OpenAI’s 100-megawatt commitment to TCS positions India as a frontline hub in the $500 billion Stargate AI infrastructure build-out, underscoring a decisive shift from services to sovereign compute capacity.

OpenAI will become the first customer of the data center business of Tata Consultancy Services, securing 100 megawatts of capacity as part of the global artificial intelligence infrastructure initiative known as Stargate.

The companies said the capacity will support AI model training and inference, placing India directly within a multi-year, $500 billion effort to expand computing power for next-generation systems.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The agreement is strategically significant on multiple fronts. For OpenAI, it locks in large-scale compute in one of the world’s fastest-growing digital markets. For TCS, it validates a capital-heavy pivot announced last year, when the IT services giant disclosed plans to invest up to $7 billion in building a 1 gigawatt data center unit in India — a departure from its historically asset-light outsourcing model.

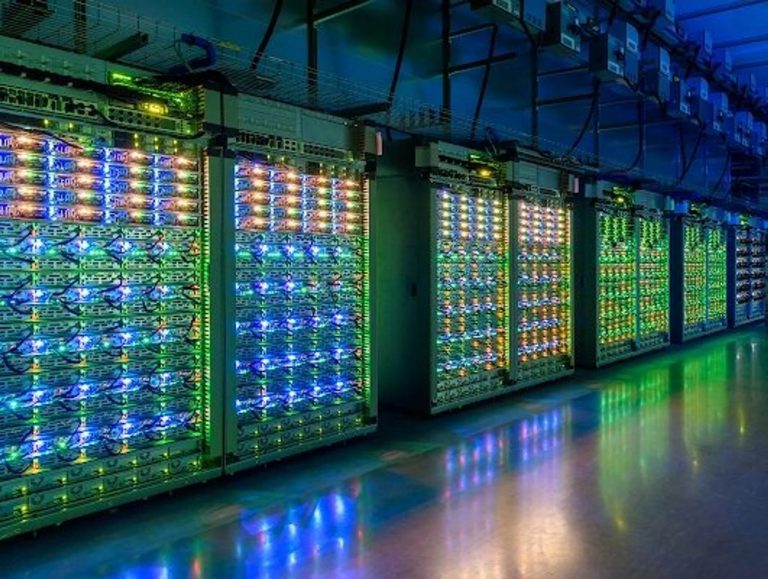

A 100MW commitment is not incremental capacity. In hyperscale terms, it represents infrastructure capable of hosting tens of thousands of high-performance GPUs, depending on configuration. AI training clusters, especially those supporting large language models and multimodal systems, are power-intensive, often demanding dense racks, liquid cooling systems, and resilient grid connectivity. Securing such capacity early is essential in a global market where demand for AI compute has outpaced supply, driving up chip prices and creating multi-year procurement bottlenecks.

The Stargate initiative, described as a $500 billion multi-year build-out of AI data centers for training and inference, is backed by major global investors. Its ambition reflects the arms race underway among AI developers, cloud hyperscalers, and governments seeking domestic control over strategic computing infrastructure. AI compute is increasingly viewed not just as commercial capacity, but as digital sovereignty.

India’s inclusion in this architecture signals a structural shift. Historically, the country’s technology strength lay in IT services and back-office operations. Now, it is positioning itself as a computing host nation. Global firms, including Google, Amazon, Meta Platforms, and Microsoft, have expanded data center investments in India in recent years. Domestic conglomerates such as Reliance Industries and Adani Group have unveiled parallel ambitions spanning cloud services, AI workloads, and renewable-powered infrastructure.

Several structural drivers underpin the surge. India’s digital economy has expanded rapidly, with a vast consumer base, increasing enterprise digitization, and government-backed digital identity infrastructure. Data localization trends and regulatory shifts have also encouraged in-country storage and processing.

Meanwhile, power costs remain competitive in select regions, and state governments are offering incentives to attract hyperscale facilities.

However, scaling to gigawatt levels presents execution challenges. High-density AI facilities require not just reliable electricity but stable grid integration, water or advanced cooling technologies, land acquisition, fiber backhaul connectivity, and proximity to subsea cable landing stations. Energy sourcing is particularly sensitive as hyperscalers face pressure to meet net-zero commitments while expanding capacity. India’s renewable build-out may become a critical enabler if AI data centers are to scale without amplifying carbon intensity.

The move redefines TCS’ role in the AI value chain. Traditionally positioned as a systems integrator and IT services provider, it is now entering the infrastructure ownership layer. Owning and operating data center capacity could enable bundled offerings that combine compute, cloud migration, AI deployment, and enterprise integration. It also diversifies revenue streams toward long-duration infrastructure contracts.

Parallel to the data center agreement, OpenAI is expanding its enterprise footprint within the broader Tata ecosystem. Under a separate partnership, TCS parent Tata Group plans to deploy ChatGPT Enterprise across the conglomerate over several years, starting with hundreds of thousands of employees. The Tata Group spans sectors including steel, automotive manufacturing, aviation, retail, and IT services, making the rollout one of the largest enterprise AI deployments globally.

Such integration could reshape internal workflows across the conglomerate — from software development acceleration within TCS to supply chain analytics, customer support automation, research summarization, and design optimization across other Tata entities. Enterprise AI adoption at that scale may generate secondary demand for compute infrastructure, reinforcing the business case for domestic data center expansion.

OpenAI said India now has more than 100 million weekly ChatGPT users, underscoring the country’s dual significance as both a compute hub and a consumption market. That user base includes consumers, startups, educational institutions, and enterprises, suggesting that India is not only exporting digital services but actively embedding generative AI tools across its economy.

From a geopolitical standpoint, the partnership also aligns with a broader global realignment in AI infrastructure. Governments and corporations are seeking geographic diversification of computing to mitigate concentration risk. The concentration of advanced AI data centers in a handful of Western markets has exposed supply constraints and policy sensitivities. Expanding into India offers capacity expansion while tapping a skilled engineering workforce.

OpenAI’s anchoring with TCS may also serve as a signal to other regional partners. Securing a first customer agreement at scale establishes credibility for TCS’s data center ambitions and could attract additional hyperscale tenants or AI-native companies seeking local infrastructure.

Financially, the agreement reduces ramp-up uncertainty for TCS’s $7 billion data centre plan. Large infrastructure projects require anchor tenants to justify capital deployment. A 100MW allocation from OpenAI provides early utilisation, potentially easing financing and accelerating build timelines.

The deal sits within a broader context of accelerating AI capital expenditure globally. Technology majors are committing tens of billions of dollars annually toward AI chips, networking equipment, and specialised facilities. Supply chains for advanced semiconductors remain tight, with GPU procurement lead times extending into multiple quarters. Locking in power capacity is therefore as critical as securing chips.

As Stargate unfolds over multiple years, the India node anchored by TCS could evolve into a significant training and inference hub serving both domestic and global workloads. The 100MW commitment may represent only the first tranche of capacity, with expansion possible as demand scales.

Taken together, the partnership signals that India is moving beyond its historical role as an outsourcing powerhouse toward becoming a strategic host of AI infrastructure. With OpenAI embedding itself at both the compute and enterprise layers of the Tata ecosystem, the alignment illustrates how global AI developers and domestic conglomerates are converging to reshape the digital backbone of one of the world’s largest technology markets.