The crypto market seems to be finally starting a steady rebound. As a result, tokens like XLM and DOGE are seeing healthy price gains. Meanwhile, while the top 10 altcoins try to recover, a newcomer is speeding past them.

Namely, Digitap ($TAP) has been on an upward ride since its presale began, and experts see it as the best ICO of 2025, one that could also be the market’s next 50x DeFi gem. So, the presale success might only be the start for $TAP.

The XLM Price Seems to be Pushing to $0.38 Soon

Like the rest of the market, XLM has also been suffering for weeks now. The recent market downturn caused even the best altcoins to lose significant momentum, but they might finally be seeing a rebound.

XLM, in particular, has been climbing in price steadily, currently at $0.3311. This marks a 4.02% rise for the XLM price in the past week, and both its market cap and trading volume are also up.

Analysts are also bullish, which could help XLM’s price rise even more. Namely, Ali Martinez recently stated that the $0.30 was a great spot to buy XLM. And now, since XLM is above this level, he believes that its price could soon go to $0.37.

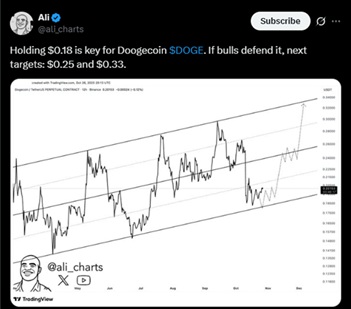

The DOGE Price Is Holding Strong Even With A Recent Whale Sell-Off

DOGE has been on the back burner even before the recent market dump. Many thought that DOGE’s momentum had finally come to an end, especially since Elon Musk hasn’t spoken about it in quite some time. However, as memecoins do, DOGE managed to surprise many nonbelievers.

Namely, the DOGE price seems to be recovering steadily now, and experts believe that it might get some renewed momentum. At the moment, DOGE’s price is at $0.2017, up by 0.21% in one week. This doesn’t look like much, but when even the best altcoins are bleeding, it’s definitely something.

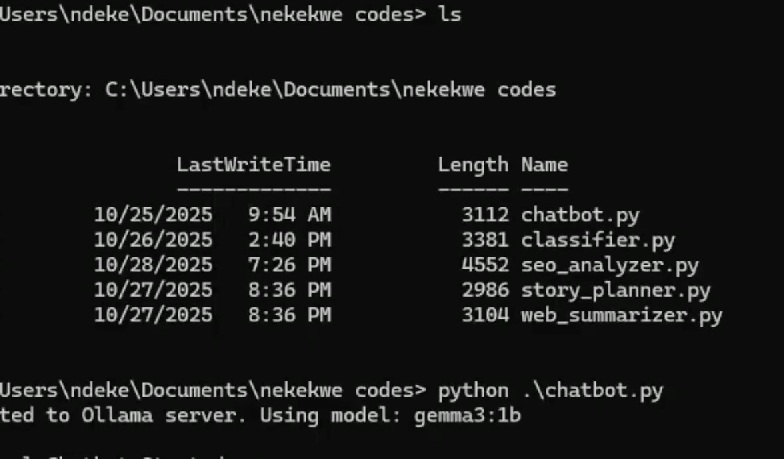

As for the sell-off, it was reported that Dogecoin whales recently sold over 500 million DOGE tokens in the span of one week.

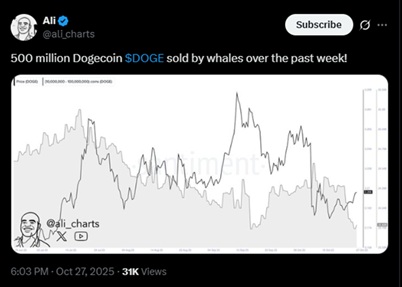

Also, according to Ali Martinez, it’s crucial for the DOGE price to now hold $0.18. If this happens, it might lead to the DOGE price rising to $0.25 and maybe even $0.33. With this in mind, DOGE might finally be a part of experts’ best crypto to invest in 2025 lists.

Why Digitap Can Still Perform Better Than Both XLM and DOGE

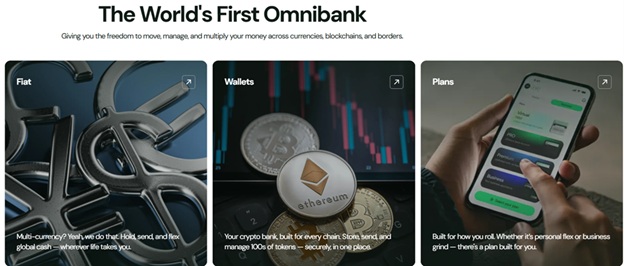

Even though both XLM and DOGE have their own bullish narratives right now, experts believe they can’t compare to Digitap. That’s because, as the world’s first omni-bank, Digitap offers utility unlike anything available before, and experts believe that it could completely change the way people manage their finances.

Namely, via its already live app, Digitap allows people to hold, store, spend, and send both crypto and fiat from one place. So, it has finally merged the two sectors, giving even non-crypto users the chance to finally enjoy the perks crypto offers without having to do anything.

Since the app is easily accessible via the Google Play Store and the Apple App Store, Digitap is also in the running to become the market’s best crypto for beginners.

Furthermore, Digitap offers crypto cards backed by Visa, which can be used anywhere Visa is accepted. Users will get instant conversions and settlements, using fiat or crypto as they please. Cross-border payments will also be cheaper with Digitap, as, via its AI-powered routing system, Digitap slashes them from the industry average of 6.2% to under 1%.

So, with a play on three multi-billion-dollar markets, as well as a utility that no other project has been able to bring before, Digitap is seen by many as the best crypto to invest in 2025.

USE THE CODE “MILLION30” FOR 30% OFF FIRST-TIME PURCHASES

The $TAP Presale: An Early Opportunity for Possibly Life-Changing Utility

In addition to offering a never-before-seen utility that can be beneficial to both crypto and non-crypto users, Digitap also offers investors a very early opportunity to enter. Namely, $TAP is currently in presale, selling for $0.0194. It has already raised over $1 million, selling more than 76 million tokens so far.

The success Digitap has seen so far shows just how ready the market is for what it offers, and how confident investors are. And since Digitap has a much bigger room for growth compared to XLM and DOGE, experts believe that 50x gains might be on the table by year-end.

| Metric | Details |

| Stage Price | $0.0194 |

| Next Stage Price | $0.0268 |

| Tokens Sold | Over 76 million |

| Capital Raised | Over $1 million |

| Fundraising Goal | $10 million |

The Next Financial Revolution Might Be Nearer Than Expected

Many have tried and failed to merge crypto and fiat into one unified project, and the feat looked impossible until now. Since Digitap has finally achieved it, experts believe it will usher in a whole new era in finance —one that gives people the chance to enjoy the best of both crypto and fiat.

Because of this, they see Digitap potentially becoming a top 5 cryptocurrency and at the forefront of financial innovation in the next few years.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app