Since I wrote the piece suggesting that Nigeria could redesign its tax policy, the conversation has largely focused on the nation’s obvious need to boost its tax revenue. In other words, a country that needs more tax revenue cannot be offering tax-holiday. That makes sense, except that focusing on the apparent short-term tax revenue losses would cost us the opportunities of the future. Here are two things to consider:

Mobility of Knowledge: In a knowledge-based economy, knowledge is a key factor of production. Unlike in the industrial-age era where it was hard to move some factors of production (like raw material), knowledge is very mobile. The key thing Uber, Google and Facebook export to the world is knowledge. The mobility of knowledge makes it possible for most of the leading technology companies to decide the jurisdictions where revenue receipts would be recognized for tax purposes. In other words, if they earn revenue in Nigeria, they could book the revenue in Cayman Islands which is a tax haven. What has happened is that Cayman Islands is assumed to hold the intellectual property of the company and must be compensated for that. Every country has structures designed to enable local subsidiaries of entities to compensate the original IP holders through royalties, IP licensing, and rights.

Nigeria has an agency of government that does just that, approving for the foreign entities to repatriate the money back. Visit National Office for Technology Acquisition and Promotion(NOTAP) and learn what they do. Simply, they manage these issues of technology IPs acquisition and transfer. So, consider a scenario where Google Nigeria has earned revenue in Nigeria, NOTAP makes it possible for Google Nigeria to pay Google International through a jurisdiction it has designated for the technologies used in Nigeria. This is vital because Google search engine was not invented in Nigeria, and even though Google Nigeria is selling adverts to Nigerian companies, it does not own the technology. That acquisition and transfer of IP is what Uber, Facebook and others do with subsidiaries globally. It is legal and is a key part of commerce and industry. Private innovation is not a human right: it has to be paid by anyone that wants to use it.

For Cayman Islands, the intellectual property it is holding is great, and if you register there and move your firm to its domain, it gets the benefits.

Google is continuing to benefit from an EU rule that is being phased out. The company disclosed that it moved $19 billion of profits in 2016 to a Bermuda shell company via several Irish subsidiaries to avoid taxation in Europe. The so-called “Double Irish” and “Dutch Sandwich” move loses its tax-free status after 2020.

Contrast this with what happens in the mining industry (an industrial age sector), you would agree that it is different. You cannot ship the core raw material like coal, and that makes it harder to move the jurisdictions where tax is recognized. Yet, while the technology to mine that coal can be paid, the system is not driven by knowledge. That makes it very cloudy, making it harder to use tax incentives to shape it. No company is going to relocate easily because the availability of raw material is a key factor in the location of the companies. Tax incentive is abused easily in this area because of the opaque of the operations.

I am not saying that Nigeria should become a tax haven. I am simply noting that tax policy works effectively in a knowledge-based economy unlike in the industrial-age where some factors of production are not as mobile.

Yes, my proposal to offer a ten-year tax-holiday to venture capital firms can work because what is involved, unlike in the industrial-age where taxes could be abused, is knowledge. That could be effectively managed.

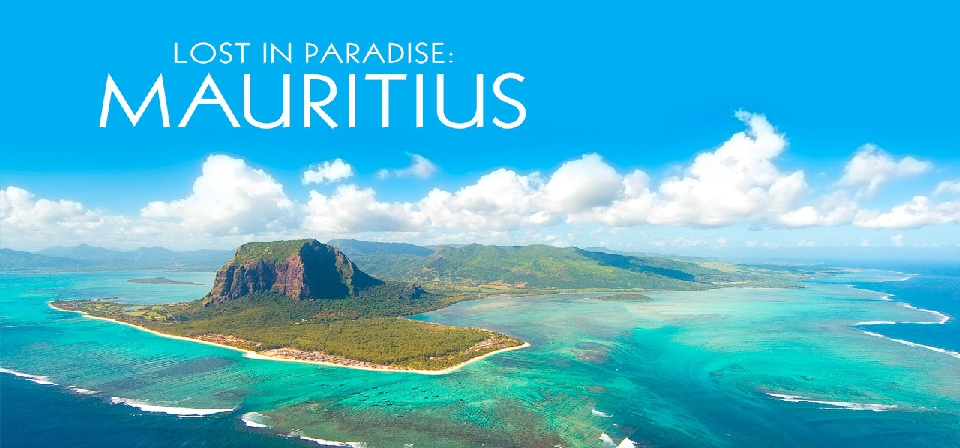

Mauritius: Most of the venture capital firms operating in Nigeria are incorporated in Mauritius (or at worst outside Africa), a known tax haven. Yet, some of the VCs and PEs (private equity firms) do most of their businesses in Nigeria. But since Nigeria taxes only profit, they do have the right to ask NOTAP to approve for them to ship most revenue to Mauritius thereby reducing the taxable profit. Once that happens, the money leaves the country and within weeks return, un-taxed. So technically, Nigeria gets nothing while Mauritius where these companies are based (legally) gets the glory (the tax there is low I must add). All you need is a post office box with no requirement to have operations in Mauritius to become whole to use this scheme.

Yet, I am not trying to say that our government is not aware of this. The problem is that as typical in Nigeria, we rarely engineer policies to change behavior in big ways. If we offer this deal, great things would happen and most of the firms would operate in Nigeria, and even if they have to leave, at the expiration of the incentive, ten years would be enough for us to seed the VC sector.

- Government should offer new VC (venture capital) firms in Nigeria a ten year tax incentive on profits if they have asset base of at least $50 million and will deploy the capital in Nigerian startups within 10 years.

- Offer new VC firms in Nigeria the opportunity to repatriate 100% of profit within ten years. That will help the country to attract foreign investors to make Nigeria home.

Beyond Venture Capital

It takes the understanding of markets to offer policies. If Nigeria redesigns its tax policy, we could get more done. As I have noted that even our education system can benefit. There is nothing that cannot be changed through a smart tax policy. The United States government just did a big one under President Trump. A key element of that tax policy is to encourage U.S. companies to bring their offshore profits back to U.S., instead of leaving them outside the country, primarily to avoid the U.S. relatively high tax rate.

If Company A wants to start a factory in Owerri Nigeria and needs to train 1000 people in the areas it does business. It can ask Federal University of Technology Owerri to do that training, providing the manuals and documents required. It will fund it say with $3 million for three years. FUTO may integrate the program in its curricula (NUC may need to approve). FUTO has received funding, expanded its program and at the same time graduating students that will likely have jobs when they finish. Brilliant!

For Company A, it has moved the non-core training out to focus on its business, knowing that whenever it wants talent, FUTO is preparing them. Then on that $3 million, Nigerian government allows it to deduct it, non taxable. Simply, the revenue where that money has come will not be taxed because it has been used to do good to the society. Just like that, the company has saved money and at the same time assisted FUTO to deepen its programs. That is an incentive which does not exist right now, and Nigeria needs to update our tax system to make it possible.

Today, what is possible is to deduct that $3 million as an expense, meaning that it is recognized in the tax book as pure business. That is not enough as the resulting balance will be taxed accordingly. In U.S. that $3 million is treated differently, offsetting not just its expense but other areas the company might have experienced losses. So magically, you use donation to make-up. That is why giving is financially good, under some circumstances, for both the recipients and the givers.

All Together

Policies work and Nigeria experienced that during the golden age of our entrepreneurship. Under the military rule of former President Ibrahim Babangida (IBB), Nigeria made many policy moves, starting in 1986. The impact is huge – between 1987 and 1992, some of the finest (old) technology and (modern) financial institutions in Nigeria were founded. In my analyses, I have zero’d in on Second-Tier Foreign Exchange Market (SFEM) which made it possible for banks to make huge profits on foreign currency transfer/trading, as catalytic. That era gave us many banks; some samples of companies starred during the time have become category-kings in their sectors. In short, the phrase “New Generation Banks” came into the lexicon during that era.

- Diamond Bank Plc – born 1990

- Zenith Bank – 1990

- Fidelity Bank – 1988

- GTBank – Jan 1990

- (STB for modern UBA) – 1990

- Access Bank – 1989

While many of the financial institutions created in that boom collapsed, some survived. Technically, that is how it works: Amazon is alive but many startups perished during the 2000 stock market collapse in U.S. Nigeria needs to create Diamond Banks, Zenith Banks, and GTBanks of the future. A smart tax policy would make that possible by making capital available.

Comments on Linkedin

A LinkedIn user: Mauritius has an effective corporate tax rate of 3% (15% corporate tax rate for income generated in Mauritius with a 80% tax credit for foreign tax paid). Nigeria’s corporate tax rate is 30% for WORLDWIDE income generated. No off sets. Foreign resident companies are taxed at 30% but for only profit generated from income in Nigeria. 30% tax on global income is tough and to an extent a breach of fiduciary duty owed to shareholders when other more tax jurisdictions are offered. In addition, a start up has limited income and instead of tax credits or incentives has to pay taxes early on against the sickly initial income stream makes 30% tax rate tough. You combine this with both legal and political risk, as an investor at least mitigating one controllable risk to enter Nigeria makes sense.