In this video, I share how the Bank of ICT which the Nigerian government is establishing, could be structured. You can read the supporting text here.

The Exciting mVisa And Challenge for African Fintechs

Visa, the global payment processor, is deepening capabilities in Africa. It has pursued many strategies in the past, with varying levels of success, but the introduction of mVisa seems to be changing the game.

Simply, mVisa is offering what any decent fintech in Africa will promise to offer the banks. But Visa wants to do it by itself, making it harder for the fintechs to find an opening to “plug” into the banks as they currently do. As I have written that it is an illusion for any fintech to imagine the disruption of Nigerian banks, in the short-term, this new product makes that perspective even more on the money. There is no bank in Africa which will not like to connect into this mVisa ecosystem, simply because most are already Visa partners.

For the fintech to take down and disrupt Nigerian banks, they must change the basis of competition. At the moment, they are sustaining innovators which are fortunate the incumbents are not doing what they are doing.

That is the problem for fintechs: they have the most important global fintech ahead of them in the partnerships with local banks

What is mVisa?

mVisa is a way to pay and be paid with phone. No need to fumble for change or hand-over your card to the merchant or queue up at your bank/ATM to deposit and withdraw cash. It is simply Scan, Pay & Go. That simplicity is huge, because with this, the acquisition cost of Post of Sale (PoS) terminal is gone.

With mVisa, consumers can directly access all of the funds in their bank accounts to pay merchants (person-to-merchant or P2M) or individuals (person-to-person or P2P). Because the transaction runs through the Visa network, the consumers and merchants do not need to be customers of the same bank or mobile operator. …Consumers can also use mVisa agents for domestic remittances as well as to access their cash if there is no ATM machine nearby. These features are intended to accelerate financial inclusion

According to a report by the Guardian, mVisa has been launched, in Nigeria, and Diamond Bank, Fidelity and First Bank attended the launch, and already on-boarded.

The solution will allow consumers in any part of Nigeria make payments, digitally, regardless of whether they use a smartphone or feature phone, said, Andrew Torre, president for Visa Sub-Saharan Africa at the launch in Lagos on Wednesday. Torre said, “Small and medium merchants in particular, no longer have to invest in expensive point of sale infrastructure as mVisa gives them the freedom to accept payments in a convenient, secure and affordable manner that their customers trust.

Why this is Huge

This is mobile money without mobile license. If every bank connects to it and customers can effectively pay without regard to where the bank account is domiciled, you suddenly have a new huge infrastructure that goes through Visa network. It is not clear what a fintech will offer considering that Visa will get scale as banks will like to join the network to serve their customers especially when they are traveling abroad. The fact that it can work on feature phone is a huge innovation.

Any African startup must have to deal with three issues:

- Provide a clear alternative, at scale, larger than Visa, locally and internationally. We know that this will not be easy considering the scale of Visa.

- Find other ways to engage the banks on mobile since the fintechs continue to plug into banks. The banks will like to ascertain that a proposal is huge to buy into it.

- Remember, that mVisa can be integrated into the banks’ apps which means the banks are offering this from their own apps. A startup must demonstrate why a bank will make its own solution muted for a similar solution from a fintech.

Watch out for more banks across the continent joining. Visa has made life easy for them as they can easily integrate this and get to market fast. Visa handles many technical things for them while they focus on getting customers. For the very simple fact that mVisa is agnostic of the bank the customer account is located, and also supports feature phones, it is a huge challenge for local fintechs across Africa to overcome. The startups must have to change their games because partnerships with banks will be harder, as they are going mobile through mVisa, and may not see a reason to anchor a startup for for a product which is already in their apps.

Practical Ideas for proposed ICT Bank of Nigeria

Good job Barr Adebayo Shittu, Minister of Communications, Federal Republic of Nigeria. The Honourable minister works really hard. He has so many ideas and he is working. While I do not like the smart city initiative, I am in for his plan to establish an ICT Bank, as reported by the Guardian.

Adebayo Shittu, minister of Communications, has said the Federal Government will soon establish a specialized bank to cater for the development of the Information and Communications Technology industry.

Shittu who stated this at the 13th International Conference of the Nigeria Computer Society (NCS) in Abuja on Tuesday also disclosed that the proposed ICT University would take off in September.

Justifying the decision to establish an ICT development bank, Shittu said the regular banks cannot cater for the needs of operators in the ICT industry because of the time it takes to develop ICT products and services, from conception to market.

The minister said the proposed bank was provided for in the ICT Roadmap which, he said, has been approved by the Federal Executive Council.He said, “I am happy to inform you today that the Information and Communications Technology Roadmap has been approved by the Federal Executive Council.

The fact is clear: the present funding institutions are not structured for funding startups. Startups can go for years, without a single revenue. This means the commercial banks and Bank of Industry cannot help. Hence, what the Honourable minister is planning is a good one.

Here, I offer some perspectives on how our Honourable minister can make this bank deliver on its mission. It has to be totally different from Bank of Industry (BOI), which requires entrepreneurs, to get sureties, and in some cases collateral. to access capital The fact is this: only those with means can have access to those documents or assets.So, at the end, the people who may need the funds, never get support from BOI.

ICT works on brainpower and that must be recognized. That one does not have rich family members for sureties, or parents that own assets like land, which can be used as collateral, must not limit the individual.

Also, it has to be totally different from the way commercial banks support companies today. The 20% interest rate will not work, when startups have to build businesses over years, before they start making money. We need a new model to build this bank which is certainly going to play a huge role in our future. This week, I made a call for African Union to take action to accelerate such funding mechanisms, across the continent.

This is huge [Y Combinator $1 billion planned fund] and this will ensure the next generation of companies, indeed future Dropbox, Facebook, and Google, will be seeded in America. America is such a blessed country that its private companies can drive such national agenda. It is simply unprecedented at the scale they do this. As their President tweets tonight, he knows that some people are holding up for America, irrespective of whatever he will do tomorrow

We present core pillars for considerations by the Honourable Minister and his team as they craft this new bank:

- Make the bank a clearing house: This means the bank will not invest directly by itself. Rather, the bank will pool the funds and invest in venture capital firms with locations in the specific regions in Nigeria where they will be investing. Venture Capitalists (VCs) will be required to have presence in the regions where they will invest and they must have capabilities beyond writing cheques.

- Allow VCs to compete for the funds/Local Presence: The VCs can be local or international, but they must be located in the specific region of Nigeria where they have to invest.This is important as Nigerian startup problem is not just money. They need many things like mentoring, networks, linkages etc to get ahead.

- VCs must De-risk the Bank: VCs must provide collateral, in different forms, to protect government as the funds are provided to them. We want only funds which are sure they are coming to invest, to join this game. And only funds with at least 3 years prior-investing experience can participate. Banks can be allowed to also participate but they must run it separately from the way they run their current lending programs,

- Offer Funds at 5% interest rate to VCs and Strategic Guarantee: VCs will take the loans at 5% interest rate with funds return due within 10 years. It is important the funds cost the VCs something so that they know they have to work. Government will also have to guarantee up to 75% of losses in seed funding phase, maximum of $20,000 and not more than 5 of such, pear year, for any VC. This is important to give them room to take more risks, instead of waiting for post-revenue startups. Other investments phases, above $20,000, will not have any government guarantee.

- Tax Holiday: Every VC will have the opportunity to defer paying taxes from the profit arising from government fund for 10 years, provided those specific taxes are re-invested. That means if they make money from the government tax, they do not have to pay any tax on it provided they re-invest that waived tax into startups. For other funds, not connected to government support, government can also offer them the same. Please note that they can use the profits to do whatever they want. But only the taxes they could have paid to government is what I am proposing they avoid paying and put back to work

- Investment Committee: VCs will have their investment committees and will run their businesses independently, but whenever they need to invest any money from the government-supported fund, they must inform the bank. Government will just record the transaction, nothing more. The VCs must be required to have independent investment committees, drawn from industry to ensure there is no corruption in the system.

The ICT Bank is a good idea, and must be managed to avoid bureaucratic mess. We have to structure it in such a way as to make it easier for our young people that need the funds to access the opportunities.

The Startup Incentive Construct

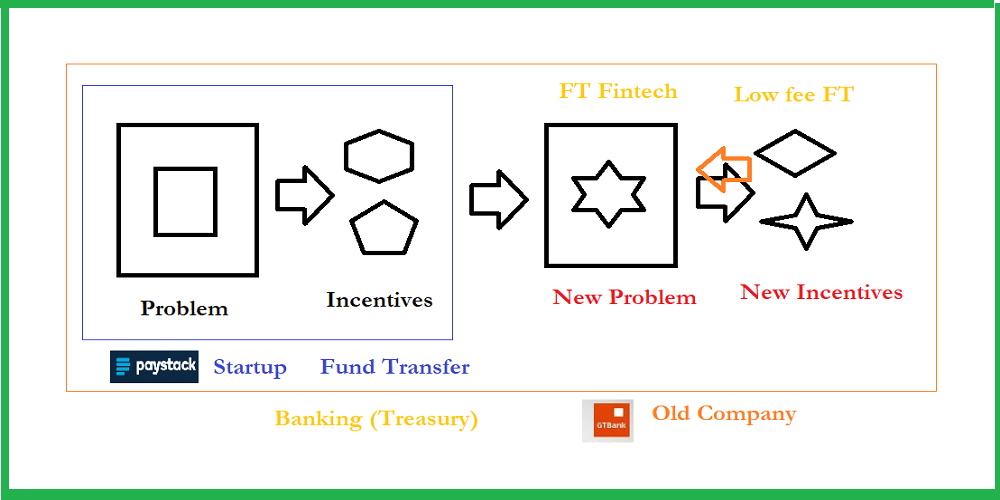

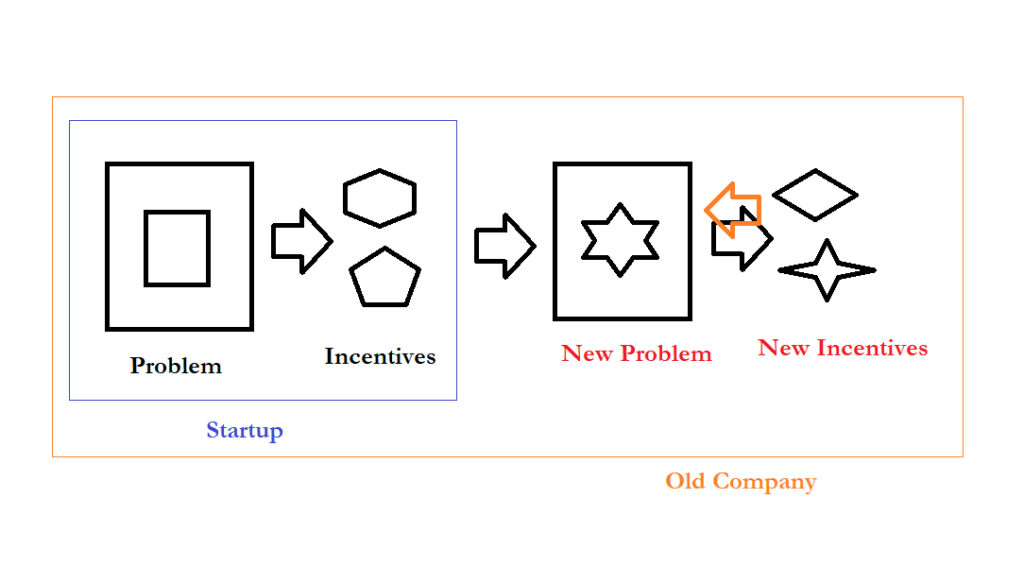

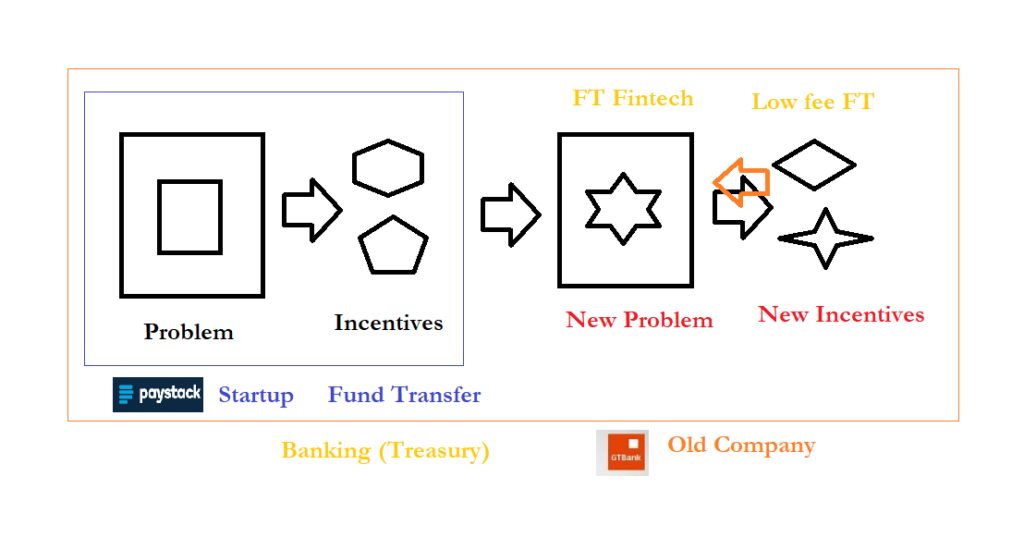

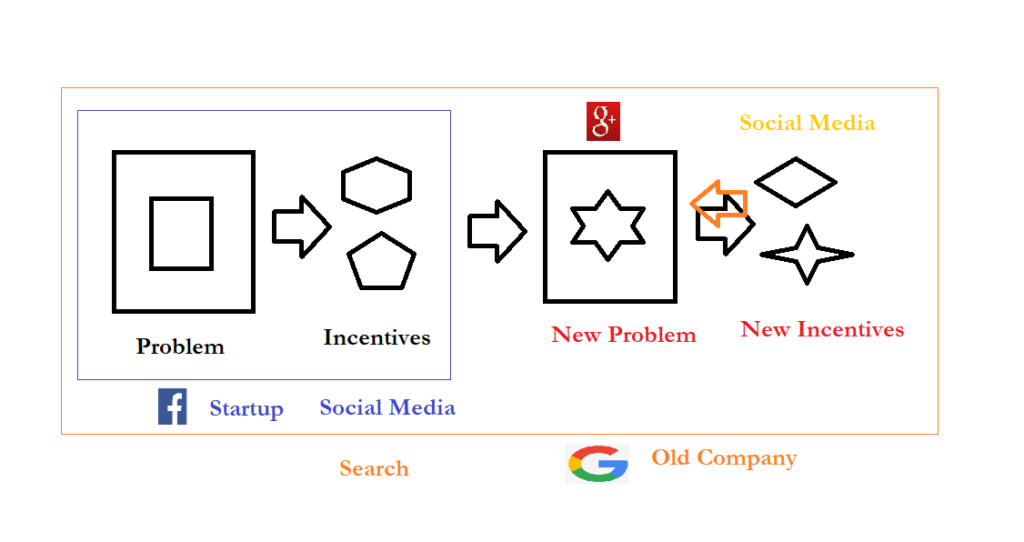

In this video piece, I explain why startups win, despite the efforts of older companies who challenge them in new areas they are pioneering. The older companies can come with money, experience and technology, but most times, they are solving problems, with the wrong incentives.

Consequently, they adjust the problems to accommodate their incentives and in the process, solve an entirely different problem, resulting in a loss. You read it from me: African and specifically Nigerian startups, you can win over the big players. Your incentives are different, and those are inherent advantages for you.

The established companies have what I have called Innovation Hangover which is an inertia to cannibalize existing revenue sources for new opportunities. See it this way: If you run a treasury operation in a bank which will yield $5,000 profit but your fintech unit (a subsidiary) can do the same for $200, would you dismantle that treasury unit, and allow the fintech unit to serve the public because one fintech startup has started offering the service for $200?

That is not what we do most times because of the revenue/profit hangover. So, what happens is this: to fix that problem, the bank has to create a new market friction, and try to solve it. Possibly, that new problem can yield for the bank $1,000 profit, and it can feel that it has innovated and has challenged the startup on pricing. Indeed, it could offer more features and services than what the fintech startup is offering for $200.

Yet, that is not the original friction which the standalone startup went for. Typically, over time, the startup can still win because the incumbent is hanging onto the established profits, and solving entirely new problems. I have called this Startup Incentive Construct.

*the GTBank Fintech in the video is just a way to explain the fintech effort of the bank. There is nothing official there.

Y Combinator Challenges African Union with $1 Billion Fund

First, do not be so excited. Y Combinator, the legendary U.S. startup accelerator, does not have the contact of the African Union to challenge it for anything. But whether it does or not, Y Combinator is putting the world on notice: America is well prepared to lead the innovation battle of this century. If not, how can you explain for a company, at its focused-level of investment, to be raising $1 billion?

TechCrunch reports that the accelerator is raising $1 billion, after a mere two years of closing $700 million fund.

Silicon Valley startup accelerator Y Combinator is raising up to $1 billion for a new venture capital fund, Axios is reporting this morning. The fundraising comes less than two years after YC announced the close of its first big investing vehicle, a $700 million growth fund called the Y Combinator Continuity fund that it hired Ali Rowghani to oversee.

This is huge and this will ensure the next generation of companies, indeed future Dropbox, Facebook, and Google, will be seeded in America. America is such a blessed country that its private companies can drive such national agenda. It is simply unprecedented at the scale they do this. As their President tweets tonight, he knows that some people are holding up for America, irrespective of whatever he will do tomorrow.

The Challenge for Africa Union

This is a direct challenge to the African Union. This is not talk and no action. We hear it all time: “we need to grow our startups” and everyone goes home from Addis Ababa, and nothing happens. Capital is required to make it happen. African Union should take the challenge by asking member countries to designate at least 1% of their budgets for investments in technology startups. As soon as that money is available, the government should give it to Venture Capital (VC) funds in the specific African country as loans, at 5% interest rate, for ten years. Then, the government should guarantee 75% loss on behalf of the funds, as they invest in startups.

The 5% is to make sure the fund costs the Funds something. That will give them incentives to work to cover the costs. Guaranteeing 75% of their exposures will enable them to take risks but also make sure they pay consequences if those risks fail since they have to account for 25%.

Finally, government should offer zero taxation to all the VC funds, for ten years, with mandate that all those forgone taxes must be put back into investments.

This should become an AU policy point. It is very critical because despite the fact that these technology companies are simplifying lives and making everyone happy, there are winners and losers, at government-levels. This is one way we can catch-up as the level is not even: Microsoft generates Nigeria’s total budget within 3 months.

Microsoft’s net income more than doubled to $6.51 billion or 83 cents per share in the quarter, from $3.12 billion or 39 cents per share in the year-earlier period. Excluding one-time items, Microsoft earned 98 cents per share. On an adjusted basis, revenue rose 9.1 percent to $24.7 billion.

Behind Tech Win-Win

Nearly all consumers win, because technology simplifies our lives. However, technology has shown that those that incubate and own the companies gain more. What they do is to make everything better, but those actions have consequences. We cannot use bad policies to stop value from technology, but we must work hard to ensure we compete in the space.

As most American cities have noted that despite the cheap products on Amazon, they could suddenly live without good schools because Amazon.com had out-competed those physical stores that provide the real estate tax that fund schools. So, for them, we have the cheap products and great simplified lifestyles due to Amazon, but our cities are collapsing.

A scathing new report from the Institute for Local Self-Reliance (ILSR), which campaigns for sustainable local economies, argues for action to curtail Amazon’s influence. It compares Jeff Bezos to a “19th-century railroad baron controlling which businesses get to market and what they have to pay to get there,” and it argues regulators should break up the company, and that states should reduce tax breaks and subsidies that privilege the company over its competitors.

How do you react? You pursue innovation and challenge your young people. Because they do not have entities like Y Combinator, you make it a policy to seed them. This is a moment because Y Combinator will likely, through this fund, have a company that will be one of the winners in Artificial Intelligence, with consequences around the world.

We need to reply and build our institutions. This is serious, for an accelerator, to be raising $1 billion. It is a huge deal: Africa must act, immediately. Do not remind me that Y Combinator could be investing in African companies; I get that. But people, we need to do something on technology and plan how Africa could compete in this space. Foreign funds will not save us.We need to build indigenous funding capabilities.