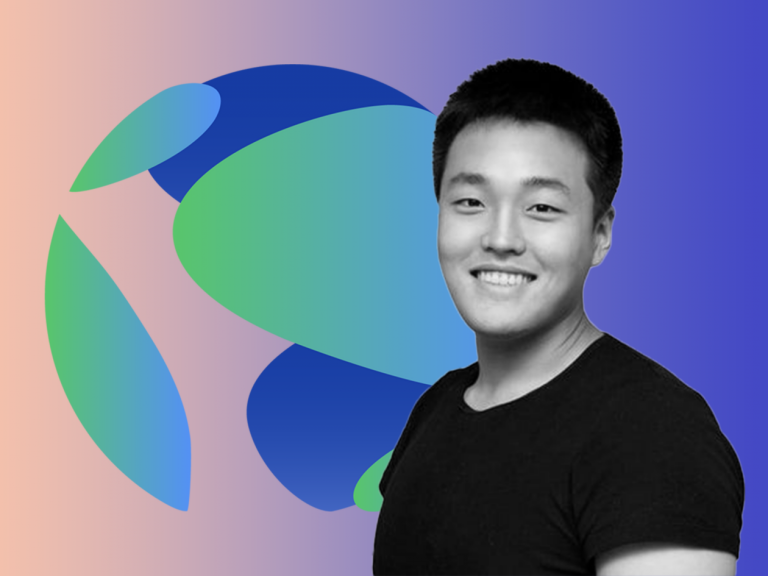

The South Korean co-founder of Terraform Labs— Do Kwon, is the central figure behind the 2022 collapse of the TerraUSD (UST) algorithmic stablecoin and its sister token LUNA.

The event wiped out approximately $40 billion in market value, affecting millions of investors worldwide and triggering a broader “Crypto Winter” that contributed to the downfall of platforms like FTX.

Kwon was accused of misleading investors by promoting UST as a stable, fully backed asset despite internal knowledge of its vulnerabilities.

U.S. federal prosecutors in the Southern District of New York filed a recommendation urging U.S. District Judge Paul Engelmayer to impose a 12-year prison sentence on Kwon for conspiracy to commit wire fraud and securities fraud.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

This stems from Kwon’s guilty plea in August 2025 to two felony counts related to defrauding investors between 2018 and 2022. Under the plea agreement, the maximum possible sentence is 25 years, but prosecutors capped their recommendation at 12 years to reflect his cooperation, including the forfeiture of over $19 million in assets and related properties.

Prosecutors described the fraud as “colossal in scope,” arguing that the losses exceeded those from high-profile cases like Sam Bankman-Fried’s FTX ($8 billion), Alex Mashinsky’s Celsius, and OneCoin combined.

They emphasized Kwon’s role in the rapid depegging of UST, which caused cascading market failures and necessitated a lengthy term for deterrence in the crypto sector. No restitution is being sought due to the complexity of calculating global investor losses.

Defense Response and Sentencing Hearing

Kwon’s legal team is countering with a request for a five-year sentence, citing: Nearly three years already spent in detention in Montenegro under “harsh conditions” while fighting extradition— arrested in March 2023 for using a forged passport.

His agreement to forfeit significant assets as partial amends. Potential for double jeopardy, as South Korean prosecutors are seeking a 40-year sentence for similar charges, with extradition likely after any U.S. term.

Judge Engelmayer requested clarification from both sides on Kwon’s foreign charges, including minimum and maximum penalties in South Korea and Montenegro, to inform sentencing. U.S. authorities have indicated they may support Kwon serving the latter half of his sentence in South Korea if he complies with plea terms.

The sentencing hearing is scheduled for December 11, 2025, in Manhattan federal court. Legal observers expect a focus on proportionality, given comparisons to other crypto fraud sentences like Bankman-Fried’s 25-year term, later reportedly reduced.

The U.S. prosecutors’ push for a 12-year sentence on Do Kwon, following his August 2025 guilty plea to wire fraud and conspiracy charges, underscores a hardening stance on crypto-related fraud.

This recommendation caps the plea deal’s maximum at 12 years versus a potential 25, reflecting partial credit for Kwon’s cooperation, including the forfeiture of $19.3 million in assets.

However, U.S. District Judge Paul Engelmayer’s December 8 order demanding clarifications—on Kwon’s 17 months in Montenegrin detention, South Korean charges up to 40 years, victim impact statements, and potential supervised release—highlights unresolved tensions in sentencing.

Legal experts anticipate a final term of 15-20 years, given Engelmayer’s history in financial fraud cases, potentially adjusted for time served abroad. This could set a benchmark for plea bargains in white-collar crypto crimes, where cooperation mitigates but does not erase severe penalties.

A pivotal challenge is cross-border enforcement. Prosecutors have signaled support for Kwon serving the latter half of his U.S. term in South Korea post-compliance, raising questions about extradition treaties, double jeopardy avoidance, and custody credits excluding Montenegrin time for forgery charges.

Failure to coordinate could lead to prolonged appeals or fragmented justice, testing U.S.-South Korean judicial alignment. Kwon’s defense argues for just five years, citing “harsh” pre-trial detention and asset forfeitures as sufficient amends, but this faces steep odds against the fraud’s scale.

This case underscores growing regulatory scrutiny on crypto founders, with potential implications for international prisoner transfers and cross-border enforcement.