transparent asset financing across different equipment categories including electronics, vehicles, etc.

- Helping workers and SMEs manage their cashflow challenges through trusted asset financing system.

Paying cash up front for brand new equipment, electronics or even cars can be expensive and can lead to cash flow problems. Individuals simply do not have the capital for a big purchase that’s where we come in, we make things easy and stress free.

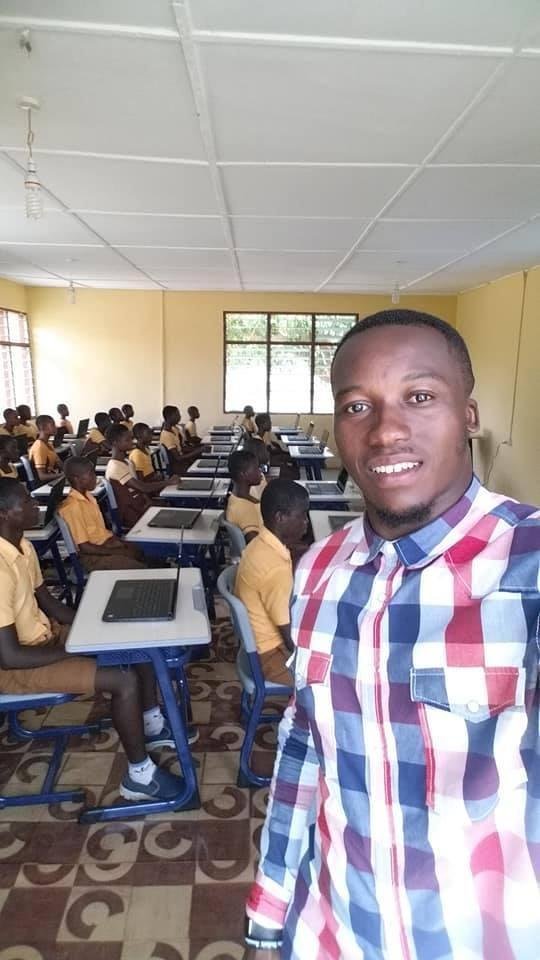

Amaecom global limited was incorporated in 2004 as a asset financing Company. Today, we are Africa’s leading asset financing company with operations in Nigeria, with presence in Cameroon, Ghana and China.

Our expertise in manufacturing, professional services, logistics, engineering and asset financing, has earned us numerous awards and recognition, both locally and internationally.

We have 25 branches in various state capitals and 3 sub branches in three states, our headquarters in Abuja, Nigeria.

Like this:

Like Loading...