Bitcoin has a strong historical track record. From 2011 to 2021, it delivered cumulative gains exceeding 20,000,000%, with an annualized return of 230%, far outpacing traditional assets like the NASDAQ 100 (541% cumulative, 20% annualized), US Large Caps (282% cumulative, 14% annualized), and gold (1.5% annualized).

In 2024, Bitcoin led with a 121% annual return, compared to gold (26.7%), NASDAQ 100 (25.6%), and S&P 500 (24.9%). Over the past decade (2014-2024), Bitcoin’s 26,931.1% return dwarfed the S&P 500 (193.3%) and gold (125.8%). Despite its volatility—posting losses in years like 2014 (-58%) and 2018 (-73%)—Bitcoin has been the top performer in seven of the last ten years, though it was the worst in the other three.

Its 2024 performance was driven by factors like Bitcoin spot ETFs, the April 2024 halving, and positive market sentiment amid economic uncertainty. Posts on X and some projections suggest continued optimism for 2025, with price targets ranging from $75,000 to $250,000, fueled by institutional adoption and potential nation-state reserve strategies.

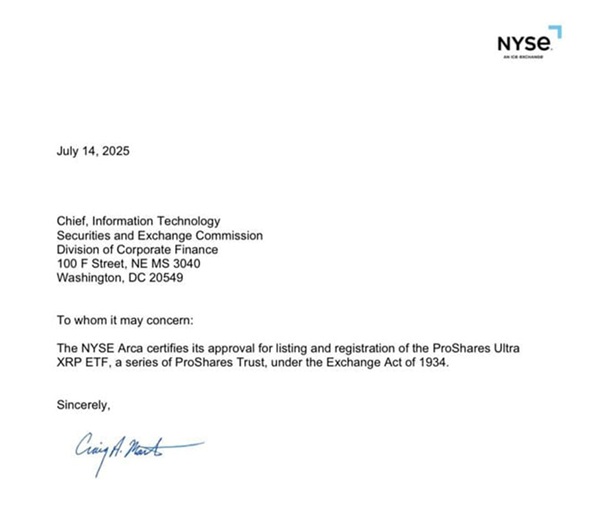

Bitcoin’s strong performance would likely accelerate institutional investment. The success of spot Bitcoin ETFs, with $14.4 billion in net inflows through July 2025, demonstrates growing mainstream acceptance. Firms like BlackRock, Goldman Sachs, and even pension funds are increasing allocations, with 86% of institutional investors surveyed planning to boost digital asset exposure in 2025.

Companies adopting Bitcoin as a treasury asset, such as MicroStrategy, Tesla, and potentially Trump Media, could see stock price premiums, creating a feedback loop dubbed an “infinite money glitch.” This could encourage more firms to hold Bitcoin, further driving demand and price appreciation. Portfolios may increasingly include Bitcoin as a standard asset class, with advisors like BlackRock suggesting 1-2% allocations to manage risk while capturing upside.

This could reshape traditional investment strategies, positioning Bitcoin as a hedge against inflation and market volatility. Bitcoin’s outperformance could signal a maturing market, with reduced volatility compared to past cycles, as seen in 2024 when volatility was lower than previous years despite a 113% return. However, its history of sharp corrections (e.g., -73% in 2022) suggests potential for significant pullbacks, especially if macroeconomic conditions worsen or regulatory hurdles arise.

Investors may face a “goldilocks scenario” where Bitcoin acts as both a high-growth tech-like asset and a safe-haven “digital gold,” but they must remain cautious of sudden market corrections driven by external shocks like geopolitical tensions or central bank policies. Bitcoin’s dominance, with a high Bitcoin Dominance Index, may limit gains for altcoins unless they offer distinct use cases. Analysts note that Bitcoin treasury companies and ETF inflows could overshadow altcoins, though regulatory shifts toward decentralized finance (DeFi) might unlock new opportunities for non-Bitcoin assets.

Investors chasing Bitcoin’s success might overlook altcoins, but selective altcoins with strong fundamentals (e.g., Ethereum’s DeFi ecosystem) could still see growth if regulatory clarity emerges. A strong 2025 performance could bolster the narrative of Bitcoin as a global reserve asset, especially if nations adopt strategic Bitcoin reserves, as proposed by President Trump and Senator Cynthia Lummis.

A 6.6% reduction in circulating supply (1 million BTC) could drive a 30%+ price increase, per some estimates. Game theory may push more countries to accumulate Bitcoin to strengthen financial systems, potentially weakening reliance on fiat currencies like the US dollar, especially in regions with currency devaluation (e.g., Argentina, Turkey). This could reshape global monetary dynamics.

Bitcoin’s outperformance amid rising US debt, a weakening USD (-11% in six months), and geopolitical uncertainty suggests it’s increasingly viewed as a hedge against economic instability. With central banks cutting rates in 2025, risk-on sentiment could further fuel Bitcoin’s rally. Bitcoin could attract capital as a non-fiat, inflation-resistant asset, but tighter monetary policies or high Treasury yields (4.75% in June 2025) might divert investors to safer assets, tempering its growth.

Bitcoin’s success could drive broader adoption for payments and remittances, especially in regions like Latin America and Africa, where P2P volume is rising due to currency devaluation. Daily active addresses (950,000–1 million in May 2025) reflect robust network usage, reinforcing its utility. Increased public and corporate acceptance (e.g., Tesla, Microsoft) could normalize Bitcoin as a payment method, though its environmental impact from Proof-of-Work mining remains a concern for broader adoption.

A crypto-friendly Trump administration and the departure of SEC Chairman Gary Gensler in January 2025 eased egulatory barriers, boosting investor confidence. However, global regulatory inconsistency (e.g., restrictions in India, Nigeria) and potential delays in pro-crypto policies could trigger market disappointment. Clearer US regulations could accelerate Bitcoin’s integration into mainstream finance, but restrictive policies elsewhere might limit global adoption, creating uneven growth opportunities.

Despite optimism, analysts warn of potential crashes, with some forecasting a drop to $90,000 or even $89,000 in a bearish scenario due to regulatory pressure or liquidity shortages. Investors must be prepared to lose their entire investment. Bitcoin’s value relies on sentiment and the “greater fool theory,” with no intrinsic backing. Its high valuations could lead to a bubble if demand falters.

Bitcoin’s energy-intensive mining could face scrutiny, potentially limiting its appeal to ESG-focused investors. If Bitcoin is the best-performing asset in 2025, it could solidify its role as a mainstream investment and potential reserve asset, driven by institutional inflows, ETF adoption, and macroeconomic uncertainty. However, its volatility, regulatory risks, and environmental concerns pose challenges.

Investors should diversify, allocate cautiously (1-2% of portfolios), and use secure storage like cold wallets to manage risks. Always conduct thorough research, as past performance doesn’t guarantee future results, and be wary of overly bullish predictions lacking robust methodology.

Like this:

Like Loading...