Cyber-attack is an attempt by a hacker to damage or destroy a computer system or network. Such attacks target national, general public, and corporate groups, and are executed through fake websites, viruses, unauthorized access and other means of stealing official and personal information from targeted attacks, causing extensive damage. Cyber-attacks are also referred to as a Computer […]

Uber Minority Investors’ Dilemma

Uber has many shareholders. One of them, SoftBank, has assumed a huge element of the boardroom with its latest investment in the ride-hailing pioneer.

Yes, Uber is now part of the SoftBank Network. Also in that network is the world’s most valued private technology startup, China-based Didi. It was Didi that gave Uber heat in China, and later on picked up the assets of the U.S. ride-hailing app pioneer. Besides Uber and Didi, SoftBank has Grab in the network through Didi.

In Africa, SoftBank controls Uber. SoftBank also controls Taxify because Taxify is backed by Didi which is under the control of SoftBank. This is head, you win; tail, you win. These super-investors never lose! That said, the news that SoftBank wants Uber to exit Africa is unfair to Uber minority shareholders [Uber is not taking that; it wants to continue to do business anywhere it wants].

Rajeev Misra, a board director with SoftBank, believes the ride-hailing company has a better chance of success—and profitability—if it focuses only on core markets such including US, Europe, Latin America and Australia

[…]

Since launching in its first African market in 2013, Uber has quickly expanded to operate in eight countries including South Africa, Kenya, Nigeria, Tanzania, Uganda, Ghana, Egypt, and Morocco.

Here is why asking Uber to leave Africa is wrong: the valuation of Uber was not done without the consideration that it is in African markets. Those markets are emerging and that means they would grow over time. If Uber exits Africa to make space for Taxify and other empires under the control of SoftBank, it is only SoftBank that would win while Uber would lose value especially now that it is planning an IPO in coming months.

Yet, it would not be an easy decision. A big dilemma since Uber could also decide to fight this riding battle in Africa, and just burn cash which could have made it look better before investors, as it readies itself for public listing. But there is a way everyone could be happy: follow the China truce.

Yes, when Uber saw that it could not win in China, it sold its Chinese assets to Didi for equity. Uber can do same in Africa by selling its assets to Taxify (for equity) so that as the latter does well, Uber will get benefits and values. And by having that structure, Uber can put in its IPO prospectus that it has African exposure (albeit through Taxify).

And most importantly, its minority investors would also see wins, unlike what SoftBank wants right now where Uber exit from Africa would only benefit it [if Uber exits Africa, the remaining SoftBank companies would have better positioning, but other Uber investors are not investors in those firms]. But if Uber sells its assets for equity to Taxify, Uber will get the up-momentum as Taxify does well, without necessarily being exposed. That model would free resources to battle Lyft at home, and other areas where SoftBank empire has limited operations. I predict it would end this way: Uber would sell for equity to Taxify.

But no matter what happens: only one company is winning the ride-hailing business, and that is SoftBank.

In all these redesigns, SoftBank is now the largest ride-hailing business in the world. It is irrelevant that it is not making apps in Japan. Right now, SoftBank is creating the apps that really matter: feeding platforms with dollars to dominate a sector. It has eminently done well and we can now say that it has won this category. Yes, the global ride-hailing app sector belongs to SoftBank

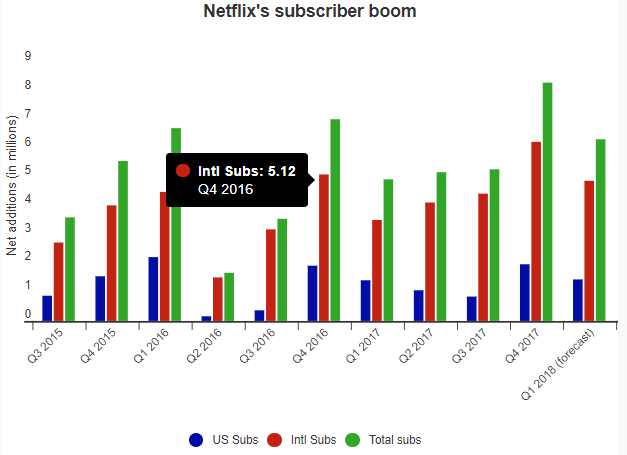

Netflix’s Parable of Winning the Web

Netflix is showing us how to win the web. The results the company is showing is mind-blowing. Simply, if you can differentiate in content, the world would reward you. Today, Netflix is worth about $100 billion. This is huge as the company has built a video content business that rivals YouTube on market capitalization. Yes, I do think that YouTube, if a separate business from Google’s Alphabet, would be around $100 billion in market cap. At Alphabet’s $814 billion in market cap, investors have priced YouTube as a key component besides Google Search. Apart from these two properties, other Alphabet businesses are marginal. Or better, other businesses are supported by the oasis which is the search business, as explained in my one oasis strategy.

Back to Netflix, here are the latest numbers, courtesy of TechCrunch.

- Revenue: $3.29 billion, compared to $3.28 billion estimates from Wall Street

- Earnings: 41 cents per share, in line with estimates from Wall Street

- Q4 US subscriber additions: 1.98 million

- Q4 International subscriber additions: 6.36 million

- Q1 forecast US additions: 1.45 million

- Q1 forecast international additions: 4.90 million

As the referred piece noted, “Netflix’s biggest challenge has been to aggressively invest in good original content that’s going to bring in new subscribers”. “Original content” is indeed a challenge because having it would drive good quarterly report and growth. As we experience a redesign in the web business, we would increasingly see companies putting more contents behind paywalls. It is irrelevant whether the content is news, video or commentary. Washington Post which has deepened its reporting is now profitable because it is getting more paid subscribers.

Besides Aggregation Construct

I am a big fan of aggregation construct where entities build platforms to monetize raw materials created by others. From Google to Facebook, aggregation is at the heart of the new internet-driven commerce. But based on what Netflix has done, there is another dimension to growth, albeit if you have the money to create those contents. Indeed, besides aggregation, there is a clear parable for web business: originality. This parable is clearly explained by a TechCrunch commenter thus: “I signed up to support their original content, not the latest rehash from Hollywood. I also find I’m watching a lot of foreign content (South Korea, Norway, Japan, etc.) – most of which isn’t available elsewhere”. That is what it could take to win the entertainment and informational business on the web.

Full Text of Olusegun Obasanjo’s Statement on Buhari Not To Seek Re-election [PDF]

Nigeria’s former President Olusegun Obasanjo, on Tuesday, in an unbelievable and excoriating statement, commanded President Muhammadu Buhari not to seek re-election in 2019. The words were extremely unforgiving.

The statement entitled “The Way Out: A Clarion Call for Coalition for Nigeria Movement” notes that Buhari has failed in leadership, performed below expectation, and should honorably “dismount from the horse”. As at press time, APC has no statement and Buhari has entered emergency meeting with Tinubu and other APC kingmakers.

Read the full text here [PDF]

But there are three other areas where President Buhari has come out more glaringly than most of us thought we knew about him. One is nepotic deployment bordering on clannishness and inability to bring discipline to bear on errant members of his nepotic court. This has grave consequences on performance of his government to the detriment of the nation. It would appear that national interest was being sacrificed on the altar of nepotic interest. What does one make of a case like that of Maina: collusion, condonation, ineptitude, incompetence, dereliction of responsibility or kinship and friendship on the part of those who should have taken visible and deterrent disciplinary action? How many similar cases are buried, ignored or covered up and not yet in the glare of the media and the public?

The second is his poor understanding of the dynamics of internal politics. This has led to wittingly or unwittingly making the nation more divided and inequality has widened and become more pronounced. It also has effect on general national security.

The third is passing the buck. For instance, blaming the Governor of the Central Bank for devaluation of the naira by 70% or so and blaming past governments for it, is to say the least, not accepting one’s own responsibility. Let nobody deceive us, economy feeds on politics and because our politics is depressing, our economy is even more depressing today. If things were good, President Buhari would not need to come in. He was voted to fix things that were bad and not engage in the blame game.”

[…]

We can collectively save ourselves from the position we find ourselves. It will not come through self-pity, fruitless complaint or protest but through constructive and positive engagement and collective action for the good of our nation and ourselves and our children and their children. We need moral re-armament and engaging togetherness of people of like-mind and goodwill to come solidly together to lift Nigeria up. This is no time for trading blames or embarking on futile argument and neither should we accept untenable excuses for non-performance.

Let us accept that the present administration has done what it can do to the limit of its ability, aptitude and understanding. Let the administration and its political party platform agree with the rest of us that what they have done and what they are capable of doing is not good enough for us. They have given as best as they have and as best as they can give. Nigeria deserves and urgently needs better than what they have given or what we know they are capable of giving. To ask them to give more will be unrealistic and will only sentence Nigeria to a prison term of four years if not destroy it beyond the possibility of an early recovery and substantial growth.

THE WAY OUT: A CLARION CALL FOR COALITION FOR NIGERIA MOVEMENT

Special Press Statement

By

President Olusegun Obasanjo

Read the full text here [PDF]

Follow These Simple New IBM Steps for Your Partner Strategy

Finally, IBM grew, again, last quarter. That is very exciting. Over the quarters, as an IBM PartnerWorld member through my Milonics Analytics, we have seen razor-focused commitment of the iconic American company in making sure that partners win. Today, it shared this non-confidential message [see below] to partners on its redesigned partner strategy. I would adopt it, as I do most times, in my own products which I also engage partners [In short, the channel strategy for our cybersecurity business, Facyber, mirrors IBM’s]. You can learn some new things on how to build your partner strategy therein. That “Offer alternative routes to market through Third-Party Marketplaces” is key: you do not need to have 37 branches to serve Nigeria today. You need to find how 3rd party marketplaces can drive your growth, anchored by the unbounded Internet.

In a board strategy session yesterday here in Nigeria, I told a client that it was a very wrong metric, to think that having more branches for the business is a sign of success. We saw the expanding branches as deficiency on strategic capabilities to exploit the inherent features of the modern digital world which would reduce cost even when bringing operational simplicity. So, for some businesses [again, some businesses], do not think that you are doing well because you are adding more branches. IBM is reducing cost through channels.

I am pushing that small companies in countries like Mali, Gambia, Sierra Leone and Liberia can look up to Nigerian companies as their own “America” to strike channel partnerships. If you model your channel process effectively, those firms would respond and help you expand at zero marginal cost. It is weakness to be opening branches and running costs for most businesses now. The number of branches was a metric for the 20th century commerce across most sectors. Today, most businesses do not need to have any.

[The video, unfortunately, is in PartnerWorld member area, and not available to everyone].

Driving client value and growth together through transformation

Team,

Today, we are introducing the next phase of IBM’s ecosystem transformation. This evolution in our strategy represents a significant change in our engagement model that will make it easier and faster to deliver more value to our mutual clients so that together–you and IBM–remain competitive and grow.

We know you have choices. We have heard you tell us you need a vendor you can count on, one that helps you differentiate yourself to compete in a fast paced, ever changing marketplace with:

- Partner ready, market leading offerings

- Simple and predictable programs for greater profit potential

- Rules of engagement you can trust

Today, we are announcing changes to our program that will:

- Shift rewards from fulfillment to value, offering the highest potential earnings where Business Partners deliver the most value. For example, you’ll earn greater rewards for developing new clients, generating new opportunities, retaining clients through On-Time renewals, implementing high value solutions and/or delivering solutions as a service

- Expand and simplify opportunities around SaaS including the ability to earn more throughout the life of a SaaS client engagement

- Make it easier to adopt and embed IBM technology and develop solutions

- Offer alternative routes to market through Third-Party Marketplaces

- Provide a better end-to-end experience when working with IBM

This announcement represents an increased commitment to our partner ecosystem. We have carefully and thoughtfully designed these changes so that together we can win in today’s dynamic marketplace while setting the stage for future accelerated growth.

Please take a moment to view our

video and webcaststo learn more.Sincerely,

John Teltsch

General Manager

Global Business Partners, IBM