I have gotten this question many times on why I think ALAT from Wema Bank is different from other bank apps or digital products.

Great initiative. Great strategy. But I am yet to see how any digital offering yet in Nigeria is helping businesses increase their own revenue. Digital has mostly helped to make spending or payments easier but none is expanding access to markets or investments.

This is my response:

ALAT is not necessarily a bank product because the creators took the bank out of it. That means it is a startup which is not designed to make money immediately for the bank. Just like startups can operate for years at losses provided they are adding customers, ALAT wants to do just that. So, because it was not structured to bring immediate revenue, it is not relevant looking for one. What you look for is the capacity to bring new customers to the bank: 90% of its users are new to the bank. That is significant.

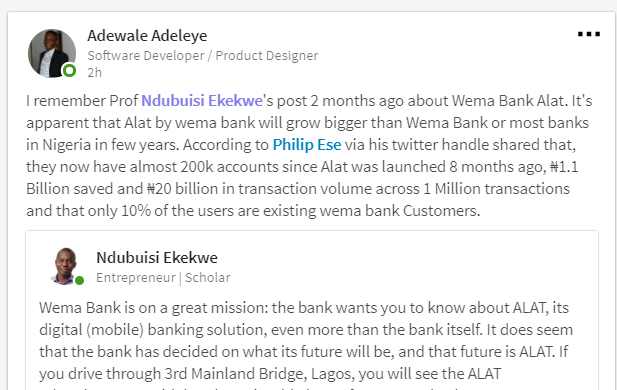

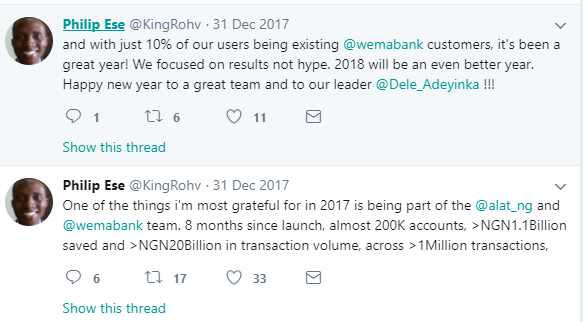

These numbers are significant because the implication is that ALAT is driving growth in Wema Bank. Wema Bank has about 1.5 million customers and hopes to push the number to 3 million through ALAT by 2020. Within 8 months, they have 200,000 on-boarded. My focus is not really the 200,000 customers in ALAT but the fact that Wema is attracting new people into Wema: “with just 10% of our users being existing @wemabank customers”. This is significant for the relatively small bank. Getting 90% of new customers through ALAT is very great. It would have been bad if it was only moving current customers to ALAT. So, ALAT offers growth to the bank

So, there is no issue of helping Wema Bank improve revenue immediately. They did not call it Wema Bank App; they called it ALAT. That strategy is very significant: they want to create a new business possibly from the bank which can appeal to the youth. And they are succeeding: they moved from 16th position to 7th in youth attractiveness within a year.

The 2016 Ciuci Consulting Annual Banking Report- What Nigerian Retail Customers Want shows a significant climb for Wema Bank in the perception ranking of the 18 to 24 age group, where they moved from 16th place in 2015 to 7th place. Wema Bank is succeeding in capturing the hearts of the youth as the report shows a strong attraction by this age group as their ranking with them is much higher than the bank’s overall perception ranking of 14th.

With a near-zero marginal cost, this can scale and over time most young people will forget it is coming from a bank. All the bank needs to do is to put resources and grow it just like other fintechs that keep growing even when losing money. My understanding looking at the strategy is that Wema Bank is building a NEW business within Wema Bank. That business is ALAT.

But where you make your app as an extension of your bank, the hangover will happen as there are things you cannot easily do because you are running a bank app. ALAT does not have to worry about that because it is a digital native. The implication is that it will not bring any great revenue but it can grow the bank. Wema Bank needs that growth because it has not done well in adding users for 72 years.

See the numbers: Wema Bank was established in 1945. It has about 1.5 million customers in Nigeria. ALAT was established in 2017 and has brought NEW 180k customers to the bank, about 12% of the total bank customer base. Wema Bank is a relative small bank but if ALAT can add 180k NEW customers within 8 months it is a home run. For 72 years, the bank got 1.5 million customers; about 21k per year on average. If it can get something that gives it 180k in 8 months, it can party. So if you are looking for revenue, you may not be looking at it from the right angle: this bank wants to grow and ALAT is the path to it.

And finally, ALAT is not just a product, it is also a platform. And that is good. Because it is not built to be an extension of a bank, it has the capabilities to transmute. It will be the oasis in a one oasis strategy.