Cross-border payments and remittances have quietly emerged as one of crypto’s most impactful use cases. The market processes more than $150 trillion annually and is projected to rise above $250 trillion by 2027. For years, Ripple (XRP) was the poster child for blockchain in international transfers.

Ripple’s most loyal supporters argued it was just a matter of time before XRP would play a dominant role in helping banks and other financial institutions move money faster and cheaper. Money transfers remain reliant on SWIFT, the decades-old system for moving capital.

Ripple has not made meaningful progress in disrupting the money transfer industry. In fact, rival blockchains have seen better progress in scoring partnerships. For example, SWIFT is using Chainlink’s infrastructure to connect more than 11,500 of its member banks to public and private blockchains.

Enter Digitap ($TAP), a rising project blending the convenience of traditional banking with the power of crypto. Analysts are beginning to argue that Digitap, backed by a fully functioning and globally accepted Visa card, could outperform XRP to become the best crypto to invest in today.

Digitap is currently running the $TAP presale on its official website, where early buyers can view the current stage price, next stage price, percentage of tokens sold, and total dollar amount raised in real-time.

Ripple’s Small Wins Not Enough

Ripple is an early pioneer in merging crypto with cross-border transactions. By using XRP and the RippleNet network, banks can settle transactions in seconds rather than days. This is because XRP’s technology was designed specifically to avoid correspondent banking bottlenecks. This has made XRP popular for institutional use cases.

For example, Japan-based SBI Remit runs live corridors using XRP as a bridge currency to move money from Japan to accounts in the Philippines, Vietnam, and Indonesia. However, the deal was announced more than two years ago and hasn’t been followed up with a monster deal that would propel XRP way above $10.

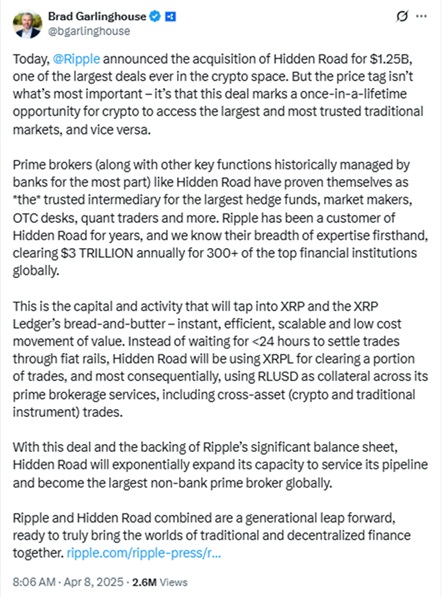

Still, Ripple investors have reason to remain optimistic that the coin has potential to inch higher. The U.S. Securities and Exchange Commission ended its multi-year legal spat with Ripple in March, in which it accused the company of selling unregistered securities. Approximately one month later, Ripple acquired Hidden Road for $1.25 billion as part of one of the largest M&A deals in the crypto space.

XRP continues to trade around $3, roughly the same level it traded at a month ago. The token has attempted on several occasions to break above $3 but lacked any serious buying momentum to sustain a rally. Many smart-money and long-term XRP holders are now assuming the easy money in XRP has already been made and are asking what is a good crypto to invest in.

Digitap: The Visa Card Bridging Fiat and Crypto

Ripple has seen success at the institutional level and excels in bank-to-bank transfers. However, retail users have virtually no interaction with XRP in their daily lives. This is where Digitap’s proposition comes into play, as it targets the consumer market that Ripple continues to dream of serving.

Digitap brands itself as “the last money app you’ll ever need.” Sure, investors have every reason to be skeptical with early-stage crypto startups. But in Digitap’s case, it has a live product that is available to download on Apple and Google app stores.

Unlike Ripple, Digitap is a pure direct-to-consumer play: it provides a unified account and a Visa card that comes in both physical and virtual form. Users can spend cryptocurrencies or traditional fiat anywhere in the world where Visa is accepted. Balances are auto-converted at the point of sale, making the user experience as simple as tapping a phone for a payment or swiping a physical card in a machine.

Beyond the Visa card, the Digitap app operates as a multi-currency wallet and banking platform. Users can take advantage of features that include multi-currency IBAN accounts, instant currency exchange, offshore account options, and the ability to send money globally through blockchain transfers or a SEPA bank transfer.

Conclusion: Why Digitap Could Beat Ripple in 2025

Digitap’s core offering addresses usability, which is a key consideration for investors asking what is the best cryptocurrency to buy. Digitap addresses a real user problem, as managing multiple finance apps and dealing with high fees for cross-border transfers can be challenging. Digitap is driving early innovation, and its omni-bank model merges the roles of a bank, crypto exchange, and payment processor into one.

Users can download the Digitap app today, while Ripple does not offer a similar retail product. The convenience of Digitap’s solution, which includes spending crypto anywhere while earning cash-back rewards, can drive viral growth, especially among younger and tech-savvy consumers and the estimated 1.4 billion people worldwide who are unbanked.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale https://presale.digitap.app

Social: https://linktr.ee/digitap.app