SoftBank's WeWork Ratchet

Quote from Ndubuisi Ekekwe on September 28, 2019, 7:36 PM

Head they win, tail they win. Yes, some investors never really like to take risks. They build sophisticated complex systems in the term sheet which ensure they never lose, no matter what happens next. Softbank has one in WeWork: "Investors like SoftBank have an obscure protection that will grant them hundreds of millions in shares if WeWork’s IPO value is lower than they bought in at in the private market.The fine print is known as a ratchet, and speaks to the opaque nature of private markets and sky-high valuations. The real estate start-up’s parent company was valued at $47 billion after its last funding round from SoftBank." WeWork is not an admirable company.

Fine print in WeWork’s IPO paperwork shows that some investors, including SoftBank, are protected from losing money if the company lists below the price where they last valued it.

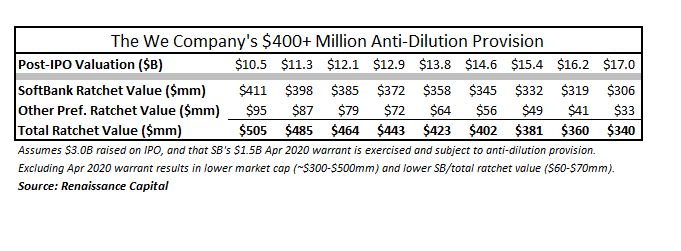

WeWork’s provision, known as a ratchet, could give $400 million worth of additional shares to SoftBank in the event of a weak IPO performance, according to Renaissance Capital. This is expected to be the biggest of that type of protection in history if and when the start-up goes public.

The provision speaks to how opaque private valuations can be and the type of protection venture capital investors are able to negotiate.

Uber, which went public this year is trading 30% south its IPO price; Lyft is down excess of 40% since March. WeWork knew that it was about to lose huge numbers. So, it cut-off its planned IPO. The rocketing valuation was possible because private investors were just happy pumping money provided valuations were going north. Public investors are largely more focused on the profitability of the endeavors since, to most, that is what determines the longevity and health of companies.

Head they win, tail they win. Yes, some investors never really like to take risks. They build sophisticated complex systems in the term sheet which ensure they never lose, no matter what happens next. Softbank has one in WeWork: "Investors like SoftBank have an obscure protection that will grant them hundreds of millions in shares if WeWork’s IPO value is lower than they bought in at in the private market.The fine print is known as a ratchet, and speaks to the opaque nature of private markets and sky-high valuations. The real estate start-up’s parent company was valued at $47 billion after its last funding round from SoftBank." WeWork is not an admirable company.

-

Fine print in WeWork’s IPO paperwork shows that some investors, including SoftBank, are protected from losing money if the company lists below the price where they last valued it.

-

WeWork’s provision, known as a ratchet, could give $400 million worth of additional shares to SoftBank in the event of a weak IPO performance, according to Renaissance Capital. This is expected to be the biggest of that type of protection in history if and when the start-up goes public.

-

The provision speaks to how opaque private valuations can be and the type of protection venture capital investors are able to negotiate.

Uber, which went public this year is trading 30% south its IPO price; Lyft is down excess of 40% since March. WeWork knew that it was about to lose huge numbers. So, it cut-off its planned IPO. The rocketing valuation was possible because private investors were just happy pumping money provided valuations were going north. Public investors are largely more focused on the profitability of the endeavors since, to most, that is what determines the longevity and health of companies.