Developing Vibrant Industrial Clusters in Africa – Pillars and Lessons from Advanced Economies

by Ndubuisi Ekekwe

Executive Summary

Around the world, it has been recognized that industrial clusters are more than a collection of companies since they offer a unique business-sphere for stimulating technological innovation, nurturing new startups, attracting investment and generating socio-economic growth. The popularity and growing significance of cluster in development are underpinning new policy supports in national economic initiatives as nations seek ways to stimulate growth by supporting business environments to improve competitive positions. Silicon Valley remains the global benchmark with its leading hi-tech firms. In Africa, Nairobi in Kenya is an emerging cluster for information and communication technology (ICT) sector. Italy is known as the world’s footwear capital because of clusters in Parma, Montebelluna and other towns that have existed since the time of Michelangelo. In all these places, there are inherent business advantages arising from clustering of firms.

Clusters are effective mechanisms that help to concentrate resources and align trade routes, diagnosing ways to generate and accelerate development processes besides being growth poles in economies. The birth of Silicon Valley stimulated a vibrant venture capital and brought lawyers with specializations in intellectual property as well as professionals in other fields that serve the technology ecosystem. Cluster developments are very strategic for national competitiveness in the global economy.

In Africa, many of the economies are experiencing high economic growth rates. However, those rosy statistics have not translated into better living standards for Africans with close to 49% of sub-Saharan African population surviving on less than $1.25 a day according to the World Bank. The asymmetry between economic growth and job opportunities cannot be decoupled from the structures of most African economies. They remain dependent on minerals, hydrocarbon and overall commodities for their foreign exchange earnings. Besides the obvious challenges which could emerge on post-mineral era, Africa is challenged by the fact that regional integration may not happen effectively without homogeneity in the economic structures. But regional integration is a vital catalyst to drive the competitiveness of the continent and expand its economic system with shared prosperity.

Competitiveness driven by knowledge based economies with industrial capacities in new areas of technology will help Africa overcome the cyclical budgetary turbulence associated with commodities. If that happens, welfare loss associated with budget shortfalls could be minimal across regional economies. This implies that African governments must invest to drive sustainable competitiveness which will usher higher living standards for the citizens. Though most African economies have broad-based growth strategies which are tailored for the domestic market and anchored by ICT, light manufacturing, agriculture and trade, the progressive innovation process has not been stellar. We note four main factors which have stymied these countries to build prosperous diversified economies that are balanced, sustainable and largely decoupled from trade shocks and welfare loses tied to overdependence on commodities:

- Poor Governance: Despite the human capital, the quality of governance in most African countries must improve for them to be competitive in redesigning their economies for the opportunities of the 21st century.

- Education: At the tertiary education level, Africa has education crises. In the 21st century where knowledge will define the wealth of nations and competitiveness will be driven more by brainpower than minerals and hydrocarbon, without improving its educational system, its recent achievements may be unsustainable especially in the post-mineral era. The continent must push for higher quality and relevance of tertiary education as the schools have underperformed across many metrics.

- Health: Despite the efforts of many successive governments, life expectancy at birth, infant mortality, child malnutrition and access to improved water source have only improved marginally. It could be opportunistic for the governments to reform the healthcare sector just as they have done in the telecommunication sector through privation of government clinics.

- Infrastructure: Africa must invest in power, roads, waterways and other critical infrastructure that support trade and commerce.

Most clusters in Africa are inventive with minimally scaled organic and homegrown innovations. Yet, the trajectory of advancement is promising especially in some economies as the markets attract foreign investors, better managerial and technical talents. In this paper, we explain how African can approach the development of its industrial clusters and make them vibrant. We observe that United States, Canada and Europe built their hi-tech sectors through specific intervention programs that galvanized the participations of the universities, private sector and government research labs. Exploring those countries and recent efforts in Brazil and China, we propose Five Pillars that will help Africa develop hi-tech industrial clusters across its regions. In a decade of economic growth that has brought optimism about the continent’s future, these pillars will help not just to develop vibrant industrial clusters but also help the continent live up to its promise of creating prosperity for its citizens.

1. Introduction – The Need of Vibrant Industrial Clusters

Information and communication technology (ICT) is playing major roles in the course of socio-economic development of the Africa economy. It has redesigned major industrial areas by enabling more efficient business processes even at lower costs. In both the public and private sectors, it is driving a new vista of human and organizational capabilities that will equip the continent to compete at international levels (Oshikoya, 1998). As ICT transforms the region into a knowledge-based economic system and a cashless society made of the citizens, companies and the states in electronic-linked mutually dependent relationships, the continent will be expected to benefit in ways that will drive opportunities for the citizens (Islam, 2012). While there are potentials across different technology spheres to improve competitiveness in the continent, lack of deep structures on growing and nurturing industrial clusters are major challenges that continue to stymie developments in the continent.

As the 21st Century enters the mid of its second decade, Africa is confronted with daunting challenges of building a new generation of workforce and critically-needed infrastructure to not just compete globally but also to prepare for its post-mineral era. The continent must foster a climate of innovation and pursue sustainable growth despite evolving economic realities that strain national budgets (Ekekwe, 2010). Harvard Business School Michael E. Porter (Porter, 2003) has through his work on competitiveness explained how economic prosperity can be driven through clustering. The co-existence of firms enables them to collaborate, improve, compete, stimulate demand of supplier industries, develop specialized talents and spur innovation. This jockeying enhances productivity with abilities to venture into new markets for new revenues translating to better local jobs, industrial growth and regional prosperity. In other words, there is a correlation between clusters on other side and business growth, competitiveness and globalization on the other.

Globally, data shows that clusters play major roles in regional job growth, wages and formation of new companies. This virtuous cycle has encouraged many governments to work on ways to support clusters because of their impacts on sustainable economic growth. Since the dawn of the new democratic dispensation across most African economies, the governments have embarked on different reforms geared to retool their economies and make them more competitive (YouWin, 2014). The planning process has elements for growth, preservation, good governance and economic sustainability. Governments have also identified specific industries and consequently advocated for strategic investments to enable these industries thrive. Different initiatives have been structured to support economic and workforce development as governments work to position Africa as the preferred destination for foreign direct investment (FDI) in the emerging world.

In 2014, the African Institution of Technology, with funding from the Tony Elumelu Foundation, spent six months studying the innovation ecosystem in Nigeria by looking at the formation of clusters and how companies located therein prove relatively more competitive with better growth (Ngclustermap, 2014). The goal was to investigate the relationship between some industry clusters and the existing infrastructure to understand how Nigeria’s goals of strategic investment and economic development align. This study has shaped our understanding of some key industrial systems in Africa and what the continent must do for sustainability especially in the post-mineral era. Also, a homogenous African economy, based on knowledge economy, can support regional integration without welfare loss arising out of commodity trade shocks (AUC, 2009).

As Africa works to achieve some economic targets, developing capabilities in the industrial system will help. The continent needs vibrant clusters and companies to drive development. As the continent looks for ways to diversify its economy from hydrocarbon, clusters operating more efficiently can assist companies to develop stronger competitive capabilities that will help them succeed globally. When firms collaborate, their chances of identifying market niches, accessing the export market and influencing policy improve (Porter, 2003). Efficient clusters with needed infrastructural support give rise to higher productivity, more business opportunity and deeper technical capabilities. The typical triple helix of state, industry and academia must exist in Africa to improve infrastructure, university system and provide strong legal systems that will help protect and accelerate innovations.

- Developing Industrial Cluster Infrastructure

Infrastructures perform vital services for states, firms and citizens (Enright, 1998). They improve the quality of life of people and in the process serve as catalysts to attract them to live in some communities. In Africa, it is very evident that infrastructure is an important factor that drives the formation and nurturing of the organic clusters around the continent. Most of these organic clusters are forming in the big and important cities and if these facilities are improved upon, the effectiveness of the clusters will be enhanced. The following infrastructures will impact the development of the regional clusters across Africa:

Table shows infrastructural impacts on cluster development

| Infrastructure | Cluster Relationship |

| Transportation | Without the means to move goods and services, commerce will suffer. Africa needs investment to develop its road, rail and air networks. Unlocking the clusters could be as simple as providing transportation networks that will link raw materials in rural areas to the cities where some of these organic clusters have formed. |

| Technical Workforce | Though the government has opened more new universities, the need to pick few ones and transform them into global centers of learning and research that can attract top international talents will be helpful. |

| Legal System | Intellectual property and property rights are essential elements for the development of any advanced economic system. From land ownership to prosecuting violators of software IPs, Africa must demonstrate that it can enforce its property rights laws. |

| Standards | Industrial ecosystem works on products standards which help define quality. Helping to build a culture of product quality will help accelerate acceptance of local products in African economies. People that can afford them overwhelmingly prefer foreign brands over local ones mainly due to standards and quality factors. |

| Investment Climate | The investment climate in African economies suffers owing to the perception of corrupt public institutions at all levels of government. Some international investors will be turned off by corruption. Investment is an amalgam of many factors like legal system, infrastructure and security. |

| Power | African countries are slowly making progress on providing electricity to help drive their respective industrial policies. Most national power industry has been commercialized; the success of these new power players will define the success of the respective nation’s industrial ecosystem. No nation can incubate a manufacturing sector without power. |

| Broadband & Telecoms | In most of the big African capital and cities, there is broadband internet. However, the cost remains very high compared to most global economies. The industry is dynamic and it is expected that competition will bring the cost down as well as help improve service quality in sector. |

| Hospitals / Recreation | The health sector in Africa is a key component in the sustenance of the wellbeing of the citizens. Cluster players, especially those planning to move from other countries will evaluate the quality of care in the nation. African private sector must work to improve the sector. The same argument applies to recreation. |

| Higher Education Institutions | Despite hundreds of universities in the continent, Africa has few technical institutions that can drive an innovative ecosystem and build a process that will technologically redesign the economy. |

| Parks, Centers and Labs | Africa has a duty to improve the quality of research in government labs and centers. In most Western economies, transformative technologies have emanated from government labs. Africa needs to institute new systems and processes to fund, measure and accelerate local innovation. |

| Water and Sewer | Water is very expensive in Africa. There is need to provide water along with a well planed sewage to improve the quality of lives of the citizens and make the cities also welcoming for entrepreneurs. |

| Capital | The lending structure in most African economies is not designed to build a strong industrial sector. They are high-interest short term loans which cannot drive major projects. The Development Finance Institutions (DFIs) across African capitals must expand capacity to meet growing needs. Nevertheless, the breakthrough will come when private sector pushes capital to fund and grow ideas in the nation. |

| Security | Africa must find a lasting solution to the pockets of security crises across the region, from Somali to Nigeria. |

What Regional African Governments Can Do

Globalization is pushing multinational companies to seek for opportunities in any place they can find them. This trend which has been facilitated by new technologies will continue to determine companies that win and lose. As they seek places to invest, states, regions and nations have to compete for them. In Africa, regional governments must strengthen their comparative advantages to attract these opportunities (Elumelu, 2013). Even within a country, there will be evolving regional competitions on where firms locate their plants and factories. Just as in U.S. where California few years ago to get-ahead in stem-cell research approved a $3B bond in order to attract the best minds in biotech in the area, regions in Africa must look at ways to finance shared infrastructure by pooling resources together (Saskal, 2014). To stimulate vibrancy in the current organic clusters across Africa, the following are programs or initiatives we advocate at regional levels across the continent.

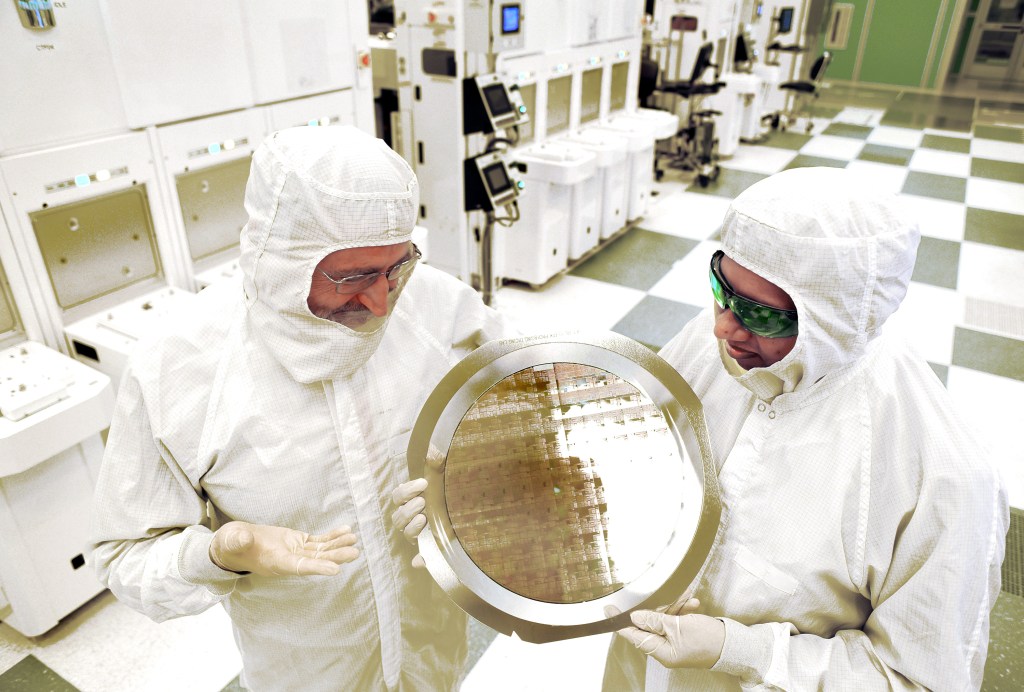

Innovation Hub Initiative: All the regional economic communities in Africa must work to designate certain areas within existing clusters as Innovation Hubs. This will help to bring regional integration at industrial level. The economic strengths of some nations may not optimally execute some serious projects, so, we reason that a regional-level plan will be more successful. The region will leverage its assets including the universities, government labs and linkages to boost competitiveness and drive investment growth (Ekekwe, 2012). They will allow private firms to administer and manage these hubs with agreed KPIs (key performance indicators). For Africa to attract multinational firms like Intel, HP, and Apple, they may need to invest in the foundation structures that may require high capital-intensive projects in semiconductors, only when they pool resources together can they achieve success.

Development Finance Institutions (DFIs): The regions must setup DFIs (development finance institutions) in order to provide capital and other resources towards promoting and developing new technologies, products and enterprises. African Development Bank and such likes are not structured for small firms. These present institutions have legal and administrative requirements that some agile and small firms are not designed to participate in. So, Africa needs to have new models to finance industry. We recommend having crowdfunding platforms managed by NEPAD regional offices that seek new ideas on industry and trade. They can partner with banks or registered investing firms to deploy capital in their regions. A key requirement will be a competitive and rigorous process that is decoupled from political patronage in funding decisions.

Accelerated Growth Hubs: Regions must setup special economic zones that will be geographically confined areas within existing clusters that enjoy tax incentives. The goal will be to use such incentives to get disparate companies operating in the region to co-locate so that resources can be more appropriately provided to them.

- African Regional Integration and Industrial Economy

The pursuit of industrialization and development of industrial clusters by stimulating organic clusters or setting up new ones will help in creating more homogenous economies across regions in Africa. Unlike presently where most of the countries depend on minerals, hydrocarbons and commodities to finance their budgets with disparities in their economic structures, industrializations will bring order. The key advantage will be shocks that can result to welfare loses owing to the varying prices of commodities in the international market will be solved.

For regional integration to take place, Africa must look at having ways to ensure the economic structures are largely uniform. Many African nations are still oriented in trade toward former colonizers in Europe than immediate neighbors and across African capitals; there is an understanding that integration could be a key catalyst to transform the continent (AUC, 2009). The major challenge is how the continent could develop the plan considering the lopsided economic structures among the nations (e.g. Nigerian GDP is big in the ECOWAS region), which can affect response strategy during economic crises. This is fundamental as if major regional economic powers stay out of this integration for fear of being net losers, it could have adverse effects to realizing the continental goal.

Regions must be supported to diversify their industrial structures to enable more homogenous trade shocks, stabilize inflation and interest rates. Africa Union needs to ensure that NEPAD (New Partnership for Africa’s Development) delivers on its peer-review mechanism towards economic growth, good governance and strong fiscal policies across all economic regions. With vibrant industrial clusters across African economic communities which can morph into one African integrated community even in currency union as time grows, regional integration will evolve with strengths and competitive viabilities.

Most African economies have broad-based growth strategies which are tailored for the domestic market and anchored by ICT, light manufacturing, agriculture and trade. Four main factors have stymied these economies to build prosperous diversified economies that are balanced, sustainable and largely decoupled from trade shocks and welfare loses tied to overdependence on commodities. These issues noted below must be properly managed:

- Poor Governance: Despite the human capital, the quality of governance in most African countries must improve for them to be competitive in redesigning their economies for the opportunities of the 21st century.

- Education: At the tertiary education level, Africa has education crises. In the 21st century where knowledge will define the wealth of nations and competitiveness will be driven more by brainpower than minerals and hydrocarbon, without improving its educational system, its recent achievements may be unsustainable especially in the post-mineral era. The continent must push for higher quality and relevance of tertiary education as the schools have underperformed across many metrics. According to World Bank, most African economies will not meet the Millennium Development Goals (MDGs). This means, they are not effectively preparing their youth for the economic opportunities of the future.

- Health: Despite the efforts of many successive governments, life expectancy at birth, infant mortality, child malnutrition and access to improved water source are still low in the region. It could be opportunistic for the governments to see how more resources can go into its legacy hospitals by privatizing them and open them to market forces.

- Infrastructure: Reforms are underway in the electric power sector with the privatization of most national grid companies (IMF, 2013). It is expected that the private investment will address the chronic issues that have affected service delivery and consequently unlock new opportunities in the region.

Besides these challenges, until Africa retools its industrial capacity, it faces a structural economic threat in near future as the world looks into a future where some of the commodities will be displaced; if automobiles are powered by hydrogen, solar and electricity, the petroleum exporting countries in Africa could suffer consequences. Also, the shale gas revolution that has enabled U.S. to reduce its oil imports will unravel oil producing countries. Across the board, declining oil revenue owing to both lower production output and weaker prices could cause shortfalls in budgetary revenues, disappearing balance of payment surplus and reduction in the foreign reserves possibly triggering macroeconomic problems.

Minerals and commodities will remain the dominant sectors in most African economies owing to their contributions in the foreign exchange earnings. They can turn these capabilities into strengths by investing appropriately in developing catalysts for an industrial economy driven by knowledge. Our state of innovation is low and one of the reasons is the overall lack of competition in the education sector both at the university and faculty levels. Africa can learn from the United States National Science Foundation (NSF) and the National Institute of Health (NIH) on how it can structure its science policy on funding and assessments of outcomes. The NSF has a mission to advance the progress of science and it accomplishes it by funding proposals for research and education made by scientists and engineers. Its medical counterpart is the National Institutes of Health. While Africa may not have the scale of NSF and NIH, it must map funds for S&T research and have a process to use rigorous peer-review system to fund grants. It must be blind to quotas and the need to balance geographical spread. It must focus on talents and the best ideas. Without a visible competitive atmosphere in education that is driven by merit and hardwork, Africa will find it difficult to develop an innovation system. Only an innovation system will bring the necessary structural economic homogeneity to support effective regional integration.

- Pillars and Lessons from Advanced Economies

African countries need to retool their economies. Building a hi-tech sector will help create jobs in ICT and other sectors. Largely, the technology participation has been driven by consumerism and imports. For the continent to provide social inclusion by providing jobs to its citizens, light manufacturing and a new sector are vital. Here, we propose a five pillar strategy for the continent. This draws from the models that have worked for different countries/regions such as United States, Canada, and Europe through MOSIS, CMC Canada and CMP/Europractice respectively (mosis.com, cmc.ca, and europractice.com). In these programs, the governments centralized and subsidized the production of specialized electronics – key sector for modern industrial societies – to help drive innovation by reducing barrier of entry. These are government intervention programs that have driven innovations and growth in electronics in these regions. The five pillars, focusing mainly in the hardware side over the software, are:

a. Pillar 1 – Education and Training

The goal will be to recruit top engineering talents across the continent and train them on key areas of hardware development. We identify the following areas

- Microcontroller programming: Nearly all hardware systems rely on microcontroller as its engine.

- FPGA (field programmable gate arrays): These are microchips that can be reprogrammed based on the requirements of the applications.

- ASIC (application specific integrated circuits): Developing integrated circuits at the level of transistors.

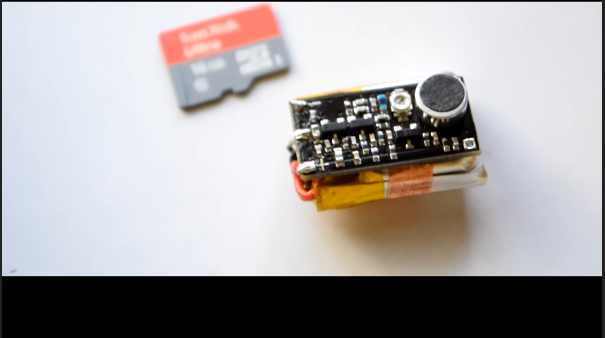

- PCB (printed circuit board): PCB is the board used in electronics. This is very important as the product of electronics is usually packaged in PCB. PCB ensures that ideas are packaged as products.

- Embedded software development: software with emphasis on how to control hardware systems

| Factor | Description |

| Target | Graduate level students |

| Objective | Grow quantity and quality of hardware designers, developers and software professionals |

| Value | Provide top talents to drive a new industry via design |

| Action Required | Expand capacity in different electronics related labs across the continent. These labs have to develop the ability to provide specialized services in training, education and resources that can help SMEs (small and medium scale enterprises), hobbyists, students, etc across the nation to test prototypes of their inventions. By having the opportunity to develop these prototypes, they can later use them to seek funding. In U.S., most microelectronics firms tested their first chips under MOSIS free, as students or at subsidized rates as startups. By having prototypes, investors could see their ideas clearly for investment. |

b. Pillar 2 – Commercial Hardware Development Training

The goal is to assemble pockets of embedded systems and hardware developers (and hobbyists) in Africa and provide them with modern skills that can help them compete in quality and scale. The one-man business that programs electronics display boards which depend on hand wiring can be trained on PCB (printed circuit board) design and development. That competence will help drive quality, ramp up volume and reduce cost through automation. This will also mean helping some hardware ICT entrepreneurs to innovate in design and development of the products they currently sell. Brazil followed this strategy when few years ago, they invested in training their citizens not just through university systems. Today, it commands more than 75% of all FDIs into South America in the sector with Apple and Foxconn committing billions of dollars in investment (Mishkin, 2013).

| Factor | Description |

| Target | Industry practitioners and hobbyists |

| Horizon | 6 – 12 months training |

| Objective | Elevate participants to become design professionals over salespeople |

| Value | Consolidate and map all the local pockets of hardware professionals |

| How | Industry workshops supported by government and delivered by universities and companies.– Train them on “Designing for industry” and design automation

– Advanced training on the areas identified in Pillar 1 |

| Action Required | Partner with world-class leading African training partners such as First Atlantic Semiconductors & Microelectronics and provide the opportunities to some of the top talents in the continent. The goal is that an aluminum door maker, for example, could see why adding motion sensors on his door will add more value than installing the doors without the systems. |

c. Pillar 3: Local Hardware Business Enablement

The hardware design and development environment in Africa is at infancy though ICT has a lot of vibrancy. The most critical structure is not available. A key structure is where to produce PCB after they have been designed. In this phase, efforts will be made to nurture the industry. One key element is PCB design equipment. We propose for government to setup a PCB production plant, via public private partnership, and offer open and subsidized paid services to companies and schools across Africa. So when companies send their designs, they pay and the company makes the PCB and ships to them. Without a PCB plant, the hardware industry will not develop in the continent. Also, the students will have the platform to move simulations and prototypes to final product concepts which are packaged neatly for demos before investors. Offering services across the whole ecosystem makes this project a sustainable one with lesser cost-factor to the governments.

It is very important to note that Africa has the capacity to develop this industry. What is needed is not any raw material but skilled manpower and the right policy. Taiwan has demonstrated that any nation with a strategic intervention program can grow the electronics industry. Africa is emerging as a region with focused strategy to develop deep technical workforce. This makes it well positioned to lead the region in this area. An electronics industry will bring Intel, HP, Dell and Apple to come to Africa and setup fabrication facilities, design centers and manufacturing bases. The semiconductor industry is the largest in the world and Africa can play a role if a PCB plant that serves to seed that sector is developed.

Expecting the startups to purchase them will slow the penetration of the sector. So, government can help fund the project. Alternatively, government can have a tender for companies to compete and the one that wins will run it and after a period pay back the government the funds. With this, they can make high quality electronics boards. Africa with a PCB plant will become the hub of electronics manufacturing as all the schools and companies in the region will send design files to be manufactured here over U.S. and China. The comparative lower wage in Africa makes it very attractive that markets from U.S. and Europe could be interested.

At this phase, we will expect most students’ projects, undergraduate and postgraduate ones, to transition from prototypes on breadboards for the awards of diplomas to ones that investors will pay attention to commercialize. The impact of PCB plant will be huge as students will have a process to miniaturize their designs. It is very possible that across Africa, engineering students have tried to solve most local problems. But most are yet to be commercialized because without PCB, they cannot improve quality and performance to seek for funds. PCB will help them to improve quality, performance and packaging that will enhance the overall marketability of the ideas.

| Factor | Description |

| Target | Local talents, students, entrepreneurs |

| Horizon | Short- medium term |

| Objective | – Enable growth of the hardware business– Facilitate design and manufacturing of PCB in Africa

– Enable product development in Africa through local sourcing of parts – Include design into the product evolution – Put incentives to those that push to develop the industry – Incentivize students to turn their projects into products |

| Value | Improves African product competitiveness and advances the economics of scale at higher quality. It also provides higher economic value. |

| How | – Provide design infrastructure like centralized PCB in Africa that operates as manufacturing boutique for the local design community– Support design house through cross-pollination of ideas

– Create hardware startup program for all graduates of Pillar 1 or/and 2 o Phase 1: technical feasibility study and guidance during inception o Phase 2: Provide design solution, support prototype, risk mitigation, initial product development |

| Action Required | The governments must develop an electronics penetration plan which all universities and affected companies in the region should participate. This can be done at regional levels. Our estimate is that the volume will be enough to sustain a PCB plant to run sustainably and profitably. The goal is to operate the PCB plant as a profit-center by charging small fees to companies and schools when they send their boards for fabrication. |

| Printed Circuit Board (PCB)As ubiquitous components that act as the foundation of any electronic equipment/gadget, PCBs have over the years evolved from uncomplicated single and double-sided Plated-Through-Hole (PTH) to multi-layered PCBs. The rapid growth of the electronics industry worldwide over the last two decades fuelled the growth of PCBs. The global production of electronics is tightly tied to the PCB industry which correlates with the growths in many sectors such as telecommunications and IT, smart cards, electronic gaming, and consumer goods, such as, digital cameras, mobile phones, and personal computer electronics.

The printed circuit boards market projects a positive outlook for years to come. Japan and Asia-Pacific collectively account for a major share of the worldwide printed circuit boards market. Asian countries such as China as well as Southeast Asian countries are central to the growth of the PCB industry. A key reason attributed to the growing significance of these countries is the rapid expansion of electronic manufacturing bases triggered by the shifting of production activities and facilities of overseas players into these countries to leverage lower labor and manufacturing cost benefits.

The global market for PCB is projected to reach US$76 billion in 2015 and it is lead by China.

Source: Adapted from “Printed Circuit Boards: A Global Strategic Business Report” by GIA. |

d. Pillar 4: Business Proposal and Capital

Build ICT hardware accelerator program to prepare firms towards getting capital. The goal is to enable top performing hardware firms or excellent student projects get venture funds and decouple the need for government to support them. Yet, it does not mean that national governments cannot award competitive grants to 5-10 companies in their respective electronics sectors. These firms can be startups or expanding firms. The purpose is mainly to provide a process to fund some talented teams to build companies. If the government provides the PCB plant, each of these firms will need $150,000 – $350,000 to develop prototypes and even try first product lots in the market depending on the nature of the product. Usually, investors like to see ideas which are nearly prototyped and that explains why a PCB plant is vital.

Action Plan: Though Africa has many accelerators and hubs, they are largely web and mobile app focused. These existing hubs will be complementary. A private sector driven hardware hub will be required.

| Concept of A Private-Sector Hardware HubAlong with the expansion of the capacity of national electronic labs, private technology hubs will be needed. Because of the attitude to government projects where people see them as charity, participants will respond better if the hubs are managed by the private sector. We propose two units inside the hubs – Microelectronics Innovation Center (MIC) and Technology Collaboration Center (TCC).

Microelectronics Innovation Center (MIC) Microelectronics has been recognized as the most pervasive industry in the world with impacts that span all areas of human endeavors. It drives space, medicine, energy, entertainment and indeed all key industrial sectors of the 21st century. Research has shown that appropriate diffusion of microelectronics enhances economic expansion by providing computing power and transitioning ICT from consuming to making. As Africa drives to become a global tech-innovation hub, microelectronics must necessarily be a critical component of that strategy. However, no credible microelectronics program is taking place in the continent in this field excluding South Africa. This Center within the Hub will be the fulcrum upon which Africa will develop and penetrate microelectronics. It will help provide the knowledge workers that will enable regional’s participation in the design and development of next generation hi-tech technologies.

The following are some of the MIC goals: – Seed microelectronics industry by operating a printed circuit board (PCB) program that supports universities, students and researchers across the continent – Bring practical-oriented integrated circuit design training thereby positioning regional African economies as a destination for microelectronics outsourcing – Seed startups in the areas of semiconductors and microelectronics through support services, mentoring, provision of CAD tools and development of appropriate design kits – Help standardize design and process kits which many African universities and microelectronics startups will adopt – Offer world-class advisory and technical support in key areas of microelectronics to hub companies, universities and microelectronics startups – Bring the world’s engine of wealth (microelectronics) to Africa and provide measurable and visible economic impacts – Technology Collaboration Center (TCC) The Technology Collaboration Center (TCC), inside the Hub, will anchor a program that will enable startups, resident companies, researchers and other stakeholders to collaborate in some focused technology areas. Companies or startups with approved projects will take office space and work with partners in creating innovations.

The following are some of the project goals: – Deepen cross collaborations in many fields in key technology sectors – Harness the immense talents of screened and qualified participants to create an open innovation space – Provide a platform for industry and government to collaboratively partner to solve practical technical problems in the society and markets – A new model through which hubs in the region works with hardware startups and companies by offering office spaces to companies – Build an ecosystem of competent experts through partnerships and better understanding of skill requirements needed in the hi-tech industry |

The purpose of the Hubs across Africa will be to facilitate the development of the most vital industry of the 21st century, microelectronics, in Africa and subsequently transform the Hubs into centers of hi-tech entrepreneurship and knowledge creation. Just as U.S., EU and other areas have used specific government programs to stimulate the sector, Nigeria must do same. The capacity to advance ICT cannot be decoupled from the propensity to build an electronics design ecosystem with tools and facilities makers and developers can use.

Both MIC and TCC will educate and train businesses and schools in the exciting field of microelectronics, and its applications to agriculture, energy, manufacturing, telecommunications, information systems and foster opportunities not only for the acquisition of new knowledge, but also the production and application of new knowledge. It will open new vistas of opportunities for small and medium scale enterprise (SMEs) to differentiate their services and create new values in their product offerings. The centers will provide broad-based innovative trainings, which would enhance the quality of their business processes and systems.

e. Pillar 5: FDI and Attracting MNCs

We estimate 5-9 years for executing the earlier pillars. At the tenth year, some regions in Africa will be ripe to market themselves as a hub of hardware design and development in the region. With deep core of talents, interests can build in the regions.

| Factor | Description |

| Target | Multinational companies |

| Horizon | Long term |

| Objective | Attract foreign direct investment |

| Value | Increase business and investments |

| How | – Attract MNCs to invest in Africa and in the emerging hi-tech firms– Attract MNCs to open design centers to tap the talents created in early pillars

– Bring global hardware design and development ecosystem leaders – Identify business opportunities and collaboration – Define market segments for consumption of local IC design and production – Facilitate delegation journey from potential investors – Define joint hardware FDI program in the region |

| Action Required | Sustain the ecosystem with good investment climate, infrastructure and strong property rights. |

Unlike ICT, electronics is not usually pursued as a technology policy in Africa. Sure, electronics falls within the engineering policy. Unfortunately, Africa is paying more attention to ICT than engineering – the buzz is so high about ICT that you can be fed with ICT related news daily on the nation’s leading papers. That imbalance makes it difficult for Africa to develop a sustainable model since ICT cannot advance itself. The engine that drives the ICT economy is electronics and when a nation does not have a plan for electronics it will largely remain a consumer of ICT. There is a limit to how fast Google Search can perform based on the microprocessors that power Google servers. In other words, microchips must advance before ICT and software can leap forward as the former puts theoretical limits on the performance on the latter. Building a strong electronics program puts a continent on the path of becoming a creator of ICT.

5. Recommendations and Conclusions

Before specific recommendations for regional and national governments on developing industrial clusters in Africa, the following are some general recommendations:

- All stakeholders must collaborate to improve cluster’s competitiveness. The private sector must advocate for the right policies and government must act. Donors can be given directions on areas where help is needed by entrepreneurs within clusters. By working together through investment, sound policies, our clusters can be made more efficient and competitive.

- Policy should gear towards supporting already existing clusters as cluster development is market-driven and takes years to evolve instead of working to create them from scratch.

- A framework for cooperation among companies, universities, research institutions at local, regional and national levels should be developed with government playing a strong catalytic role. Africa must push synergies in key areas of policy action like competition, innovation, and fiscal growth.

- Though government can use cluster-specific incentives to shape the behavior of cluster participants on investment and innovation, it must try to focus on building core platforms like infrastructures and legal systems. The seasonal grants or handouts to entrepreneur without supportive basic cluster amenities cannot help them compete against Chinese imports into Africa.

- Efforts must be made to develop and offer extended financial instruments such as venture capital funds, private equity funds, credit guarantee schemes, etc to stimulate cluster growth.

- Early stage VC funds will help unlock opportunities not just in ICT but in other technology sectors.

- The private sector should participate more actively in S&T education/training by creating alternative vehicles to close the asymmetry between university programs and immediate needs of the clusters.

- While national cluster plans will be important, regional ones may serve better owing to the disparity in levels of development. Specialized infrastructure like communications, transport and real estate are vital.

- Government could administer its startups financing programs by focusing more on companies within sector-targeted clusters to improve the overall performance of these intervention initiatives.

Regional African Governments

We emphasize the importance, at regional African governments, of:

- Technical Education – The educational system and training programs should gear towards producing workforce in science, technology, engineering, and math as they are vital to S&T clusters

- Technology Transfer from Universities – The governments must continue to push all universities especially the technical ones to establish technology transfer offices to enable the transfer of inventions to businesses and enterprises that can commercialize them. The technology transfer scheme could be incentivize so that universities can commit to building a viable relationship with the industry.

- Legal Education and IP – Africa has a dearth of IP (intellectual property) attorneys with expertise in patents, trademarks and trade secret. The Law Schools must work to remedy this situation.

- Patent & IP Laws – Governments must enforce the IP laws in its books and help transform the nations as places where intellectual properties are respected. A key part of it will be encouraging our entrepreneurs to patent their good ideas.

- Physical Infrastructure – Africa better transportation within and between clusters to ensure efficient movement of goods and services. From airport to roads, availability of these amenities will play major roles in the decision to locate companies. Also, firms and workers look for places with good amenities including housing, hospitals, roads and access to communication facilities.

- Talent Pipeline – The development of technical talent in nations especially in emerging areas of technology must be worked upon. A strong secondary education in the STEM (Science, Technology, Engineering and Mathematics) area must be worked out.

- Foreign Entrepreneurs – Government could look to lure foreigners into the countries which can possibly incubate the local counterparts through special funding and visa programs similar to the strategy adopted in Chile. In Chile, the government provided seed capital to some entrepreneurs and has succeeded in attracting talents from U.S. and Europe.

- Technology Adoption – When government redesigns its processes and adopts modern technology, there will be opportunities for some of these clusters to expand and grow. In most African cities, government dominates the GDP. So, any sector that government moves into will grow as companies will emerge to serve and take opportunities therein. From eGovernment to eTax to new farming techniques, changes in the ways government operates could stimulate cluster growth.

- Cluster Redevelopment – Each of the regional regions must work to revamp at least one cluster and transform it into a globally competitive industrial one within a decade. This means that governments at all levels must partner to unleash the full innovation potential of these clusters. This will begin by having each cluster strengths, weaknesses and opportunities assessments.

The following are guidelines to deepen cluster development in any African government at federal government level:

- Increase investment in the foundations of science, technology and engineering. Also create strong standards and accountability

- Provide more support for targeted and specialized training programs in S&T

- Develop framework to improve effectiveness in federal research and alignment to industry

- Increase research funding in universities and government labs and demand for measureable outcomes

- Strengthen the legal system especially IP rights and anti-trust laws

- Restructure research funding process via peer-reviewed competitive grant process as obtainable in U.S. National Science Foundation and National Institute of Health

- Act as an innovation-backer by providing federal matching funds to local governments that invest in S&T, and innovation

- Invest in recruiting anchor firms into regions and promote cluster awareness

- Build/upgrade vital physical and business infrastructure

- Focus to grow and support old and new innovative cluster companies

Private Sector

Besides what governments can do to improve the efficiencies of clusters in Africa, the private sector can also help. For the private, we show how they can simultaneously support the cluster while benefiting from it. For Africa to become a competitive and dynamic knowledge-based economy with sustainable growth and better social cohesion, it is the private sector that will practically execute any plan including the ones made by the government.

The following are some recommendations:

- Financial Instruments – The private sector should examine how they can offer financial support in start-up projects, networking, research, education and infrastructure without jeopardizing their fiduciary responsibilities. Africa is in dire need of early stage venture capital funds that will help nurture new ideas coming from entrepreneurs and students.

- Integrated Manufacturing Facility (a JVC) – Despite the pockets of activities across universities and the hobbyist community, Africa does not have a PCB (printed circuit board) sector to support the local industry. The transition from simulation to actually having a prototype and then production will get more impetus if a PCB plant exists. The present model of designing boards, fabricating and importing from China will never allow cost to provide a competitive advantage to the local industry. A Joint Venture (JV) similar to MOSIS (USA), EMC Canada and Europractice (Europe) but for PCB will help Nigeria have a future in the hi-tech arena.

- Anchor Companies – The private sector especially the financial and investment sector could look for anchor firms in each region and work to transform them into global players trough investment and improved management with their participations. Despite all policies, the impact of anchor firms cannot be overemphasized. They can help to seed startups and SMEs that come to service them. In the technology arena, Africa has sparks of potential anchor firms that own their technologies through research and innovations. HP anchored Silicon Valley, Nortel anchored Ottawa, and IBM did same for Raleigh-Durham; Africa needs such anchors that will serve as magnets to attract other players. Over time, they will create spin-offs which will help grow the cluster.

- Build Cluster Integration Platform – There is certainly an opportunity to build a platform that will make Africa more collaborative. This is not just in technology but also in finance, law and other areas. A business could help build a system that will bring universities, government labs and firms to share and collaborate more. Universities could be asked to use cloud-based services to share all research outputs including projects done by students. The government labs could use same to share their outputs while the firms can communicate skill needs and funding resources for specific research areas.

- Investment in Education – We think the quality of technical education in Africa will need more concerted efforts from the private sector. Government alone cannot solve the problem. This investment must provide great learning environments including technology parks, lab facilities and international internships that will help Africa produce global technology leaders.

Acknowledgement: The Tony Elumelu Foundation (an African-based, African-funded philanthropic organization founded in 2010 by Lagos businessman Tony Elumelu with mission to support entrepreneurship in Africa by enhancing the competitiveness of the African private sector) provided generous grant to the African Institution of Technology to study innovation clusters in Nigeria. The results of the study have assisted in developing this paper.

References

AUC – Africa Union Commission, (2009) “Towards a Single African Currency”, Proceedings of the First Congress of African Economists, 2-4 March 2009 Nairobi, Kenya {Online}

Ekekwe, N. (2010), “Nanotechnology and Microelectronics: Global Diffusion, Economics and Policy”, IGI Global Publishers, PA, USA. ISBN: 978-1-61692-006-7

Ekekwe, N., 2012, “Africa is Open for Business”, Harvard Business Review, {online} http://blogs.hbr.org/2012/02/africa-is-open-for-business/

Elumelu, T.O. (2013), “AFRICAPITALISM – THE PATH TO ECONOMIC PROSPERITY AND SOCIAL WEALTH”, {online}

Enright, M. (1998) “The Globalisation of Competition and the Localization of Competitive Advantage: Policies towards Regional Clustering”, Paper presented at the Workshop on Globalisation of Multinational Enterprise Activity and Economic Development, University of Strathclyde, Glasgow, Scotland, 15?16 May 1998.

IMF (2013), Regional economic outlook. Sub-Saharan Africa — Washington, D.C.: International Monetary Fund, 2003– {Online} https://www.imf.org/external/pubs/ft/reo/2014/afr/eng/sreo0414.pdf

Islam, N. and Ekekwe, N. (2012), “Disruptive Technologies, Innovation and Global Redesign”, in Disruptive Technologies, Innovation and Global Redesign: Emerging Implications, Ekekwe, N. and Islam, N. (Eds.), IGI Global: PA, USA. ISBN: 978-1-46660-134-5; EISBN: 978-1-46660-135-2

Mishkin, S.(2013) “Foxconn Challenged as Global Reach Grows” {Online} http://www.cnbc.com/id/100353348#.

Ngclustermap (2014), Nigeria Innovation Cluster Mapping project {online} http://ngclustermap.com/

Oshikoya, T.W. and Hussain, N.M. (1998) ‘Information technology and the challenge of economic development in Africa’, African Development Bank, Economic Research Papers, No. 36

Porter, M.E. (2003), “The Economic Performance of Regions,” Regional Studies, 37, pp. 549-578

Saskal, R. (2014), “California’s Next Big Ballot Item: $3B Bond for Stem Cell Research” {Online} http://connection.ebscohost.com/c/articles/13127228/californias-next-big-ballot-item-3b-bond-stem-cell-research

YouWin! (2014) Youth Enterprise with Innovation in Nigeria {online} https://www.youwin.org.ng/