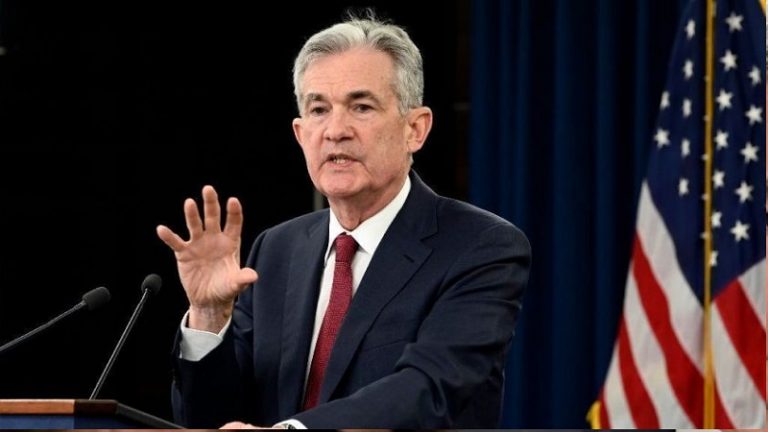

President Donald Trump has moderated his previously aggressive rhetoric toward Federal Reserve Chair Jerome Powell and China’s trade policies, responding to warnings from financial markets, business leaders, and advisors. On April 22, 2025, Trump stated he has “no intention” of firing Powell, a sharp reversal from earlier remarks where he called Powell a “major loser” and suggested his “termination cannot come fast enough.” He expressed a desire for Powell to be more proactive in cutting interest rates to stimulate the economy, particularly in light of his tariff policies, which economists warn could fuel inflation and slow growth.

Regarding China, Trump signaled a willingness to reduce the 145% tariffs on Chinese imports, stating they would “come down substantially” but “won’t be zero” as part of a potential trade deal. Treasury Secretary Scott Bessent described the current tariff levels as “unsustainable,” emphasizing the need for mutual de-escalation to avoid prolonged trade tensions. This shift followed concerns from major U.S. retailers like Walmart, Target, and Home Depot, who warned that tariffs could disrupt supply chains, raise prices, and lead to empty shelves.

China’s Foreign Ministry expressed openness to dialogue but maintained a firm stance, with spokesperson Guo Jiakun stating, “We don’t want a fight, but we are not afraid of one.” The softened tone sparked a market rally, with the Dow Jones rising over 400 points, the S&P 500 up 1.7%, and the Nasdaq gaining 2.5% on April 23, 2025. However, White House Press Secretary Karoline Leavitt clarified that Trump would not unilaterally cut tariffs without a “fair trade deal.”

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Despite the de-escalation, skepticism persists. Some analysts and Chinese social media users labeled Trump’s shift as unreliable, with hashtags like #TrumpWimpsOut trending on Weibo. Markets remain cautious, as Trump’s history of policy reversals and the complexity of trade negotiations suggest uncertainty ahead.

U.S. and India Finalize Trade Deal

The U.S. and India have made significant progress toward a trade agreement, with Vice President JD Vance announcing on April 21, 2025, that the two nations had finalized the “terms of reference” for the talks. While details remain sparse, the agreement is described as a broad framework or memorandum of understanding, with specifics to be negotiated over the coming months. This development follows productive discussions between Trump and Indian Prime Minister Narendra Modi, aimed at reducing U.S. tariffs on Indian imports and strengthening bilateral trade ties. The White House is under pressure to demonstrate progress amid market volatility caused by Trump’s broader tariff policies, and the India deal is seen as a step toward stabilizing economic relations.

However, experts caution that the agreement’s ambiguity and the time required for finalization may limit its immediate impact on markets or political backlash against Trump’s trade agenda. The deal is strategically positioned to signal that India views the U.S., not China, as a primary trading partner, though negotiators have incorporated purposeful ambiguity to avoid antagonizing Beijing. India’s deep economic ties with China complicate the talks, and any overt pivot toward the U.S. could face resistance. The announcement aligns with broader U.S. efforts to secure trade agreements with multiple nations, with Trump claiming that over 100 countries have initiated trade talks following his tariff announcements.

While Trump’s softened stance on Powell and China appears to be a pragmatic response to economic warnings, it raises questions about the consistency of his economic strategy. The retreat from aggressive tariffs and threats against Powell may reflect sensitivity to market reactions and corporate lobbying, but it risks undermining his leverage in trade negotiations, particularly with China, which has shown resilience in the face of U.S. pressure.

The U.S.-India trade framework, while promising, lacks specificity and faces challenges due to India’s complex economic relationships and domestic priorities. Both developments suggest a tactical recalibration rather than a fundamental shift in Trump’s “America First” agenda, with markets likely to remain volatile as negotiations unfold.