Ethereum (ETH), the king of smart contracts, is dancing on the edge of a key price cliff—and traders are watching closely. After surging to new local highs, ETH now shows signs of exhaustion on the charts, and the pressure from big-money profit-taking is stacking up. Analysts are calling it: a pullback to $2,000 could be on the horizon. But while ETH holders brace for a possible cooldown, another player is stealing the spotlight and capturing attention across Crypto Twitter and Telegram groups. Little Pepe (LILPEPE)—the meme-fueled, EVM-powered machine that’s been sending shockwaves through the presale scene. While Ethereum may be slowing down, LILPEPE is simply roaring its engines, and early investors are sprinting to get their bags before the currency releases for $0.003.

Ethereum Approaching $2,000: A Strategic Dip or the Calm Before the Next Storm?

After a strong push above $2,400, Ethereum is beginning to show classic pullback signals. On-chain metrics indicate that whales have been transferring substantial amounts of ETH to exchanges—over 385,000 ETH was moved in the past week alone. Historically, such a movement is often a precursor to large-scale sell-offs. Add to that rising open interest, bearish RSI divergence, and a mounting wall of resistance near $2,600, and the writing on the chart is clear: a short-term correction is very likely. If ETH drops to around $2,000–$2,200, this would align with Fibonacci retracement levels and provide a healthy consolidation range before any major upward continuation. Smart traders aren’t panicking, though—they’re simply looking for better entries. But while ETH recalibrates, something far more exciting is unfolding in the altcoin jungle.

ETH’s current market outlook Source: Tradingview

Meanwhile, Little Pepe (LILPEPE) Is Building a Fortress of FOMO

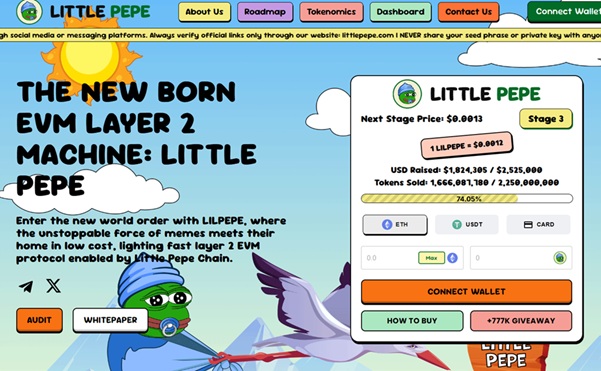

While Ethereum prepares for a breather, LILPEPE is on fire. Deep-pocketed investors are piling into this next-generation meme coin, and for good reason. Built on its own Layer 2 EVM blockchain, LILPEPE is more than just another frog-themed token—it’s a full-blown movement. At the time of writing, Stage 3 of the LILPEPE presale is already 74.01% filled, with over $1.82 million raised out of the $2.525 million target. Investors have purchased 1.66 billion out of the 2.25 billion tokens allocated for this round. Once this stage closes, the price moves up to $0.0013, inching closer to the official listing price of $0.003.

Let’s break that down:

- Buying now at $0.0012 means you’re staring at an immediate 150% gain once LILPEPE lists.

- Those who invested at $0.0010 are already enjoying 20% profits—and the token hasn’t even launched yet!

- Stage 2 sold out in just two days, and if history repeats itself, Stage 3 could close at any moment.

Buy LILPEPE at $0.0012 now before the next price jump.

A Potential 445x Gain Before 2025 Ends?

Here’s where it gets wild. Crypto analysts—and even some daring insiders—are eyeing $0.534 as a potential price target for LILPEPE by the end of 2025. That’s a 445x return from the current presale price of $0.0012. Sound insane? Maybe. But meme coins have made crazier runs before. Just ask early DOGE or SHIB holders.

LILPEPE’s $770,000 Giveaway: Yes, You Read That Right

To intensify the excitement, LILPEPE is distributing tokens valued at $770,000, with each lucky winner receiving $77,000 in LILPEPE. Enter the $770K Giveaway Here. With this kind of community-driven momentum, the project is gaining momentum rapidly across Telegram, Discord, and YouTube. Influencers are talking. Deep-pocket investors are buying. And retail traders are rushing in, desperate not to miss what could be the subsequent big meme explosion.

Final Thoughts: Rotate, Don’t Retreat

Ethereum is a solid long-term play—nobody’s denying that. But with ETH possibly heading for a dip around $2,000, many savvy investors are rotating profits into high-upside gems like LILPEPE. With its Layer 2 edge, rapid presale growth, community hype, and potential for 445x returns, LILPEPE could become 2025’s meme coin king. Have you overlooked DOGE in 2021? If you missed SHIB’s historic run. Don’t miss LILPEPE. The third stage of presale is almost complete. The next price is $0.0013, and early investors will benefit once the public listing hits $0.003. Secure your LILPEPE tokens now before it hits 100% The Ethereum dip may be your perfect signal not to exit the market but to enter a new kingdom. Enter the kingdom of frogs. LILPEPE is just getting started.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken