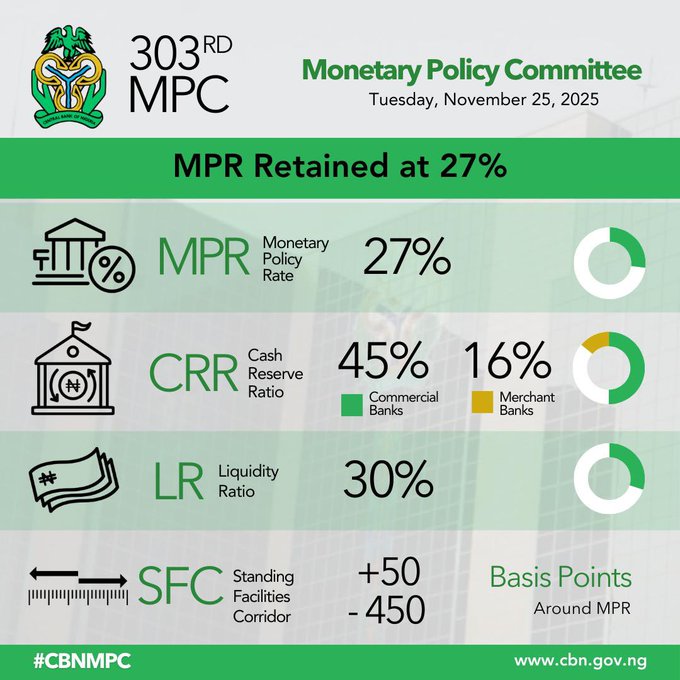

The Central Bank of Nigeria has kept the Monetary Policy Rate at 27 percent, a decision that has stirred fresh debate over the credibility of the inflation numbers published by the National Bureau of Statistics.

The MPC meeting in Abuja ended with all major policy levers unchanged, maintaining the aggressive tightening stance that has defined recent monetary decisions.

The hold on the benchmark rate came only days after the NBS announced that Nigeria’s inflation had eased to the mid-16 percent range. That announcement triggered widespread expectations that the MPC would take the first step toward loosening rates, especially since inflation had supposedly dropped far below the 27 percent policy rate. Instead, the committee froze every knob on its dashboard, signaling that the bank either sees risks that the public cannot yet see or doubts the data placed before it.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

This tension has been brewing for months, but Monday’s outcome pushed it into open conversation. Analysts argue that if the NBS figures were considered reliable by the apex bank, the MPC would have begun cutting the policy rate to bring the interest environment closer to the inflation curve. Instead, the CBN maintained the MPR and preserved the architecture of its tightening regime.

Economist Kelvin Emmanuel, who has repeatedly questioned the credibility of the NBS numbers, did not mince words.

“NBS says inflation rate is dropping but the MPC has held the MPR at 27% and someone who’s dancing to be noticed at the Villa is coming to tell you that the reason CBN has refused to cut rates to align inflation to interest yield curve is because they are avoiding an inverted yield curve. Play politics with everything including statistics,” he said.

The move by the MPC has therefore added to the growing sentiment that monetary authorities may be privately discarding the NBS inflation reports when making policy decisions. Several analysts point to the gap between the lived reality of Nigerians—where food prices refuse to drop—and the official numbers that suggest significant easing.

Meanwhile, policy parameters around liquidity and banking operations were also left untouched. The Cash Reserve Ratio remains at 45 percent for commercial banks and 16 percent for merchant banks, with the 75 percent CRR on non-TSA public sector deposits still in place. The Liquidity Ratio stays at 30 percent. The CBN also adjusted the standing facilities corridor to plus 50 and minus 450 basis points around the MPR, tightening overnight borrowing conditions while widening the discount window on deposits.

The bank’s decision signals that it is not yet convinced that domestic cost pressures have settled at a level safe enough for easing, regardless of what is printed in the monthly inflation bulletins. It also suggests that stability in the FX market and a clearer trend in price movement remain the bank’s priority, even as businesses and consumers continue to grapple with elevated borrowing costs.

With this hold, the CBN has again placed a bet on caution in an environment where inflation, FX volatility, and weak production still shape economic decisions.